- United States

- /

- Software

- /

- NasdaqGS:PRGS

Progress Software Corporation (NASDAQ:PRGS) Passed Our Checks, And It's About To Pay A US$0.175 Dividend

Progress Software Corporation (NASDAQ:PRGS) stock is about to trade ex-dividend in 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Progress Software's shares on or after the 29th of February, you won't be eligible to receive the dividend, when it is paid on the 15th of March.

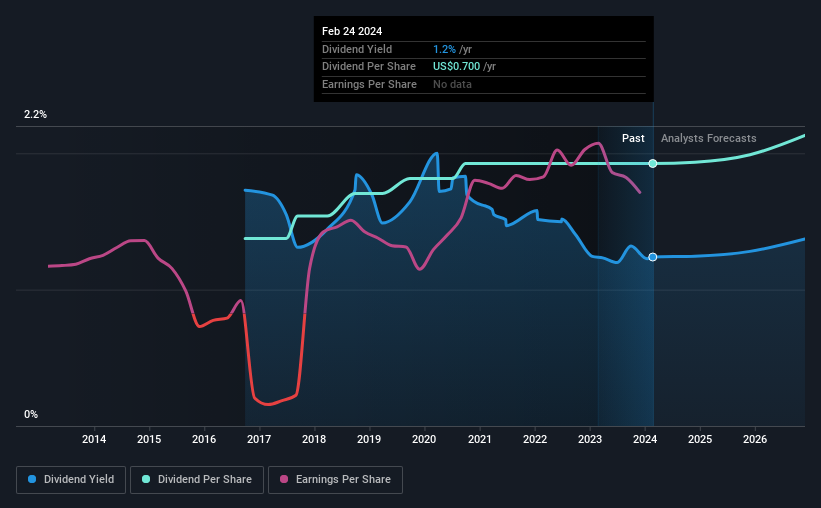

The company's next dividend payment will be US$0.175 per share, and in the last 12 months, the company paid a total of US$0.70 per share. Based on the last year's worth of payments, Progress Software stock has a trailing yield of around 1.2% on the current share price of US$56.49. If you buy this business for its dividend, you should have an idea of whether Progress Software's dividend is reliable and sustainable. As a result, readers should always check whether Progress Software has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Progress Software

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Progress Software paid out a comfortable 43% of its profit last year. A useful secondary check can be to evaluate whether Progress Software generated enough free cash flow to afford its dividend. Luckily it paid out just 19% of its free cash flow last year.

It's positive to see that Progress Software's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're encouraged by the steady growth at Progress Software, with earnings per share up 8.0% on average over the last five years. Management have been reinvested more than half of the company's earnings within the business, and the company has been able to grow earnings with this retained capital. We think this is generally an attractive combination, as dividends can grow through a combination of earnings growth and or a higher payout ratio over time.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, seven years ago, Progress Software has lifted its dividend by approximately 4.9% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is Progress Software worth buying for its dividend? Earnings per share have been growing moderately, and Progress Software is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Progress Software is halfway there. Overall we think this is an attractive combination and worthy of further research.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. For example, we've found 3 warning signs for Progress Software that we recommend you consider before investing in the business.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRGS

Progress Software

Provides software products that develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Undervalued with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.