- United States

- /

- Software

- /

- NasdaqGS:PRGS

Is There Now An Opportunity In Progress Software (PRGS) After A 35% One-Year Share Price Decline

Reviewed by Bailey Pemberton

- If you are looking at Progress Software and wondering whether the recent share price really reflects its underlying value, this article is for you.

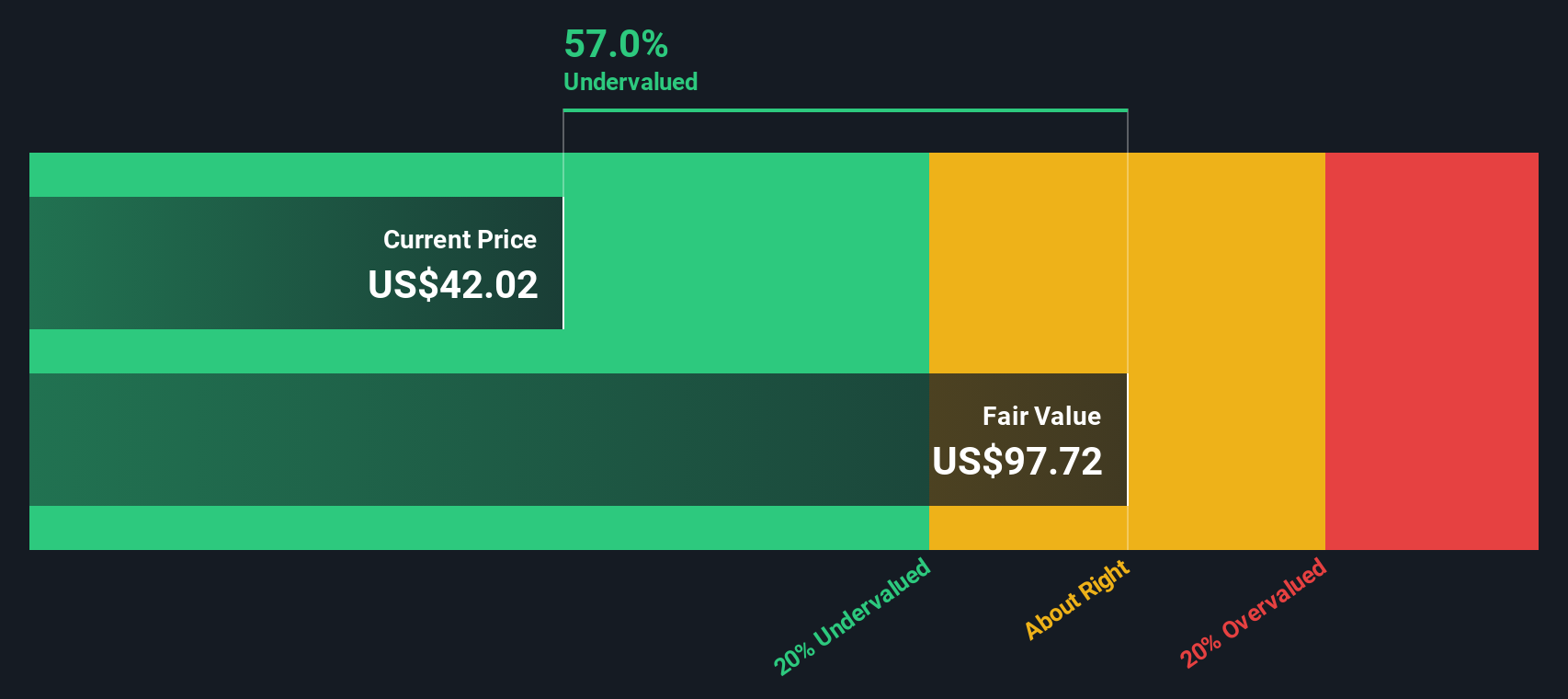

- The stock last closed at US$41.52, with returns of 4.4% decline over 7 days, 4.6% decline over 30 days, a 1.1% gain year to date, and a 35.3% decline over the past year. This naturally raises questions about both risk and potential opportunity.

- Recent headlines around Progress Software have largely centered on ongoing interest in software companies in general and how investors are reassessing growth and profitability trade offs in the sector. This broader context helps explain why the share price has been under pressure over the last year, even as some investors continue to look for value in established software names.

- Our valuation checks give Progress Software a score of 3 out of 6. This suggests the stock may be undervalued on some measures but not across the board, so we will walk through those methods next and then finish with a different, more rounded way to think about what the shares are really worth.

Find out why Progress Software's -35.3% return over the last year is lagging behind its peers.

Approach 1: Progress Software Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business could be worth today by projecting its future cash flows and then discounting those back to a present value using a required rate of return.

For Progress Software, the model used is a 2 Stage Free Cash Flow to Equity approach. The company’s latest twelve month free cash flow is reported at about $185.3 million. Analyst and extrapolated projections, provided in the model, point to free cash flow figures in the range of roughly $313.8 million in 2026, moving to $399.2 million by 2035, all in $ and all below $1b so still in the millions.

On this basis, the DCF model arrives at an estimated intrinsic value of US$92.65 per share, compared with the recent share price of US$41.52. That implies the stock is assessed to be 55.2% undervalued using this method. This represents a sizable gap between the cash flow based estimate and where the market is currently pricing the shares.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Progress Software is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

Approach 2: Progress Software Price vs Earnings

For a profitable business like Progress Software, the P/E ratio is a useful shorthand for how much investors are paying for each dollar of earnings. A higher or lower P/E often reflects what the market expects for future growth and how much risk investors are willing to accept, so a company with stronger perceived prospects or lower perceived risk can justify a higher "normal" P/E than a slower growing or riskier peer.

Progress Software currently trades on a P/E of 36.71x. That compares with a peer average of 29.72x and a broader Software industry average of 32.68x, so the shares are priced above both these simple benchmarks. Simply Wall St also calculates a proprietary "Fair Ratio" of 44.24x for Progress Software, which is an estimate of what the P/E might be given factors such as its earnings profile, industry, profit margin, market capitalization and risk characteristics.

This Fair Ratio is more tailored than a straight peer or industry comparison because it adjusts for company specific traits rather than assuming one size fits all. Setting the current 36.71x P/E against the 44.24x Fair Ratio suggests the shares trade below that modelled level, indicating Progress Software appears undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1449 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progress Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories you create about Progress Software that link what you believe about its acquisitions like ShareFile, AI focus and M&A risks to a financial forecast, a fair value and a comparison with the current share price. All of this sits within Simply Wall St's Community page where Narratives update as new news or earnings arrive. For example, one investor might see fair value closer to US$83 while another sees it near US$57. This gives you a clear, visual way to decide how your own view stacks up against the current market price.

Do you think there's more to the story for Progress Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRGS

Progress Software

Develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion