- United States

- /

- IT

- /

- NasdaqGS:PRFT

The total return for Perficient (NASDAQ:PRFT) investors has risen faster than earnings growth over the last five years

While Perficient, Inc. (NASDAQ:PRFT) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 29% in the last quarter. But over five years returns have been remarkably great. In that time, the share price has soared some 443% higher! So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

Although Perficient has shed US$185m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Perficient

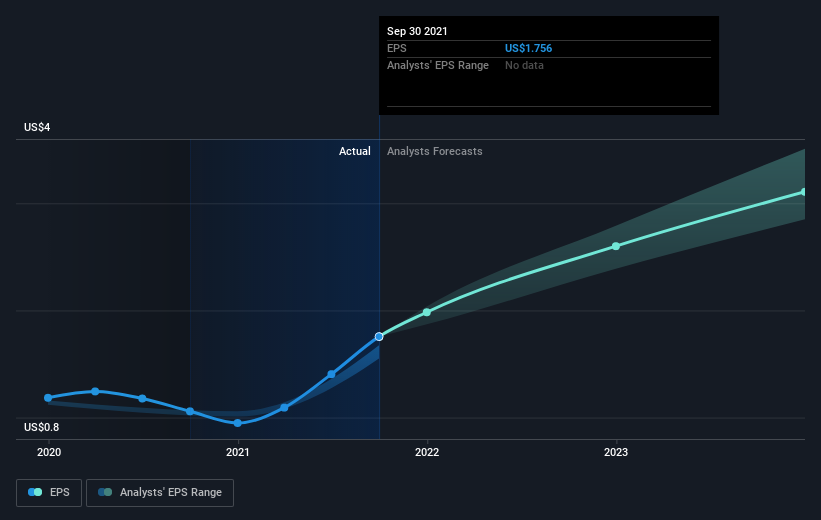

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Perficient managed to grow its earnings per share at 19% a year. This EPS growth is lower than the 40% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 58.02.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Perficient's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Perficient shareholders have received a total shareholder return of 72% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 40% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Perficient better, we need to consider many other factors. Take risks, for example - Perficient has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRFT

Perficient

Provides digital consultancy services and solutions in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Zero One +Tive report on Anime & $CTW

ICOP S.p.A. – Investment Narrative and Multibagger Monitoring Framework

The Power Behind the Brain: Why Schneider Electric is the Undisputed Infrastructure King of the 2026 AI Build-out

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026