- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Sees 16% Rise After Share Buyback Program Completion

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) recently announced a series of significant partnerships and initiatives, including collaborations with Archer Aviation and Databricks, and the launching of the R37 AI lab with R1 to transform healthcare financial performance. This suite of developments may have played a role in driving a 16% increase in the company's quarter-on-quarter share price. Additionally, the company's completion of a share buyback program, finalized on February 18, might have bolstered investor confidence. Meanwhile, the broader market context saw mixed performance, with the Nasdaq Composite experiencing declines amid tech sector fluctuations and broader economic uncertainties. Despite these market headwinds, Palantir's growth in strategic initiatives appeared to resonate positively with investors, contrasting with the general downturn in tech stocks, as illustrated by declines in other major tech companies like Tesla and Nvidia.

Palantir Technologies has experienced a very large total shareholder return of 584.99% over the past three years. This performance contrasts with broader tech market challenges. Several key developments have contributed to this growth. The company's inclusion in the NASDAQ-100 in January 2025 enhanced its visibility and credibility in the market. In December 2024, Palantir expanded its partnership with the U.S. Army for a strategic project valued at US$400 million, signaling strong government trust and long-term collaboration potential.

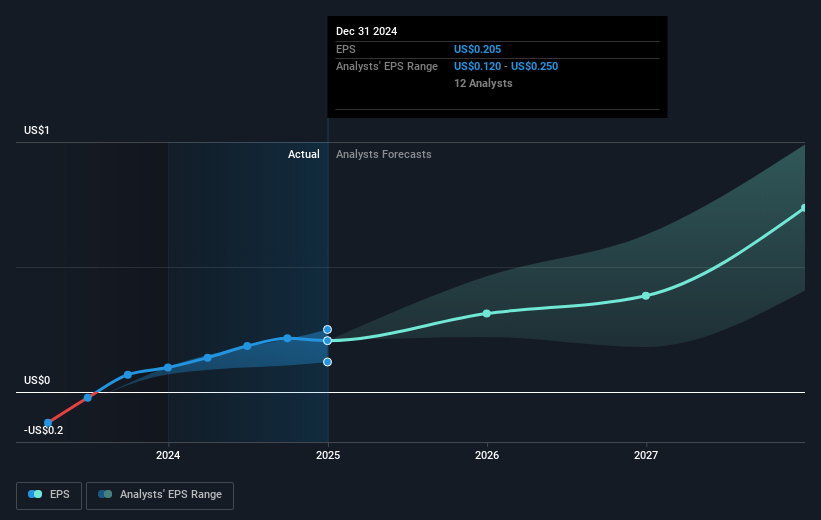

Additionally, consistent revenue growth strengthened Palantir's market position. For instance, 2024 full-year sales rose to US$2.87 billion, up from US$2.23 billion, supported by robust client engagements like those with Voyager Technologies on AI solutions. Palantir's earnings growth of 120.3% also outpaced the software industry average. These factors, combined with strategic collaborations, have been pivotal in shaping the company's impressive performance against market headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives