- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners With Natilus to Innovate Sustainable Aircraft Development

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) has experienced a notable price move of 46% over the last quarter, partly coinciding with the announcement of a strategic partnership with Natilus to bolster sustainable aircraft production using AI technologies. This collaboration emphasizes the company's proactive stance in embracing innovative solutions and sustainability initiatives. Throughout the same period, Palantir's expanded clientele and multiple collaborations in sectors like aviation, healthcare, and national security likely added weight to its upward trajectory. Despite broader market challenges, including economic contractions and investor focus on major tech earnings, these developments helped maintain positive sentiment around Palantir's prospects.

We've spotted 1 possible red flag for Palantir Technologies you should be aware of.

Over the past three years, Palantir Technologies has achieved a substantial total shareholder return of very large percentage. This remarkable performance surpasses both the US Market's 9.9% and the US Software industry's 12% return over the last year, underscoring Palantir's resilience and growth potential within the tech sector. These gains are significantly bolstered by the company's active formation of partnerships and technological innovations highlighted in the introduction.

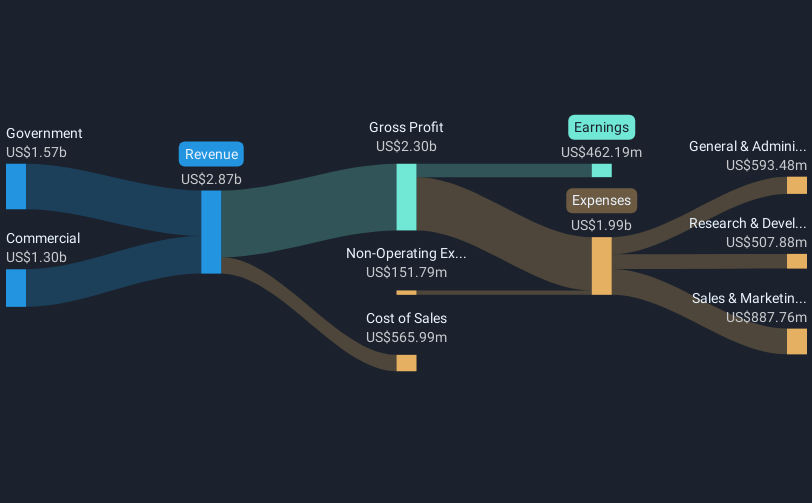

The factors outlined in the introduction are likely to impact Palantir's future revenue and earnings positively. The strategic collaborations, particularly those in sectors like aviation and healthcare, suggest a continuing expansion of their client base, which is vital for sustained growth. Palantir's reported Q4 2024 sales of $827.52 million indicate a robust financial position, with forward-looking guidance projecting revenue between $3.74 billion and $3.76 billion for 2025. Despite its current share price being below the consensus price target of US$87.05, these strong fundamentals provide a comprehensive view of its upward potential, amidst the volatility and challenges within the broader market landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Palantir Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives