- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies Ltd. (NASDAQ:PGY) Soars 30% But It's A Story Of Risk Vs Reward

Pagaya Technologies Ltd. (NASDAQ:PGY) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

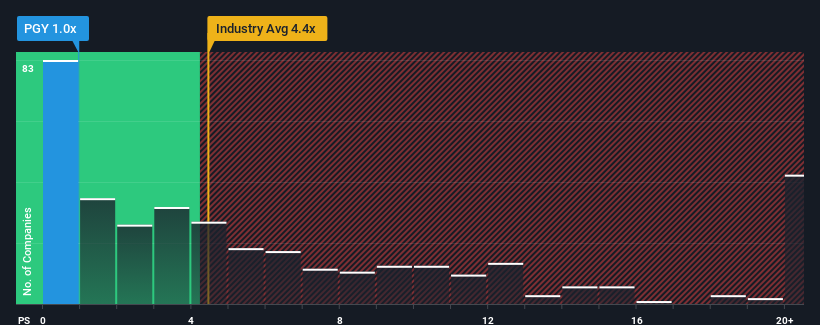

Although its price has surged higher, Pagaya Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.4x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Pagaya Technologies

How Has Pagaya Technologies Performed Recently?

Recent revenue growth for Pagaya Technologies has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pagaya Technologies.Is There Any Revenue Growth Forecasted For Pagaya Technologies?

The only time you'd be truly comfortable seeing a P/S as depressed as Pagaya Technologies' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the six analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Pagaya Technologies' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Pagaya Technologies' P/S

Shares in Pagaya Technologies have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Pagaya Technologies' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Pagaya Technologies you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives