- United States

- /

- Software

- /

- NasdaqCM:PGY

Has Pagaya’s 155% Surge in 2025 Already Priced In Its AI Growth Story?

Reviewed by Bailey Pemberton

- Wondering if Pagaya Technologies is still worth a look after its big run up, or if the easy money has already been made? This breakdown will help you assess whether the current price matches the company’s real value.

- Over the last year, the stock has surged about 155.3%, including a 137.3% gain year to date, while the last month’s 3.7% climb and a modest 0.7% move over the past week show that momentum is cooling but far from gone.

- That performance has been fueled by growing attention on Pagaya’s AI driven underwriting network and new partner integrations, which position the company as a critical infrastructure player in consumer credit. At the same time, headlines around tighter credit conditions and fintech volatility have kept sentiment mixed, making it even more important to separate hype from fundamentals.

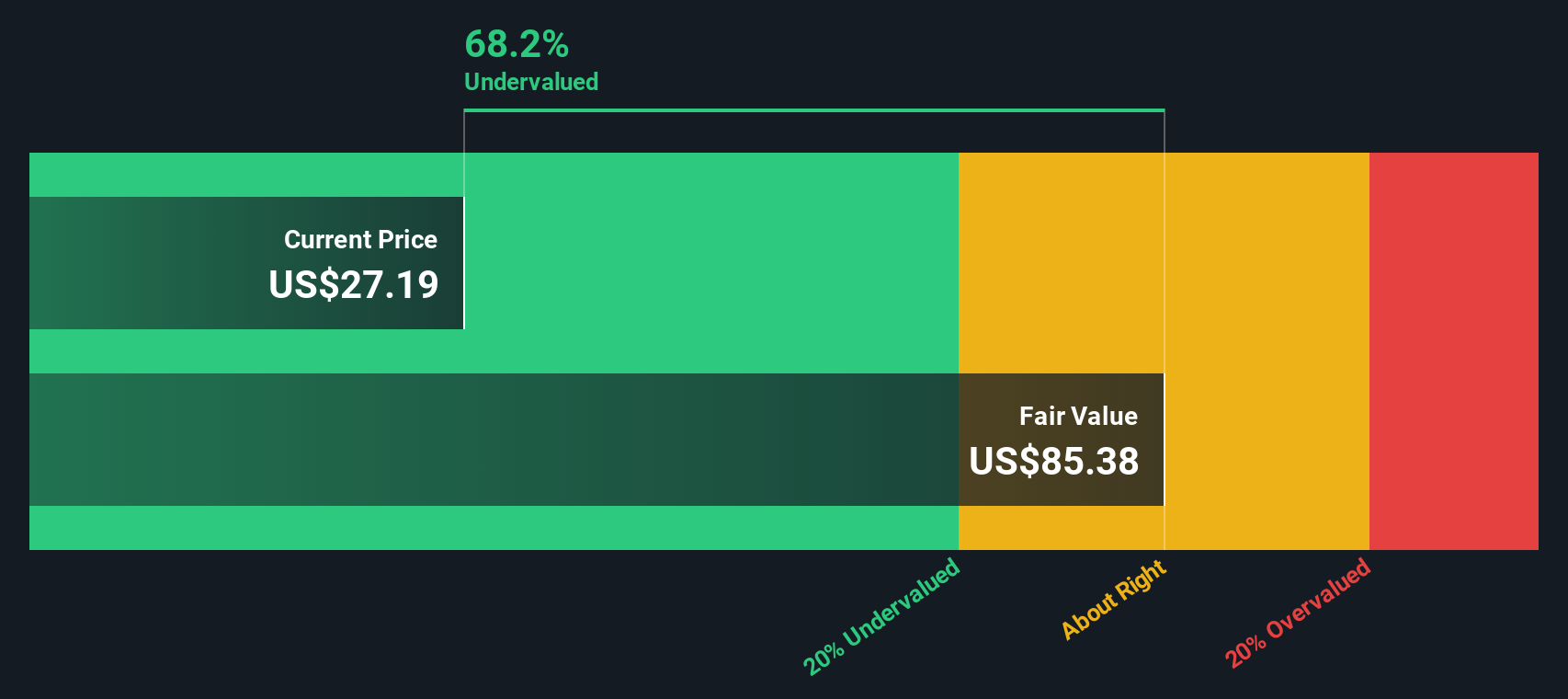

- On our valuation checks, Pagaya scores a solid 5/6. This means it screens as undervalued on five out of six metrics. Next, we will unpack what that implies across different valuation approaches, before finishing with a more nuanced way to think about what the stock might be worth.

Approach 1: Pagaya Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future, then discounting those cash flows back to today to account for risk and the time value of money.

For Pagaya Technologies, the model starts from last twelve months free cash flow of about $183.5 Million and factors in a dip to roughly negative $17.6 Million in 2023 as the business invests for growth. From there, cash flows are projected to ramp up, reaching an estimated $2.7 Billion in free cash flow by 2035. Analysts typically provide detailed forecasts only a few years out, so the later years are extrapolated based on growth patterns for similar businesses.

When all those projected cash flows are discounted back, the DCF in this model indicates an intrinsic value of around $319.9 per share. Compared with the current market price, this implies the stock is about 92.9% undervalued within the assumptions of the analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pagaya Technologies is undervalued by 92.9%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Pagaya Technologies Price vs Sales

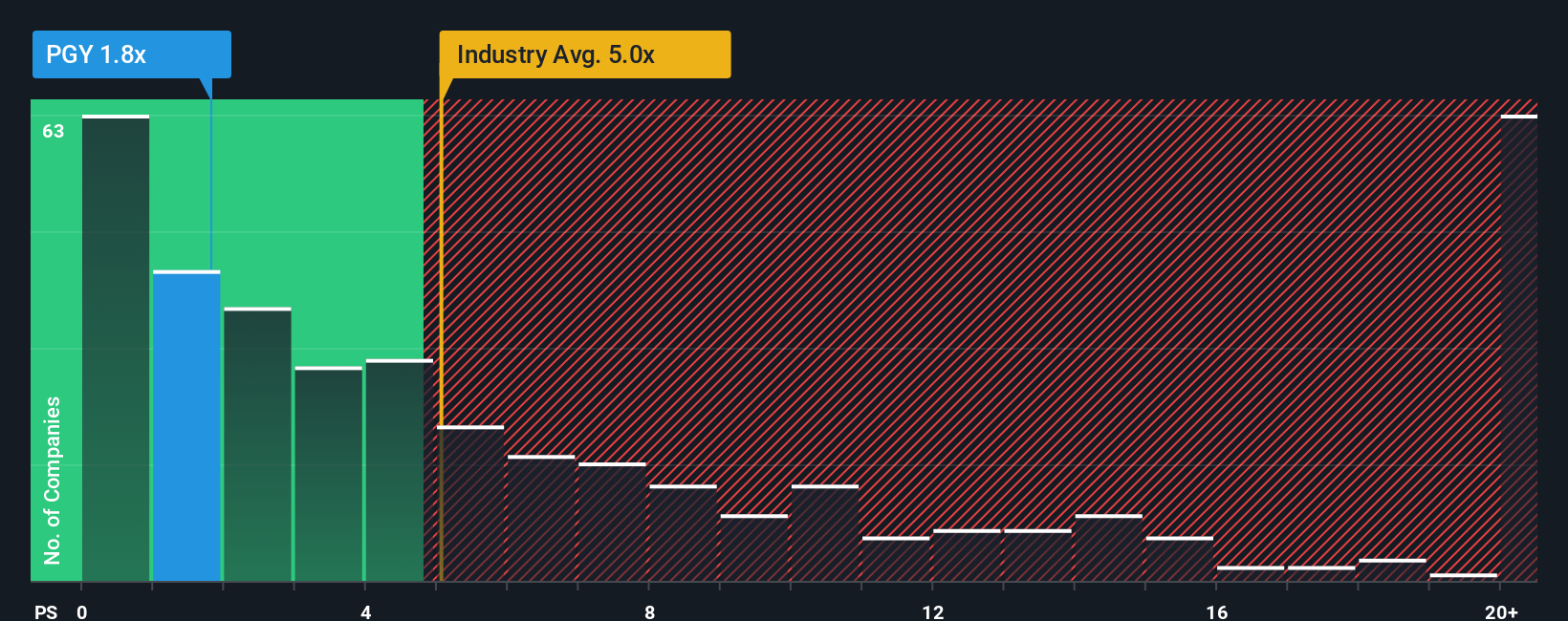

For a young, rapidly scaling software platform like Pagaya that is still normalizing its profitability, the price to sales ratio is often a more reliable yardstick than earnings based metrics. Investors are essentially paying for Pagaya’s current revenue base and the growth runway embedded in that network.

In general, faster growing and less risky businesses can justify a higher price to sales multiple, while slower growth or higher uncertainty usually calls for a discount. Pagaya currently trades on a price to sales ratio of about 1.47x, which is well below both the broader Software industry average of roughly 4.92x and the peer group average of around 3.65x.

Simply Wall St’s Fair Ratio for Pagaya is estimated at 2.90x. This is a proprietary view of what the multiple should be once you factor in the company’s growth profile, margins, risk, industry positioning and market cap. This is more informative than a simple peer or industry comparison because it adjusts for the specific characteristics of Pagaya’s business rather than assuming all software names deserve the same multiple. Since 2.90x is materially higher than the current 1.47x, the price to sales lens also points to meaningful upside.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pagaya Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Pagaya’s story with the numbers you expect it to deliver in terms of future revenue, earnings, margins and ultimately fair value.

A Narrative on Simply Wall St is essentially your investment story written in numbers. It links what you believe about Pagaya’s competitive edge, industry tailwinds and execution to a forward looking financial forecast, and then to a calculated fair value per share.

Because Narratives live inside the Community page on Simply Wall St and are used by millions of investors, they are easy to create, compare and refine. They also automatically update as new information such as earnings releases or major news affects the stock.

This means you can quickly see whether your Narrative suggests that Pagaya is worth more or less than the current price, and use that gap between Fair Value and Price as a clear, disciplined input when you consider whether to buy, hold or sell.

For example, one Pagaya Narrative on the platform might assume revenue climbs toward the higher end of $3 billion with profit margins in the high teens and a fair value near $54. A more cautious Narrative might assume slower growth, mid teens margins and a fair value closer to $27. The platform lets you transparently see, test and choose which path you find more convincing.

Do you think there's more to the story for Pagaya Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion