- United States

- /

- Software

- /

- NasdaqGS:PEGA

A Look at Pegasystems’s Valuation Following the Launch of Pega Infinity '25 and Its AI Transformation Push

Reviewed by Kshitija Bhandaru

Pegasystems (PEGA) is shaking up the enterprise software scene with the launch of Pega Infinity '25. This next-generation platform promises dependable, scalable AI agents for modernizing outdated systems and automating business workflows.

See our latest analysis for Pegasystems.

Pega Infinity '25 isn’t the only thing getting attention. Pegasystems’ stock momentum has gradually improved, with a 1-year total shareholder return of 63% highlighting renewed confidence in its growth story, even after a multi-year period of muted results. Fresh enthusiasm from this product launch suggests investors are warming up to its turnaround prospects and the company’s unique approach to reliable enterprise AI.

If you want to expand your search for innovative software leaders, this is a great time to discover See the full list for free.

With the stock trading just below analyst price targets, the real question for investors now is whether Pegasystems still offers meaningful upside or if today’s momentum already reflects all the anticipated future growth.

Most Popular Narrative: 11.1% Undervalued

Pegasystems’ widely tracked narrative pegs its fair value at $64.73, signaling 11.1% upside from the last closing price of $57.54. This suggests there is room for shares to climb higher if projected growth is realized, setting the stage for a closer look at the key drivers behind this outlook.

The adoption of agentic workflows and integration with AI models in Pega Blueprint, enabling predictable and streamlined processes, could enhance client satisfaction and retention, thereby improving net margins. Strong ACV growth, reflecting client shifts to Pega Cloud services, could lead to increased recurring revenue streams and greater financial stability.

Want to know what’s fueling that premium price? This narrative rests on a set of bold revenue, earnings, and margin assumptions as well as a market multiple higher than most software peers. Curious which financial forecasts are moving the needle? Click through to uncover the forecasted numbers that support this higher fair value.

Result: Fair Value of $64.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains as factors such as volatile term license revenue and heightened competition could potentially challenge Pegasystems’ growth outlook.

Find out about the key risks to this Pegasystems narrative.

Another View: Is the Valuation Too Ambitious?

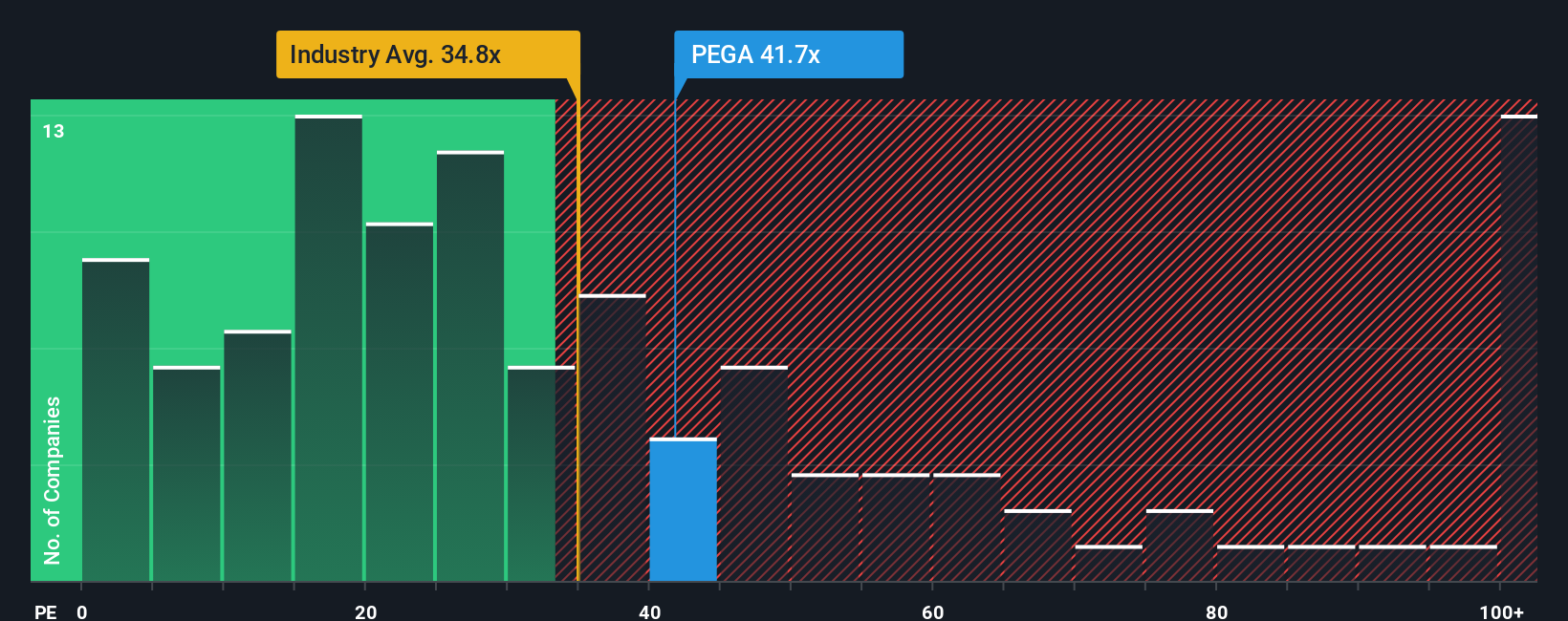

Looking at Pegasystems through its price-to-earnings ratio, the story shifts. The company trades at 44.7x earnings, making it notably more expensive than both its industry average of 35.5x and its immediate peers at 34.5x. The market’s fair ratio stands at 30.8x. This suggests investors are paying a premium for growth and AI potential, but it also means the margin for error is narrow. Could this premium leave buyers exposed if expectations aren’t met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you have a different perspective on Pegasystems or prefer to chart your own course with the numbers, you can quickly build your own view in just a few minutes. Do it your way.

A great starting point for your Pegasystems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Give yourself an edge by tapping into unique stock ideas curated by the Simply Wall Street Screener. The right move today might just spark your next big win.

- Uncover hidden potential by targeting these 3563 penny stocks with strong financials that combine robust financial health with breakout growth prospects.

- Boost your yield by selecting these 19 dividend stocks with yields > 3% offering consistent income from companies with reliable dividend payments over 3%.

- Catalyze your portfolio’s tech exposure by reviewing these 24 AI penny stocks at the forefront of artificial intelligence advancements and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion