- United States

- /

- Software

- /

- NasdaqGS:PANW

Quick Takes: Palo Alto, Alphabet, Meta & More

Reviewed by Michael Paige

Oil stocks track crude higher, and then straight back down again

Vladimir Putin’s latest mobilization caused the oil price to spike yesterday morning. Somewhat predictably, energy stocks opened higher, - but then very quickly reversed course, along with the price of crude, when it emerged that US inventories increased by 1.1 million barrels from a week earlier.

Exxon (NYSE: XOM), Chevron (NYSE: CVX) and Occidental Petroleum (NYSE: OXY) all closed lower on the day.

Our Take: In the short term, oil stocks are very sensitive to changes in the price of crude oil. But the oil price depends on a complex set of dynamics from global growth, to inventories, and OPEC’s production targets. More recently, supply chain disruptions and the war in Ukraine have added to the complexity. One piece of news can move the price $5, only for another piece of news to send it $5 in the other direction. Investing in oil stocks based on short-term movements in the oil price is like playing roulette - and not really investing at all.

PANW Stock Split (Palo Alto Networks)

Last week Palo Alto Networks (NASDAQ: PANW) executed a 3-for-1 stock split. Investors who owned shares at the close on 13th September received two extra shares for each share they owned prior to the split.

Stock splits have become popular amongst retail investors as they sometimes lead to a short-term rally in the share price. The catch is that this usually occurs when a share is already popular amongst retail investors.

Our Take: Stock splits do nothing for the intrinsic value of a company, but they can make shares available to a wider audience. In Palo Alto’s case, the stock split might function as a PR exercise to make retail investors aware of the stock. The following graphic reflects that very few retail investors own the share despite several positive attributes which we recently highlighted.

Alphabet to launch a streaming marketplace

Last month the Wall Street Journal reported that YouTube is developing a marketplace for streaming platforms. This would allow consumers to subscribe to various streaming services using their Google/YouTube accounts.

Our Take: YouTube has around 2.6 billion monthly active users, so any new product on the platform is instantly exposed to one of the largest possible audiences. It’s even large enough to be an attractive audience for Netflix (NASDAQ: NFLX) with 200 million paying subscribers and Disney (NYSE: DIS) with 180 million paying subscribers.

Whether or not it can move the needle for these companies, and for Alphabet (NASDAQ: GOOG) itself, remains to be seen. But it could be a very big deal for smaller streaming platforms like HBO Max, owned by Warner Media (NASDAQ: WBD), and Peacock, owned by Comcast (NASDAQ: CMCSA). A marketplace like this would expose these platforms to a far larger audience than they have ever had access to in the past.

It may also be a big deal - in a bad way - for companies like Roku (NASDAQ: ROKU) as they would be competing directly with such a marketplace.

Meta falls to a new 52-week low - again!

Last week Meta Platforms (NASDAQ: META) fell to a new 52-week low. The share price is now 61% below the all-time high recorded a year ago. According to most metrics, the stock is now very cheap, even if we assume that past growth rates won’t be repeated for some time. Clearly however the market is still very skeptical of Meta’s potential.

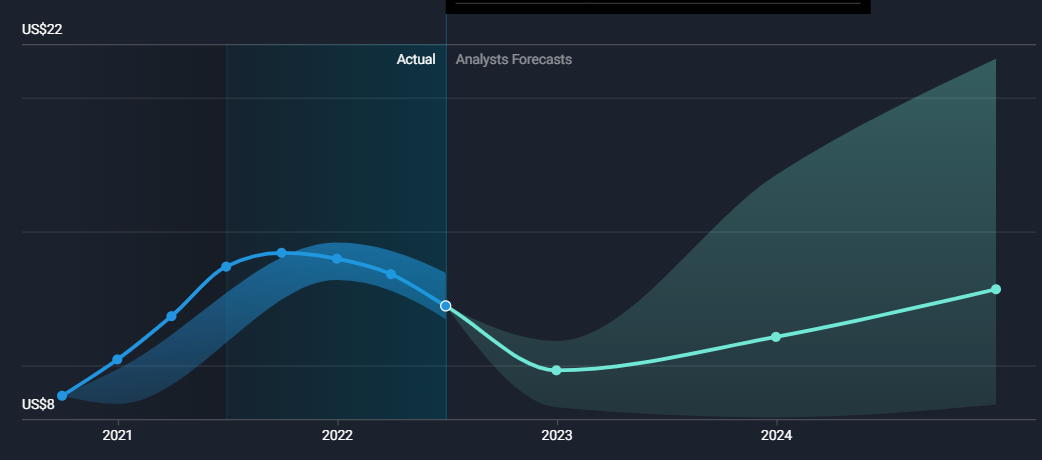

Our Take: The chart above reflects the average EPS forecasts for Meta over the next three years. It also shows how wide the range between the highest and lowest forecasts is, and how much wider that range is than it was in the past. Meta’s legacy business has matured, and it is now looking to Reality Labs and the metaverse for future growth - but when and how much this business will contribute to the bottom line is very uncertain. In short, Meta’s future looks very different from its past and investors are looking for a larger risk premium.

When assessing a stock, the range between the highest and lowest analyst forecast is a good indication of how certain or reliable future earnings may be. The wider the range, the larger the margin of safety required to justify the uncertainty. In Meta's case, the analysts seem quite divided on its future prospects! The Simply Wall St analysis page includes this range for every company covered by sell-side analysts.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives