- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks, Inc.'s (NASDAQ:PANW) Price Is Out Of Tune With Revenues

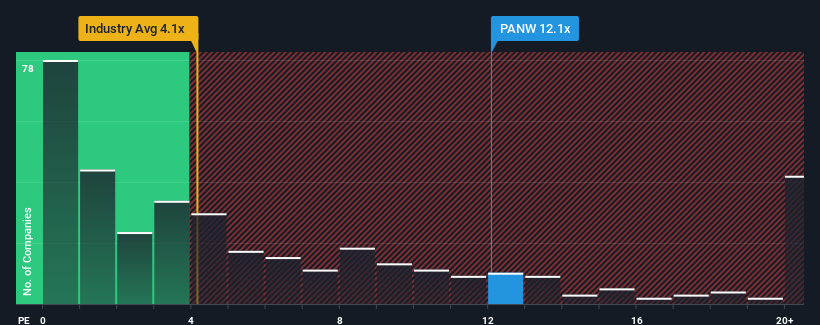

Palo Alto Networks, Inc.'s (NASDAQ:PANW) price-to-sales (or "P/S") ratio of 12.1x might make it look like a strong sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.1x and even P/S below 1.6x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Palo Alto Networks

How Has Palo Alto Networks Performed Recently?

With revenue growth that's superior to most other companies of late, Palo Alto Networks has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Palo Alto Networks will help you uncover what's on the horizon.How Is Palo Alto Networks' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Palo Alto Networks' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 99% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 16% per year over the next three years. That's shaping up to be similar to the 15% per annum growth forecast for the broader industry.

With this information, we find it interesting that Palo Alto Networks is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Palo Alto Networks' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Palo Alto Networks (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Palo Alto Networks, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.