- United States

- /

- Software

- /

- NasdaqGS:PANW

Assessing Palo Alto Networks After Double-Digit Growth and AI-Driven Security Momentum in 2025

Reviewed by Bailey Pemberton

Trying to decide what to do with Palo Alto Networks stock? You are definitely not alone. With all eyes on the cybersecurity industry, this company has been making some notable moves both in the headlines and in the markets. Over the last year, shares have climbed 21.0%, and the five-year gain stands at a staggering 392.3%. Even in the past month, the stock is up 8.2%, hinting that investors continue to see promise in its growth story.

Part of the recent momentum has been driven by increasing market focus on network security, as businesses everywhere scramble to strengthen their cyber defenses. Palo Alto Networks finds itself at the center of attention, and it is hard not to be intrigued by how the narrative is shaping risk and reward for shareholders. However, all this excitement comes with a familiar question: is Palo Alto Networks fairly valued after such a remarkable run?

Looking at the numbers, the company currently scores 1 out of 6 in undervaluation checks. In other words, just one indicator suggests the stock might be undervalued. That makes valuation a critical discussion point for anyone thinking about buying, holding, or selling.

Let us break down what goes into that score, explore the different ways analysts size up Palo Alto Networks’ valuation, and give you something even more useful to consider as you make your own decision.

Palo Alto Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palo Alto Networks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by forecasting its future cash flows and discounting them back to reflect their value in today’s dollars. This approach helps investors gauge whether a stock’s current price aligns with its future earning potential.

Palo Alto Networks currently generates $3.5 Billion in Free Cash Flow, highlighting the robust profitability of its core business. Analyst estimates suggest FCF could grow to $4.0 Billion by 2026, with projections reaching over $8.3 Billion by 2030 according to extrapolated models. Initial projections rely on analyst coverage, while estimates beyond 2029 are modeled to extend the trend, providing a long-term view of expected performance.

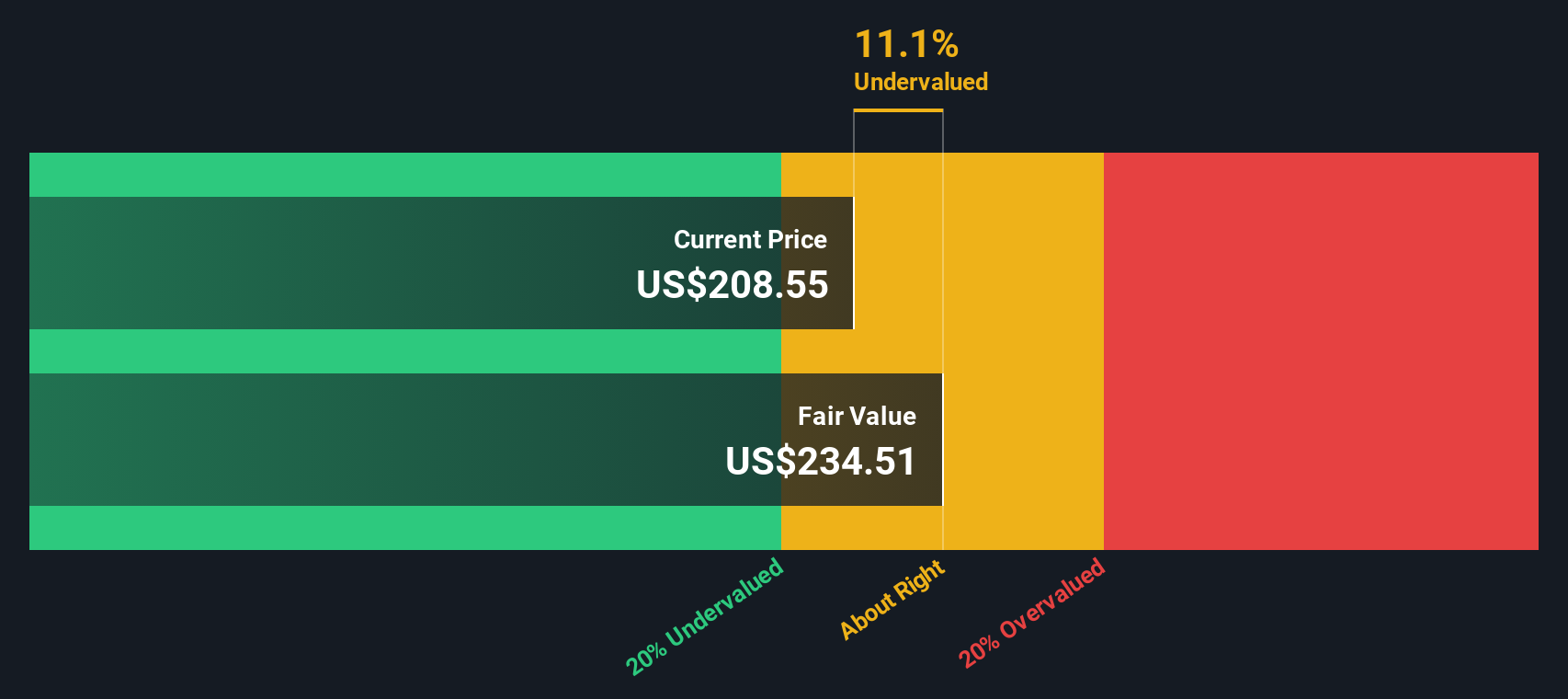

Based on this multi-stage DCF, the analysis indicates an intrinsic fair value of $235.41 per share for Palo Alto Networks. This valuation suggests the stock is trading at an attractive 12.0% discount compared to its current market price, implying a margin of safety for new or existing investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palo Alto Networks is undervalued by 12.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Palo Alto Networks Price vs Earnings

The Price-to-Earnings (PE) ratio is often the metric of choice when valuing profitable technology companies like Palo Alto Networks. It reflects how much investors are willing to pay for each dollar of earnings, making it especially useful for companies with a track record of consistent profitability.

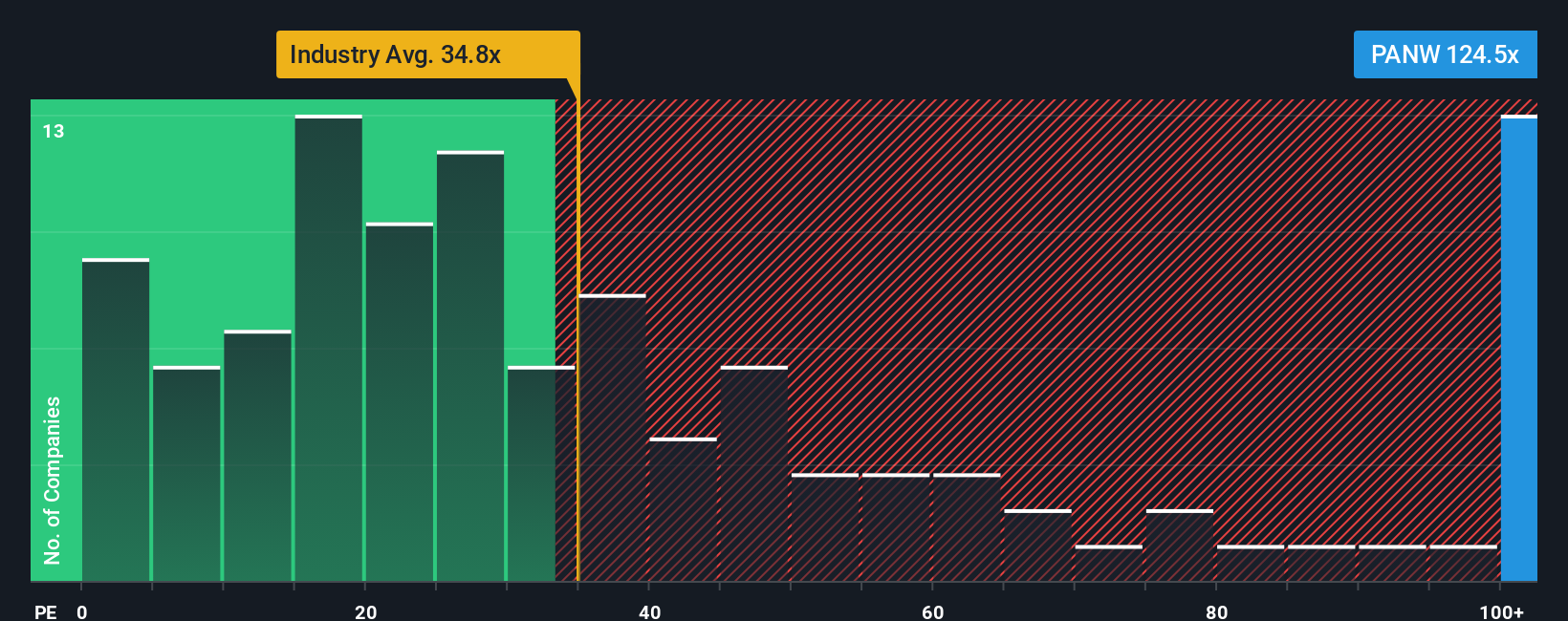

Growth expectations and perceived risk play a big role in shaping what qualifies as a “fair” PE ratio. Companies with higher expected earnings growth and lower risk typically command premium PE multiples, while those facing uncertainty or slower growth trends often see lower ones. For context, Palo Alto Networks is currently trading at a PE ratio of 122.2x, compared to a software industry average of 35.7x and a peer average of 59.6x. These benchmarks show that the stock commands a substantial premium, likely reflecting healthy earnings growth and market leadership.

To go one step further, Simply Wall St’s “Fair Ratio” analyzes not just industry or peer averages, but also factors unique to Palo Alto Networks such as its profit margins, market cap, earning trends, and risk profile. This makes it a more tailored benchmark and provides a clearer gauge of whether the company’s valuation stacks up against its specific fundamentals. For Palo Alto Networks, the Fair Ratio is 44.9x. With its actual PE far above this, the stock appears to be valued well ahead of fundamental expectations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palo Alto Networks Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, personal story or perspective you create about a company, connecting what you believe about the business to numbers like future revenue, earnings, and profit margins. Instead of only focusing on ratios or analyst targets, a Narrative lets you express your own view of Palo Alto Networks’ future, linking its strategy and industry context to a specific financial forecast and resulting fair value estimate.

On Simply Wall St's Community page, millions of investors already use Narratives to turn their opinions on opportunities and risks into actionable valuations. Narratives help you decide when to buy or sell by directly comparing your estimated Fair Value with the current Price, and since they're updated automatically whenever new information (like fresh earnings or news) is released, your analysis stays relevant without any extra effort.

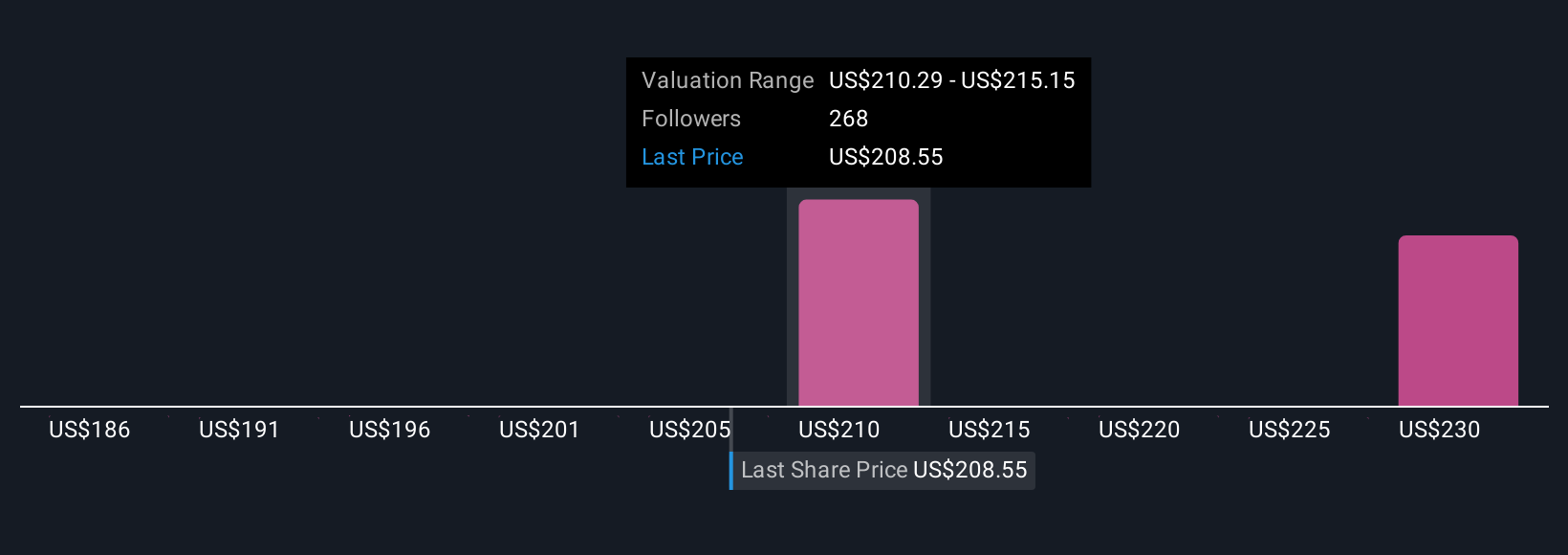

For example, some investors using Narratives believe Palo Alto Networks could be worth as much as $240 if rapid AI-driven security adoption boosts growth. Others estimate a fair value as low as $131 due to concerns about competition and integration risks. This shows how the Narrative approach captures real differences in investor outlooks and gives you a flexible, dynamic way to invest smarter.

Do you think there's more to the story for Palo Alto Networks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion