- United States

- /

- Software

- /

- NasdaqGS:OTEX

OpenText (NasdaqGS:OTEX): Evaluating Valuation After Platform Innovation and Key Leadership Appointments

Reviewed by Kshitija Bhandaru

Open Text (NasdaqGS:OTEX) recently introduced advanced features to its Core Threat Detection and Response platform, offering deeper integration with Microsoft’s cybersecurity stack. In addition, the company welcomed Steve Rai as CFO and George Schindler to its board.

See our latest analysis for Open Text.

Open Text’s recent string of product launches and leadership moves has captured investor attention, and the momentum is showing up in the numbers. The 90-day share price return of 37% is hard to miss, highlighting a steady year-to-date rally while the 1-year total shareholder return stands at 18%. With steady innovation and new faces at the helm, enthusiasm for the company’s long-term potential appears to be building.

Curious to see what other tech leaders are making bold moves? Explore the next wave of innovators with our See the full list for free..

With momentum in both technology and leadership, the question for investors now is clear: is Open Text still trading at a discount, or have recent gains already captured its future growth prospects?

Most Popular Narrative: 2.5% Overvalued

With the narrative consensus fair value at $34.80 and Open Text's last close at $38.60, current sentiment suggests shares have run just ahead of underlying assumptions. Attention is turning to whether expected business improvements can deliver more upside from here.

Ongoing business optimization and restructuring initiatives are expected to deliver substantial annualized cost savings (with 35% additional realized in FY26). This is anticipated to enable further EBITDA margin expansion and continued robust free cash flow growth.

Wondering what powers this valuation? The narrative's projected shifts in cost structure and margins play a starring role. Curious which specific financial levers support this price? Read on to see how expectations for efficiency gains and earnings shape the outlook.

Result: Fair Value of $34.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legacy business decline or unexpected challenges in executing restructuring plans could quickly alter Open Text’s growth trajectory and valuation outlook.

Find out about the key risks to this Open Text narrative.

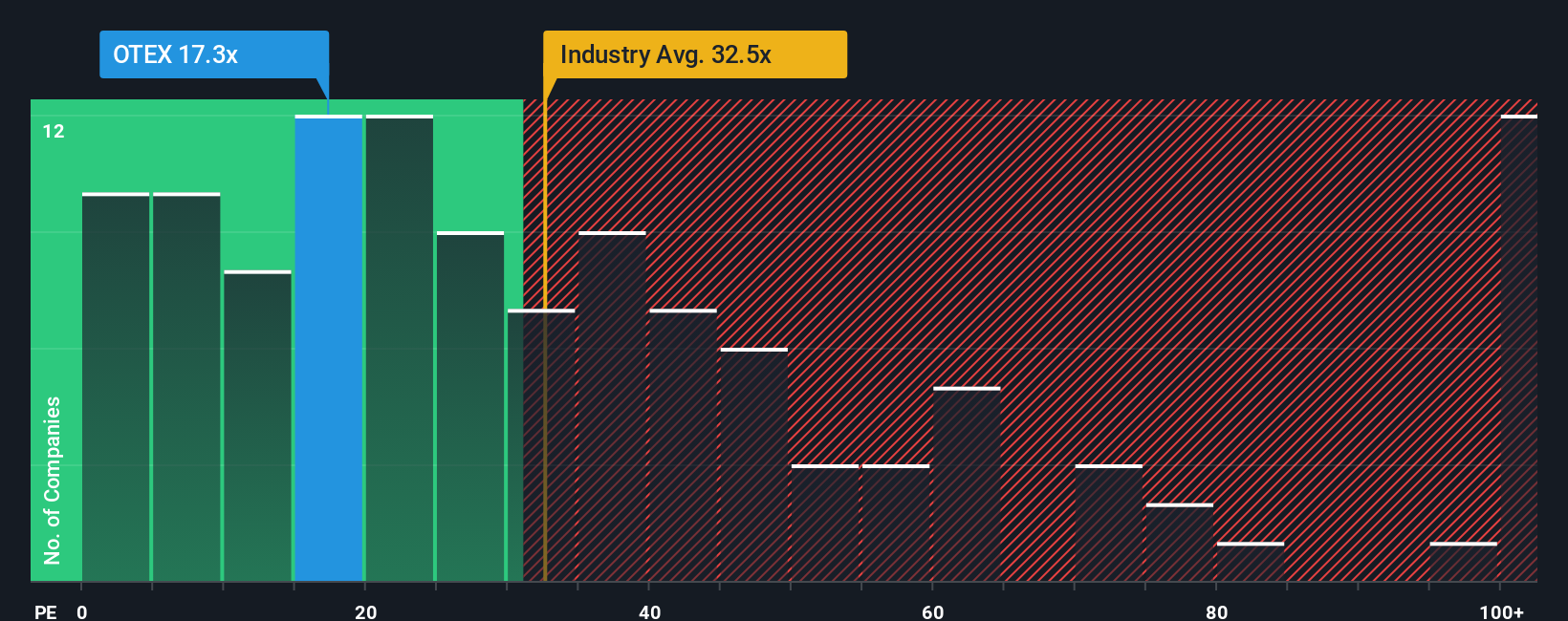

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings, Open Text trades at 22.1 times earnings, which is well below US Software industry peers at 34.8 times and a fair ratio of 36.5. This signals relative value compared to others, but could also reflect lingering uncertainty. Will the market close this gap, or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Open Text Narrative

If you'd rather put the story together yourself or have a different perspective, you can easily create your own take in just a few minutes. Do it your way.

A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on the next great opportunity. Don’t let your portfolio miss out on high-potential trends and smart picks:

- Tap into the tech revolution by seeking out AI-powered companies using these 24 AI penny stocks, a tool tailored for the most promising names riding the artificial intelligence wave.

- Maximize your search for hidden gems with these 892 undervalued stocks based on cash flows, which features stocks that may be trading below their intrinsic value based on future cash flows.

- Boost your income potential by securing these 19 dividend stocks with yields > 3%, offering robust yields and strong fundamentals for investors who value reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion