- United States

- /

- Software

- /

- NasdaqCM:OSPN

It's Unlikely That OneSpan Inc.'s (NASDAQ:OSPN) CEO Will See A Huge Pay Rise This Year

CEO Scott Clements has done a decent job of delivering relatively good performance at OneSpan Inc. (NASDAQ:OSPN) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 09 June 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for OneSpan

Comparing OneSpan Inc.'s CEO Compensation With the industry

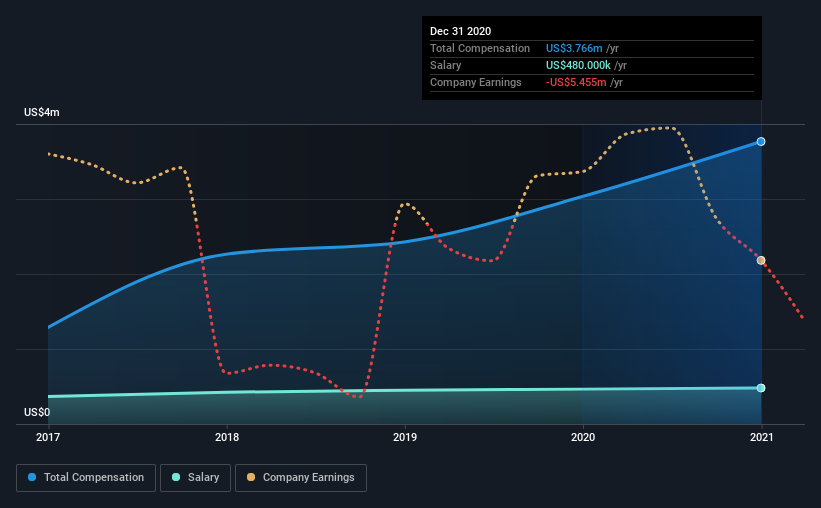

Our data indicates that OneSpan Inc. has a market capitalization of US$1.1b, and total annual CEO compensation was reported as US$3.8m for the year to December 2020. We note that's an increase of 24% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$480k.

On comparing similar companies from the same industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$2.6m. This suggests that Scott Clements is paid more than the median for the industry. What's more, Scott Clements holds US$4.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$480k | US$465k | 13% |

| Other | US$3.3m | US$2.6m | 87% |

| Total Compensation | US$3.8m | US$3.0m | 100% |

Speaking on an industry level, nearly 11% of total compensation represents salary, while the remainder of 89% is other remuneration. OneSpan is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

OneSpan Inc.'s Growth

OneSpan Inc. has seen its earnings per share (EPS) increase by 61% a year over the past three years. Its revenue is down 20% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has OneSpan Inc. Been A Good Investment?

OneSpan Inc. has served shareholders reasonably well, with a total return of 21% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling OneSpan (free visualization of insider trades).

Switching gears from OneSpan, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading OneSpan or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OSPN

OneSpan

Provides digital solutions for security, authentication, identity, electronic signature, and digital workflow products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026