- United States

- /

- Software

- /

- NasdaqGS:OS

OneStream (OS): Evaluating Valuation After Launch of Modern Financial Close and Enhanced ESG Planning Solutions

Reviewed by Kshitija Bhandaru

OneStream, Inc. (OS) has just rolled out its Modern Financial Close platform, along with enhanced ESG Planning & Reporting and new SensibleAI features. These launches focus on greater automation and deeper insights for finance departments looking to streamline their reporting processes.

See our latest analysis for OneStream.

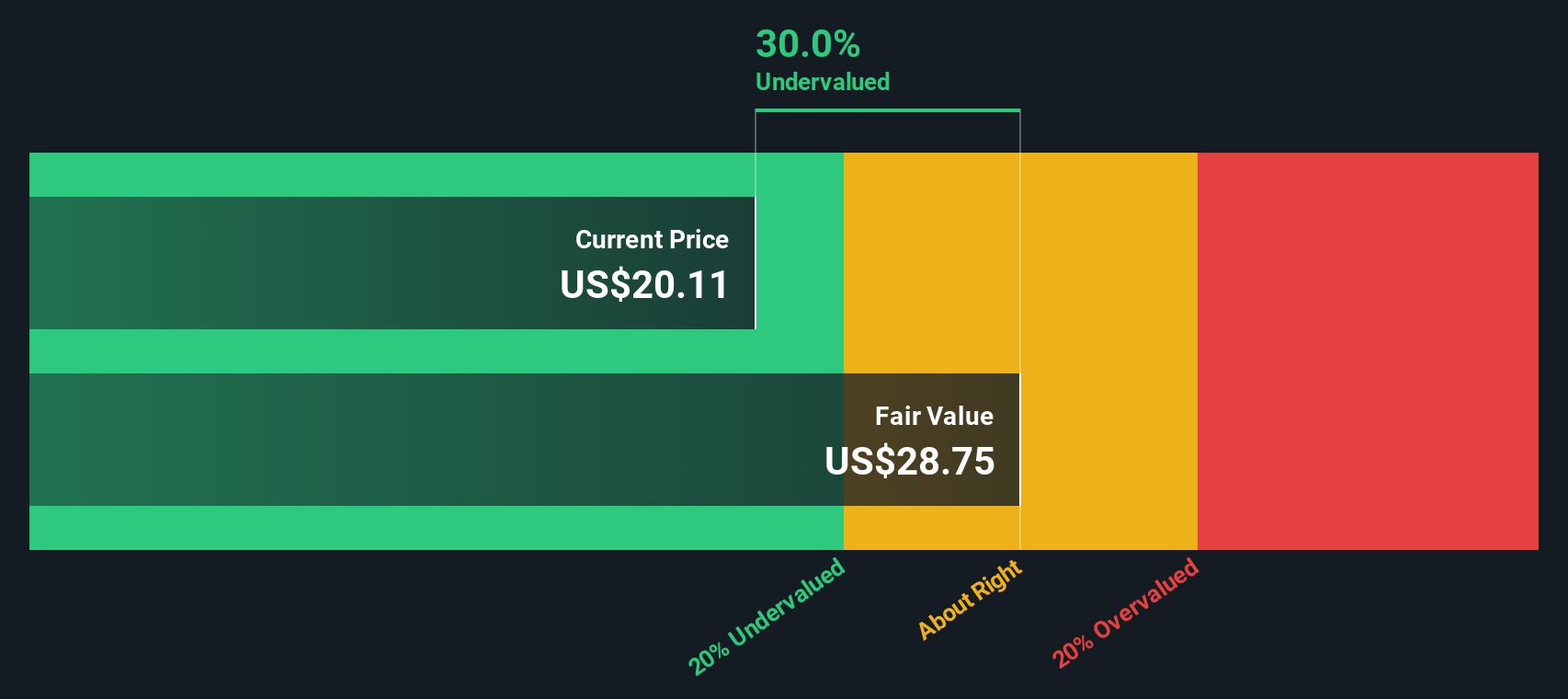

While OneStream continues to innovate with automation and AI-driven features, its share price has seen considerable pressure, with a 1-year total shareholder return of -42.5% and a year-to-date share price return of -38.1%. Some recent events, like the recent board expansion and technology platform launches, have captured headlines. However, the market's response suggests investors remain cautious for now. That said, short-term volatility does not rule out a shift in sentiment if execution improves or risk perceptions change.

If you’re looking for other investment opportunities in software and technology, exploring the current movers and disruptors via our curated tech and AI stocks list could be an eye-opener: See the full list for free.

With shares trading well below analyst price targets despite double-digit revenue growth and major product launches, investors may wonder if the market is overlooking OneStream’s longer-term potential or if the current price already reflects all future upside.

Most Popular Narrative: 40.2% Undervalued

OneStream’s fair value, as estimated by the most widely followed narrative, stands significantly above the last close price of $17.49. This perspective suggests the market may be overlooking core drivers and future potential, making the disconnect between price and fundamentals hard to ignore.

Ongoing large-scale digital transformation across industries, with CFOs increasingly seeking unified platforms to replace legacy financial systems, strongly positions OneStream to capture expanding market share. This supports sustained subscription revenue and new customer growth.

Ever wondered what numbers underpin such a bullish view? The fair value hinges on projections about massive market demand, rising margins and a dramatic swing in earnings. Want to see exactly which future assumptions create this pricing gap? Read the full narrative for the details that could turn sentiment.

Result: Fair Value of $29.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing public sector uncertainty or delays in enterprise tech spending could easily undermine growth expectations and change the bullish view on OneStream.

Find out about the key risks to this OneStream narrative.

Another View: What Does the SWS DCF Model Say?

To add perspective, the SWS DCF model estimates OneStream’s fair value at $28.32. This places current shares 38.2% below this level and indicates it is also undervalued by this method. However, DCF models rely on long-term forecasts. How much weight should investors place on future cash flow projections compared to today’s numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own OneStream Narrative

If you want to dig into the numbers or challenge these perspectives, it takes just a few minutes to analyze the facts and shape your outlook. Do it your way

A great starting point for your OneStream research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next opportunity could be waiting. Don't let it pass you by. Use these handpicked lists to find companies poised for growth, income, or game-changing innovation.

- Boost your portfolio with reliable income by tapping into these 18 dividend stocks with yields > 3% offering yields above 3% in today’s market.

- Catch the momentum in artificial intelligence and secure your spot among leaders with these 25 AI penny stocks transforming industries worldwide.

- Harness tomorrow’s tech by researching these 26 quantum computing stocks shaping breakthroughs in computing power and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OS

OneStream

OneStream, Inc. delivers a unified, AI-enabled, and extensible software platform in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives