- United States

- /

- Diversified Financial

- /

- NasdaqCM:OLB

Here's Why Shareholders May Want To Be Cautious With Increasing The OLB Group, Inc.'s (NASDAQ:OLB) CEO Pay Packet

Shareholders of The OLB Group, Inc. (NASDAQ:OLB) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 15 September 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for OLB Group

How Does Total Compensation For Ronny Yakov Compare With Other Companies In The Industry?

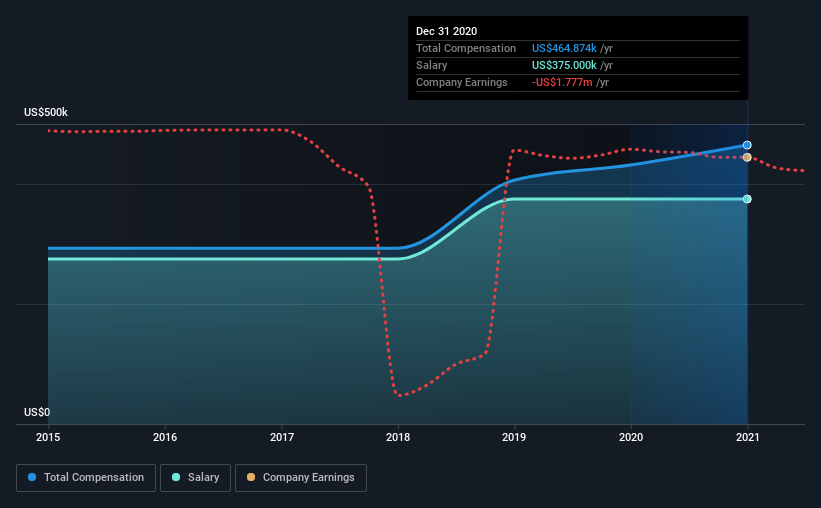

Our data indicates that The OLB Group, Inc. has a market capitalization of US$31m, and total annual CEO compensation was reported as US$465k for the year to December 2020. That's just a smallish increase of 7.7% on last year. Notably, the salary which is US$375.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$364k. So it looks like OLB Group compensates Ronny Yakov in line with the median for the industry. What's more, Ronny Yakov holds US$18m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$375k | US$375k | 81% |

| Other | US$90k | US$57k | 19% |

| Total Compensation | US$465k | US$432k | 100% |

On an industry level, roughly 18% of total compensation represents salary and 82% is other remuneration. OLB Group pays out 81% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

The OLB Group, Inc.'s Growth

Over the past three years, The OLB Group, Inc. has seen its earnings per share (EPS) grow by 63% per year. Its revenue is up 4.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has The OLB Group, Inc. Been A Good Investment?

The return of -51% over three years would not have pleased The OLB Group, Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 3 warning signs for OLB Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade OLB Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OLB

OLB Group

Provides integrated financial and transaction processing services for small and mid-sized merchants in the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026