- United States

- /

- IT

- /

- NasdaqGS:OKTA

Will Okta's (OKTA) Recent Outage and AI Threats Shift Its Digital Security Narrative?

Reviewed by Sasha Jovanovic

- Okta recently faced a significant outage that drew attention to its cybersecurity defenses, with CEO Todd McKinnon addressing the evolving landscape of AI-driven threats in an interview following the incident.

- This disruption underscores the increasing importance and complexity of securing digital identity in cloud-based environments as enterprises confront more sophisticated risks.

- We’ll look at how this outage and heightened AI threat focus may influence Okta’s long-term investment outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Okta Investment Narrative Recap

To be an Okta shareholder right now, you need to believe enterprises will increasingly require dedicated, cloud-first identity platforms as digital transformation and cybersecurity threats accelerate. The recent outage spotlights the ongoing risk of operational disruptions, but it does not appear to materially alter the company's primary catalyst: its push to innovate rapidly in AI-powered security solutions. However, persistent reliability concerns may intensify competition from integrated security vendors targeting Okta’s core customers.

Okta’s September announcement of new AI agent-focused identity platform capabilities is particularly relevant in the wake of this outage. By enhancing digital credential security and simplifying the management of AI-driven application access, Okta aims to address the same threats that brought its recent challenges into focus and reinforce its position as a leader in secure cloud identity for complex enterprise environments.

On the other hand, investors should be aware that increased market consolidation among cybersecurity platforms could...

Read the full narrative on Okta (it's free!)

Okta's outlook anticipates $3.6 billion in revenue and $414.2 million in earnings by 2028. This scenario is based on 9.5% annual revenue growth and a $246.2 million increase in earnings from the current $168.0 million.

Uncover how Okta's forecasts yield a $120.37 fair value, a 35% upside to its current price.

Exploring Other Perspectives

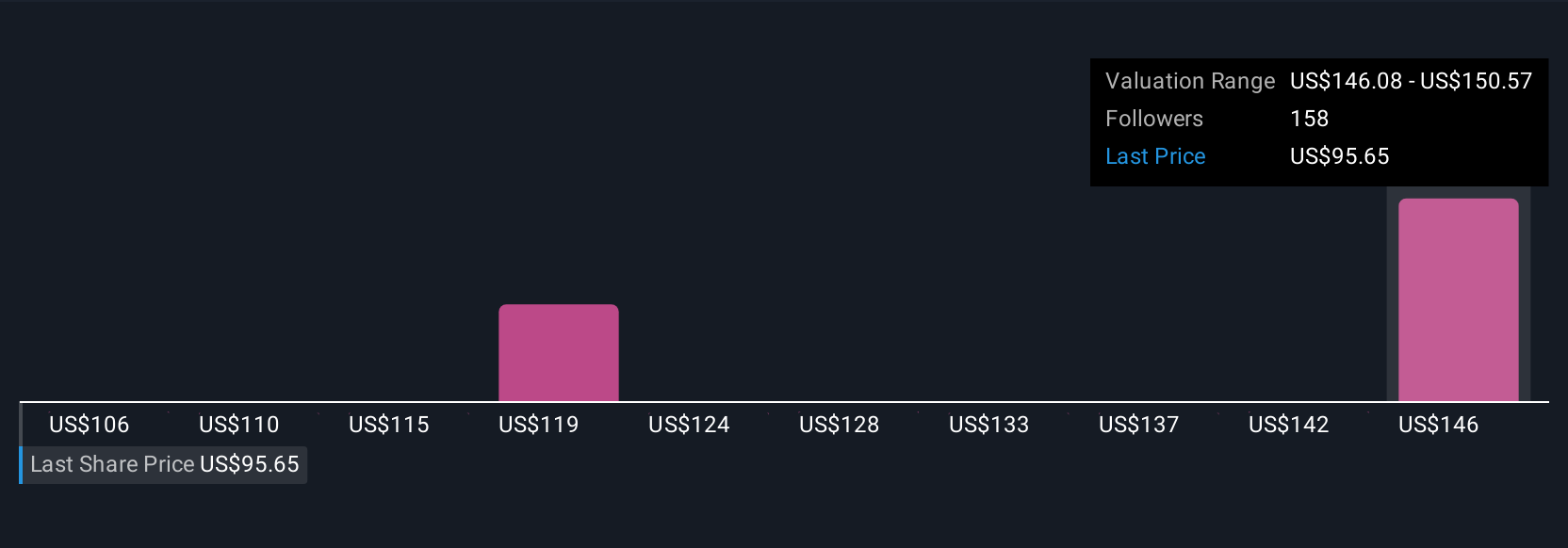

Six member estimates from the Simply Wall St Community place Okta’s fair value between US$116.61 and US$147.87 per share. Many are watching how market consolidation and evolving enterprise preferences could impact Okta’s future growth and pricing power, urging readers to consider a range of opinions.

Explore 6 other fair value estimates on Okta - why the stock might be worth as much as 65% more than the current price!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives