- United States

- /

- IT

- /

- NasdaqGS:OKTA

Weekly Picks: 📈 Okta’s Next Move, Atlassian’s AI Edge, and XTB's Growth Path

Reviewed by Bailey Pemberton

Welcome to Weekly Picks, where each week our analysts hand pick the best community Narratives ( what is a Narrative? ).

This week’s picks cover:

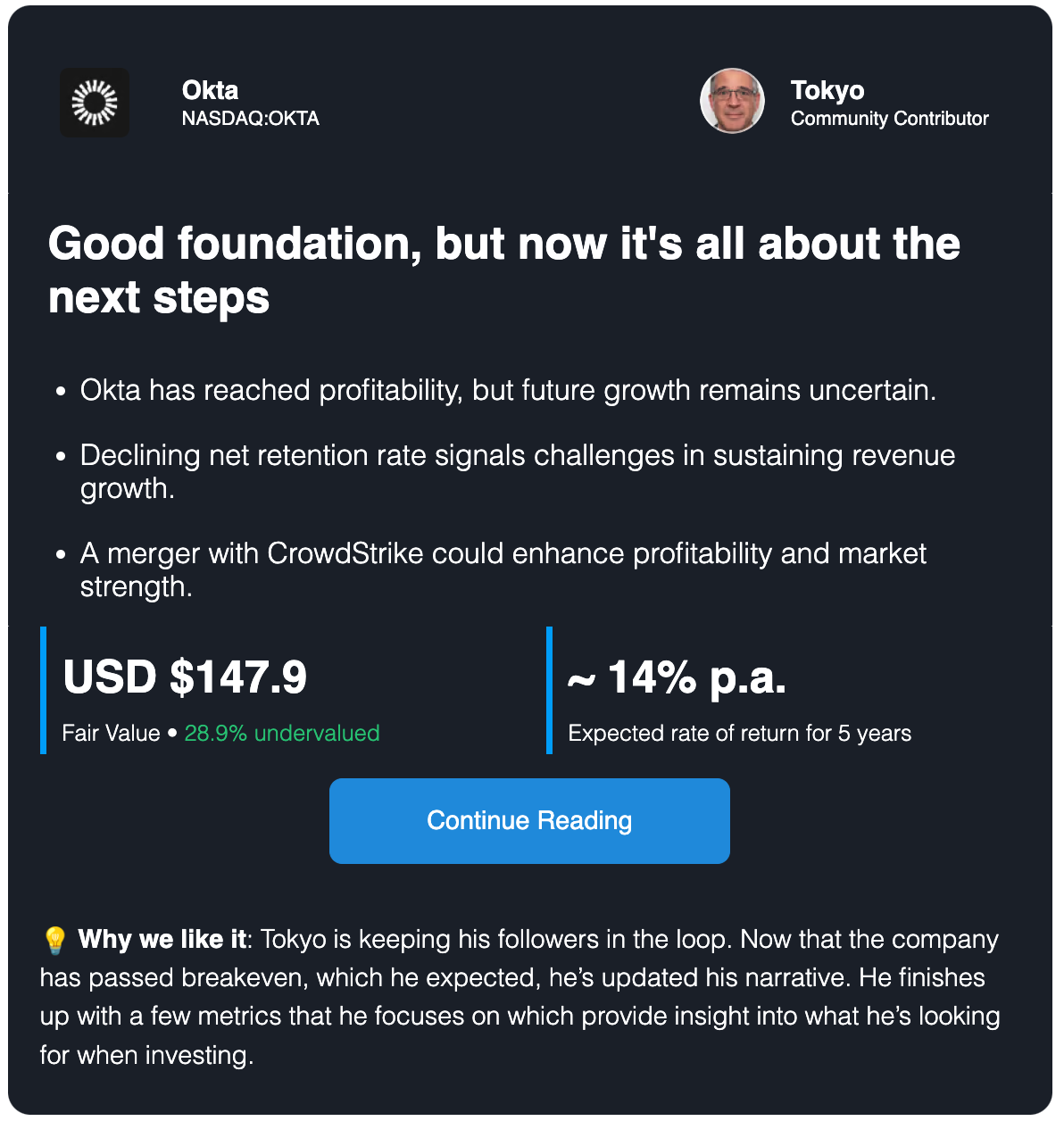

- 🪪 Why Okta is well positioned to seize its opportunity.

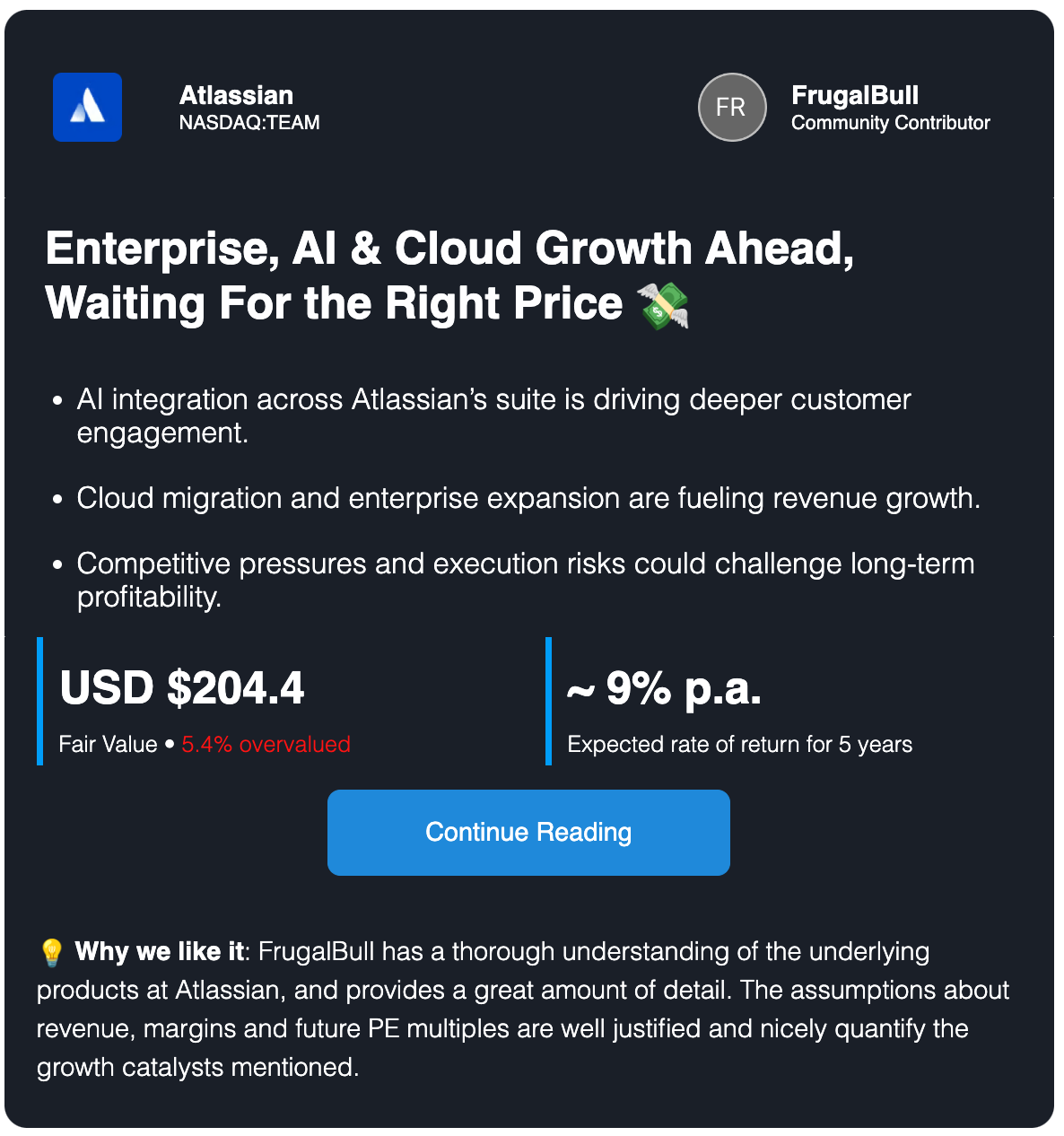

- 💻 The 4 catalysts behind Atlassian’s potential upside.

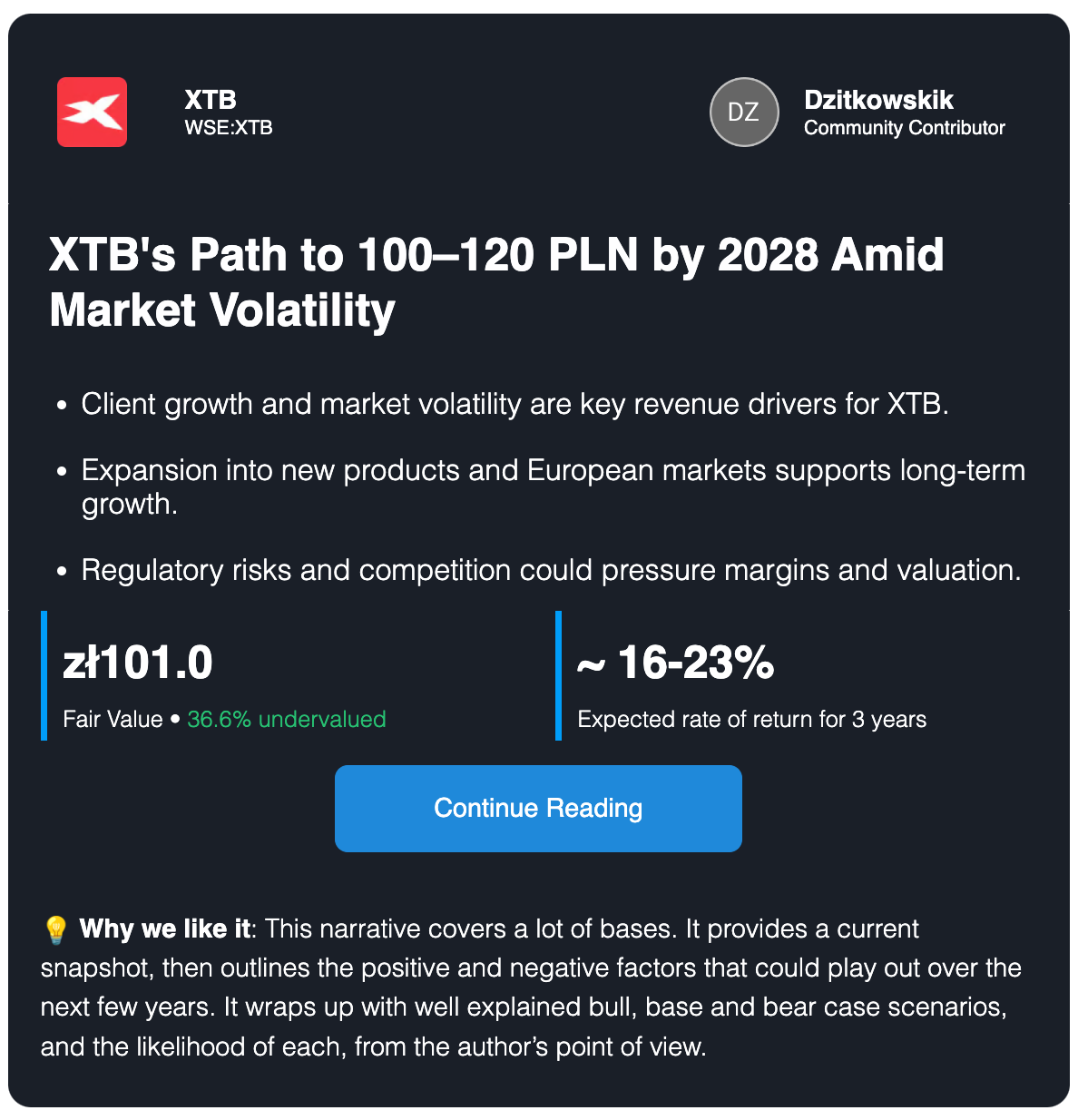

- 📊 Why even XTB’s base case looks appealing.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success