- United States

- /

- IT

- /

- NasdaqGS:OKTA

How Recent Partnerships Are Shaping Okta’s Investment Appeal in 2025

Reviewed by Bailey Pemberton

- Curious if Okta is a hidden gem or just riding the tech wave? You're not alone. Plenty of investors are watching for signals that it could be undervalued right now.

- The stock has seen some interesting movement lately, rising 2.4% this week, pulling back 8.1% over the last month, but still holding on to a modest 2.2% gain year-to-date.

- Recent shifts in Okta's share price have been fueled by a combination of renewed interest in digital identity solutions and broader market swings affecting tech stocks. Headlines about increased cybersecurity threats and high-profile partnerships have added a fresh perspective for both risk-aware and growth-focused investors.

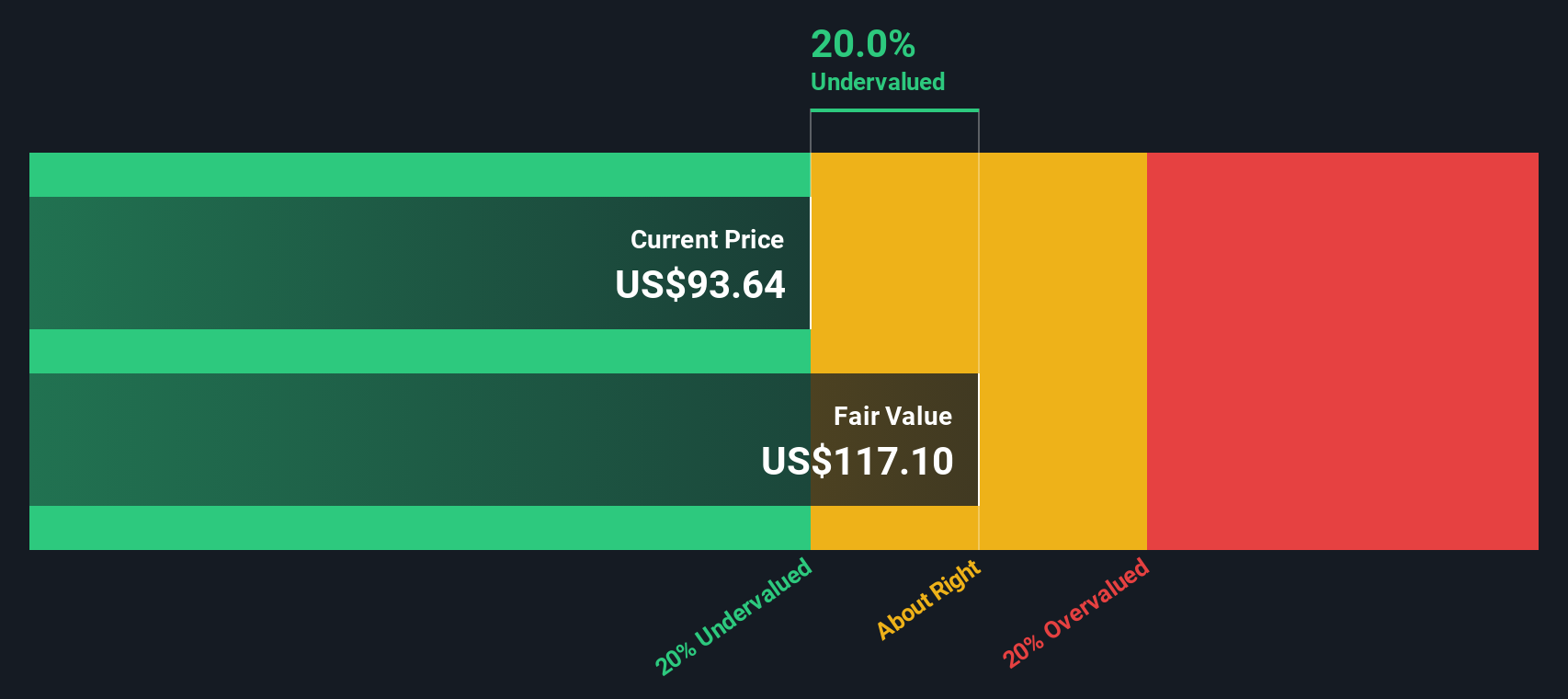

- According to our checks, Okta currently earns a 3/6 valuation score, meaning it is undervalued by half of the major criteria we use. Let's break down what goes into that assessment, and keep in mind that the most insightful way to look at Okta's value might surprise you at the end.

Find out why Okta's 3.9% return over the last year is lagging behind its peers.

Approach 1: Okta Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to today to reflect their present value. This approach is commonly used to determine if a stock is trading below or above what its future earnings are truly worth.

For Okta, the latest reported Free Cash Flow (FCF) sits at $830.2 Million. Analysts provide detailed estimates for the next several years, with projections indicating steady growth and reaching as high as $1.21 Billion in FCF by 2030. While analyst estimates are used for the first five years, projections beyond that rely on long-term growth assumptions.

By adding up these future yearly cash flows and discounting them to today's dollars, the DCF model calculates an intrinsic value of $108.74 per share for Okta. This represents a 25.9% discount compared to the current share price, which implies the stock is solidly undervalued at today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Okta is undervalued by 25.9%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Okta Price vs Earnings

For established, profitable companies, the Price-to-Earnings (PE) ratio remains one of the most meaningful ways to gauge valuation. The PE ratio measures how much investors are currently willing to pay for each dollar of a company’s earnings, making it especially relevant for businesses generating consistent profits.

A “normal” or fair PE ratio depends on many factors, including expectations for future growth and the perceived risk of the underlying business. Companies with faster growth or lower risk often command higher PE multiples compared to their sector peers.

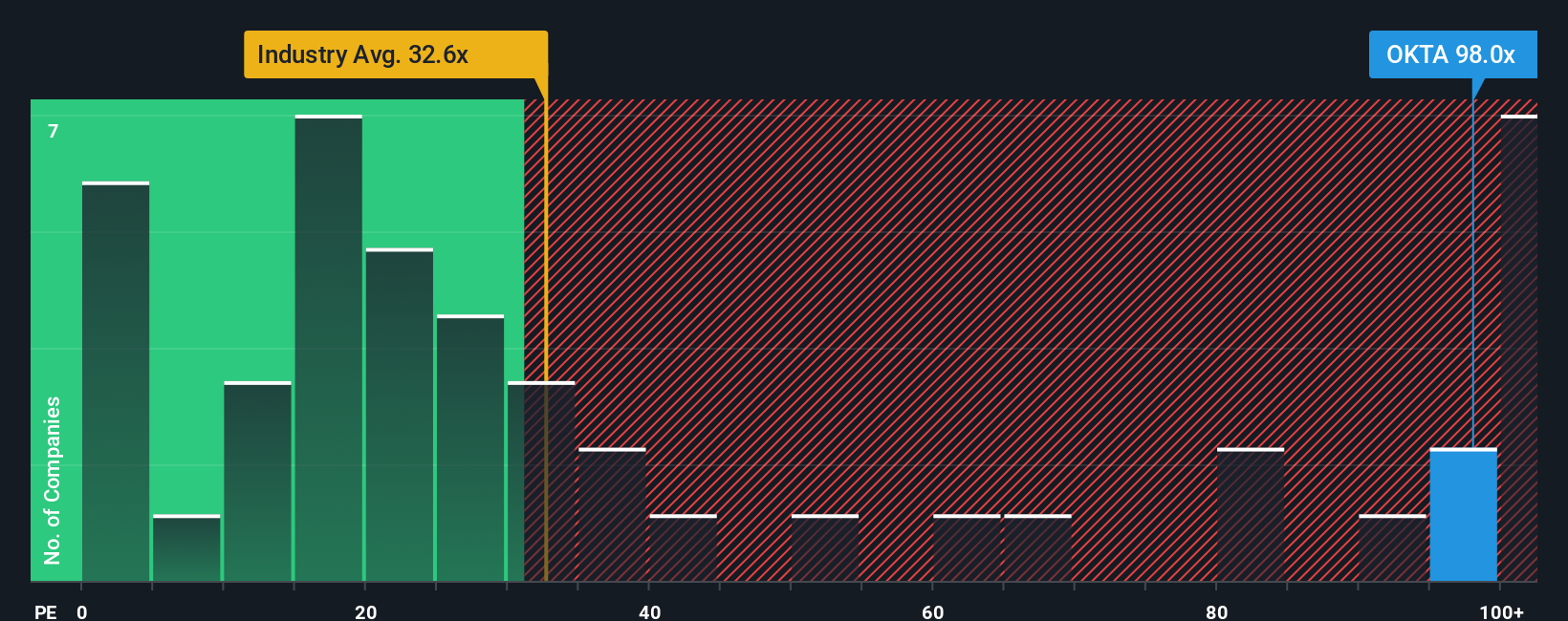

As of now, Okta trades on a PE ratio of 84.5x. For context, the average PE ratio in the IT industry stands at 27.8x, while Okta’s peer group sits slightly higher at 28.2x. This suggests Okta is trading at a significant premium to both its industry and direct competitors.

However, relying solely on these benchmarks can overlook the company’s unique qualities. That is where Simply Wall St’s “Fair Ratio” comes in: it estimates the most appropriate PE multiple for Okta by factoring in earnings growth prospects, industry characteristics, margin profile, company size, and risk factors. Okta’s current Fair Ratio is calculated at 40.8x, reflecting its growth outlook and other fundamentals in a more tailored way than generic industry comparisons.

Comparing Okta’s actual PE ratio of 84.5x to the fair multiple of 40.8x suggests the stock is priced significantly above what would be considered reasonable when all company specifics are taken into account.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Okta Narrative

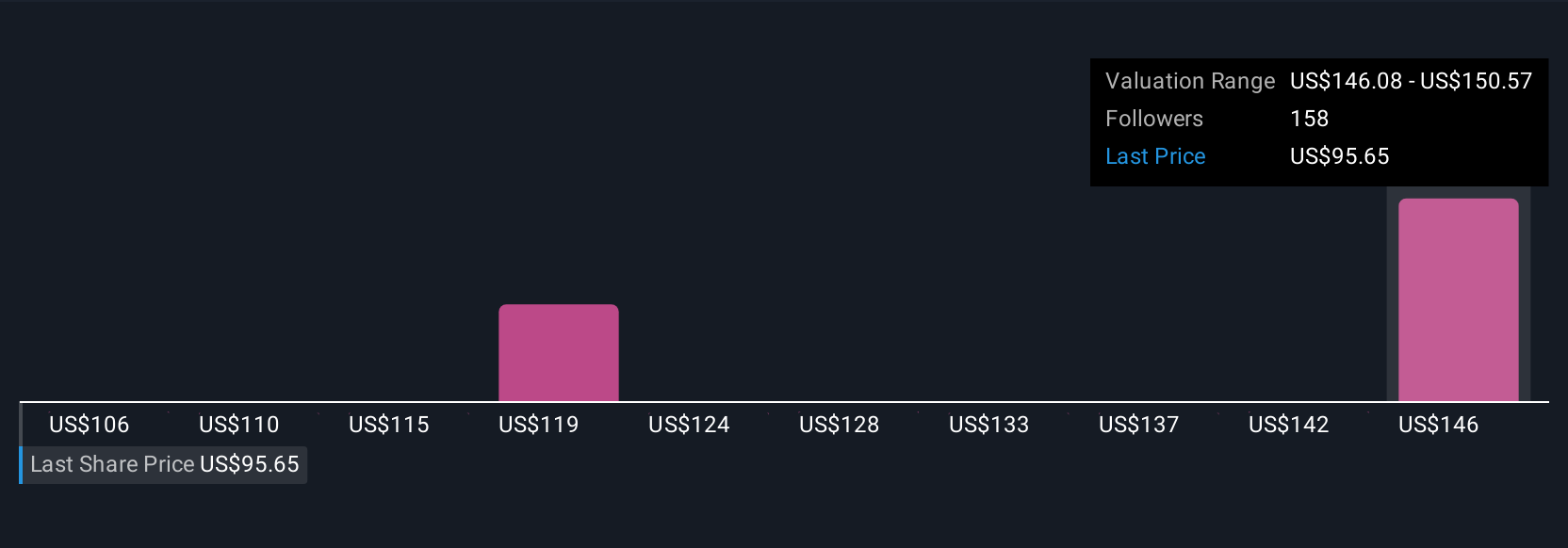

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company's future, such as your view on Okta’s revenue growth, margins, and fair value based on your personal interpretation of the facts and outlook.

Instead of just looking at static ratios or forecasts, Narratives link your view of a company's story directly to a financial forecast and an up-to-date fair value. This approach is accessible to everyone and is available within the Community page on Simply Wall St, where millions of investors share and refine their beliefs.

With Narratives, you can easily compare your own Fair Value estimate for Okta to the current price and see where your expectations align or differ from the market. This can help you decide if and when to buy or sell.

The best part is that Narratives update automatically whenever there is new information, such as news or quarterly results, so your analysis always stays relevant. For example, the most optimistic Okta Narrative recently placed fair value near $148 on the belief that profitability and sector leadership are accelerating, while the most cautious estimate was $75, reflecting concern over competition and slower-than-expected growth.

Narratives offer a dynamic, story-driven way to invest smarter by putting your insights and expectations at the heart of your decision process.

Do you think there's more to the story for Okta? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.