- United States

- /

- IT

- /

- NasdaqGS:OKTA

How Okta’s (OKTA) Expanded AI Security Partnership With Palo Alto Networks Could Affect Investors

Reviewed by Simply Wall St

- Earlier this week, Okta and Palo Alto Networks announced an expanded partnership featuring direct integrations between Okta’s identity solutions and Palo Alto’s security platforms, aiming to unify threat response, secure corporate app access on any device, and simplify security operations for enterprise customers.

- This collaboration introduces AI-driven risk detection and automated threat response, highlighting a trend toward integrated security platforms that help organizations proactively manage cyber threats as workplace environments rapidly evolve.

- To understand how this deeper integration with Palo Alto Networks could reshape Okta's investment outlook, let's assess its impact on growth drivers and product differentiation.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Okta Investment Narrative Recap

To own Okta, you need to believe that identity security will become ever more critical as organizations demand streamlined, AI-enabled protection across devices and clouds. The expanded integration with Palo Alto Networks targets Okta’s biggest near-term catalyst, deepening product stickiness and cross-sell, but it does little to change the key risk: ongoing net revenue retention softness from challenging seat upsells and conservative enterprise budgets.

Among Okta’s recent announcements, the rollout of Cross App Access in June 2025 stands out. This protocol broadens Okta’s AI-driven security controls, connecting directly to the themes of secure automation and workflow integrations addressed in the Palo Alto partnership. Enhanced product breadth remains central to Okta’s goal of deeper IT integration and higher average contract values.

By contrast, investors should also be aware that persistent declines in net revenue retention signal ongoing challenges within existing accounts and if this trend continues, the impact on recurring revenue could be...

Read the full narrative on Okta (it's free!)

Okta's outlook suggests $3.5 billion in revenue and $354.5 million in earnings by 2028. This is based on an expected annual revenue growth rate of 9.6% and a $224.5 million increase in earnings from the current $130.0 million.

Uncover how Okta's forecasts yield a $122.36 fair value, a 28% upside to its current price.

Exploring Other Perspectives

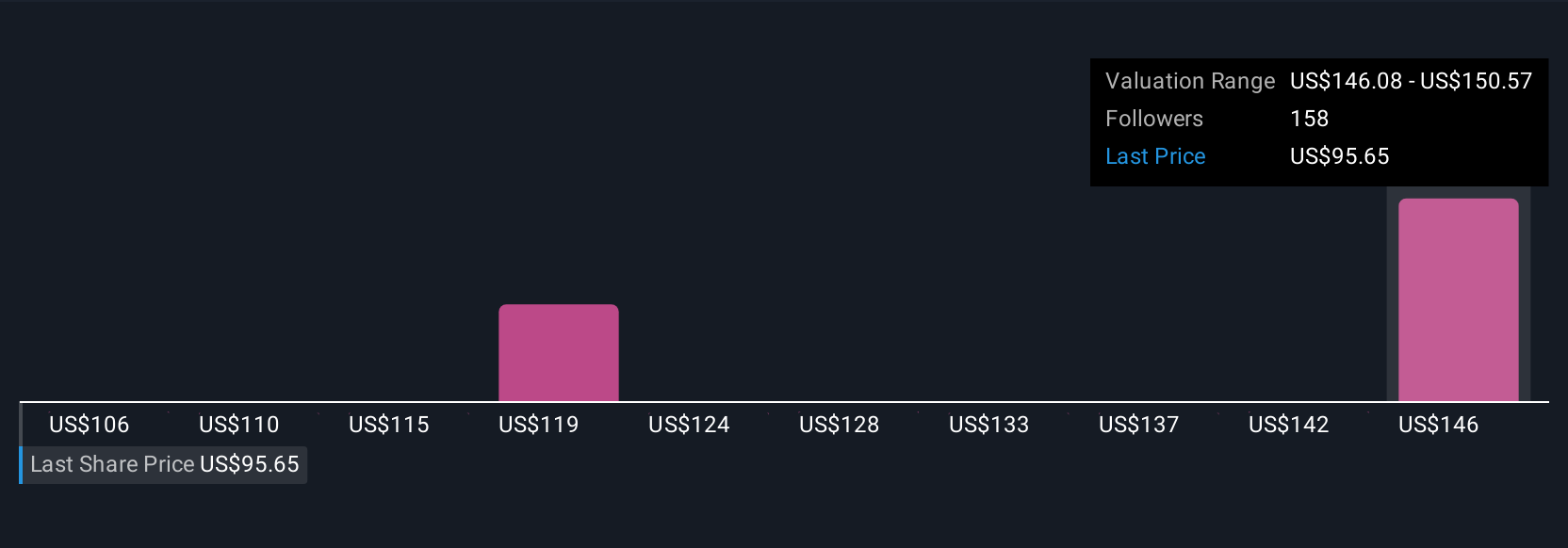

Eight members of the Simply Wall St Community estimate Okta’s fair value between US$105.65 and US$150.77, showing considerable divergence in outlook. While some see room for share price recovery, ongoing challenges in retaining and upselling within existing customer accounts highlight a risk worth further exploration as you weigh these opinions.

Explore 8 other fair value estimates on Okta - why the stock might be worth just $105.65!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives