- United States

- /

- IT

- /

- NasdaqGS:OKTA

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The market has climbed 4.2% in the last 7 days and is up 24% over the past 12 months, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high growth tech stocks that align with these positive trends can be crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Advanced Energy Industries (NasdaqGS:AEIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Energy Industries, Inc. provides precision power conversion, measurement, and control solutions in the United States and internationally with a market cap of $3.72 billion.

Operations: Advanced Energy Industries generates revenue primarily from its Precision Power Products segment, amounting to $1.51 billion. The company specializes in precision power conversion, measurement, and control solutions across various markets globally.

Advanced Energy Industries has demonstrated a robust commitment to innovation, with R&D expenses accounting for $42.5 million in the last quarter alone, reflecting a focus on advancing semiconductor solutions. Despite a 12.2% drop in sales to $364.95 million and net income falling to $15.03 million from $27.14 million year-over-year, the company anticipates earnings growth of 41.5% annually over the next three years, outpacing market expectations of 15.3%. Their recent product launch, NavX impedance matching network, highlights their strategic move towards enhancing plasma control in semiconductor fabrication processes.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles in the United States and internationally, with a market cap of approximately $3.01 billion.

Operations: The company generates revenue primarily from its U.S. Marketplace segment ($686.26 million) and Digital Wholesale segment ($134.48 million).

CarGurus has shown a dynamic approach to growth, with revenue forecasted to increase by 12.9% annually, outpacing the US market's 8.8%. Despite current unprofitability, earnings are expected to surge by 51.5% per year over the next three years. The recent appointment of Mike O’Hanlon as Chief Revenue Officer underscores their commitment to strengthening customer relationships and scaling operations in SaaS and online marketplaces. R&D expenses reflect a strategic focus on innovation, with significant investments aimed at enhancing their platform's capabilities.

- Dive into the specifics of CarGurus here with our thorough health report.

Explore historical data to track CarGurus' performance over time in our Past section.

Okta (NasdaqGS:OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

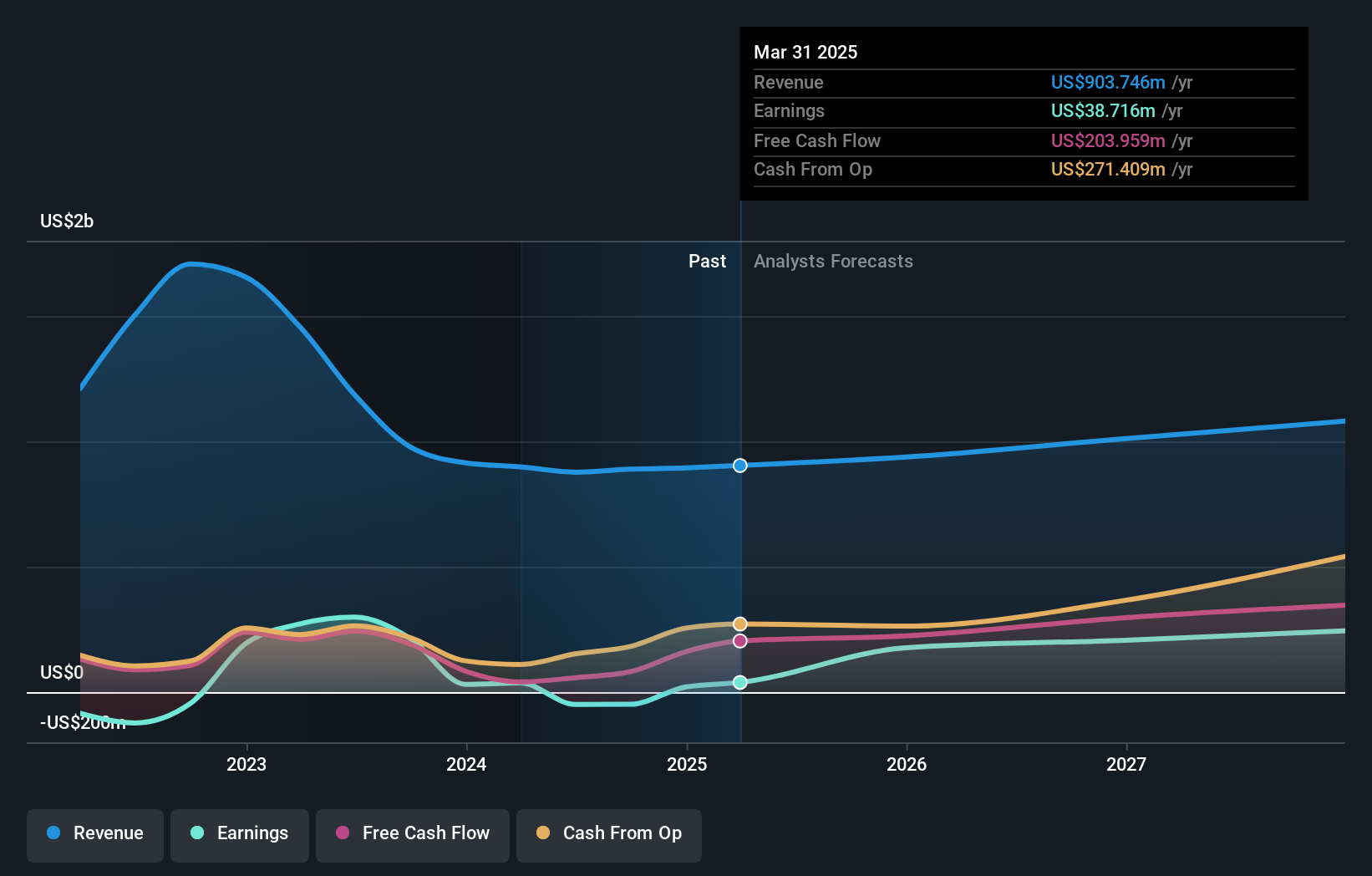

Overview: Okta, Inc. operates as an identity partner in the United States and internationally, with a market cap of $12.58 billion.

Operations: Okta, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $2.45 billion. The company focuses on providing identity solutions both in the United States and internationally.

Okta's recent financial performance highlights a significant turnaround, with Q2 revenue rising to $646 million from $556 million last year and net income hitting $29 million compared to a net loss of $111 million. The company forecasts annual revenue growth at 10.9%, outpacing the US market's 8.8%. R&D expenses reflect strategic investments in innovation, contributing to its robust identity and access management solutions, which are crucial for clients like Jamf and Zimperium.

- Click here to discover the nuances of Okta with our detailed analytical health report.

Review our historical performance report to gain insights into Okta's's past performance.

Taking Advantage

- Access the full spectrum of 251 US High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and undervalued.