- United States

- /

- IT

- /

- NasdaqGS:OKTA

Assessing Okta’s True Value After 6% Share Price Dip and Cybersecurity Sector Shifts

Reviewed by Bailey Pemberton

If you own Okta stock, or have it on your watchlist, you have probably felt the market’s uncertainty firsthand. The last week alone saw shares dip 6.3%, though it is important to keep the bigger picture in mind. Year to date, Okta is up an impressive 11.3%, and over the last three years, the stock has rallied a remarkable 61.2%. Compare that with a five-year plunge of 59.5%, and you can see why investor conviction might waver. Is this a stock on its way back, or one still working out its risks?

Recent market moves have been shaped in part by evolving demand for identity and access management solutions, a space where Okta continues to innovate. Shifts in technology spending and confidence in the cybersecurity sector have contributed to some of those price swings, as investors re-evaluate which companies could benefit most from growing digital priorities.

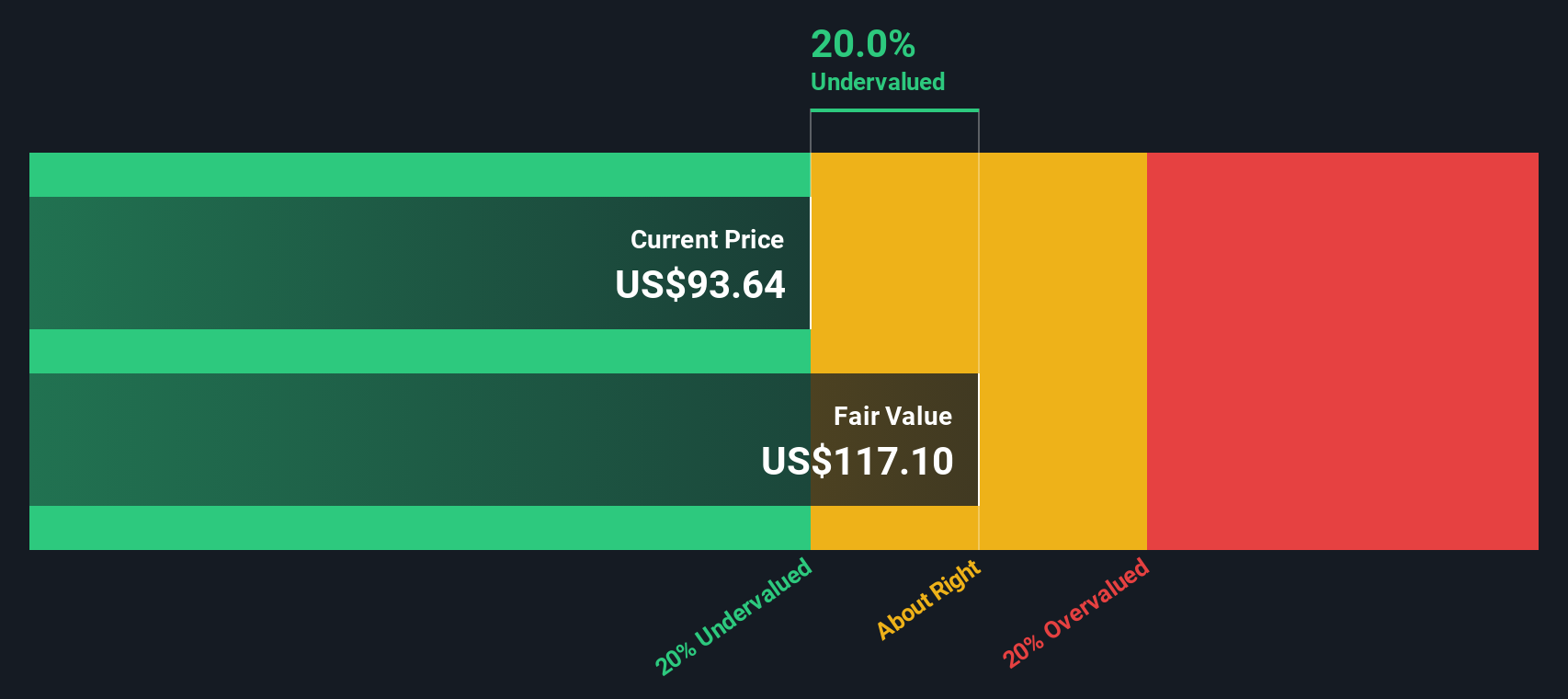

Of course, price alone does not tell the whole story, and this is where valuation comes into focus. Okta currently earns a value score of 3 out of 6, which means it is undervalued in half of the main criteria we track. So, how does Okta stack up when you break down those valuation checks? And is there a smarter, more holistic way to decide what the shares are actually worth? That is exactly where we are headed next.

Approach 1: Okta Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates the value of a company by projecting its future cash flows and discounting them back to their present value. This approach helps investors understand what the business is truly worth based on its capacity to generate cash in the years ahead.

According to the latest data, Okta's current Free Cash Flow (FCF) stands at $830.2 million. Analysts forecast growing cash flows over the next several years, reaching approximately $1,276.8 million by 2030. Estimates for the first five years are based on analyst projections, while longer-range numbers are extrapolated to capture ongoing business momentum. These projections reflect both anticipated revenue growth and operational efficiencies as Okta expands within the identity and access management sector.

Based on these cash flow estimates and after discounting to today's dollars, the model arrives at an intrinsic value of $117.48 per share for Okta. This figure represents a 25.3% discount compared to the current market price, which may indicate that the stock is undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Okta is undervalued by 25.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Okta Price vs Earnings

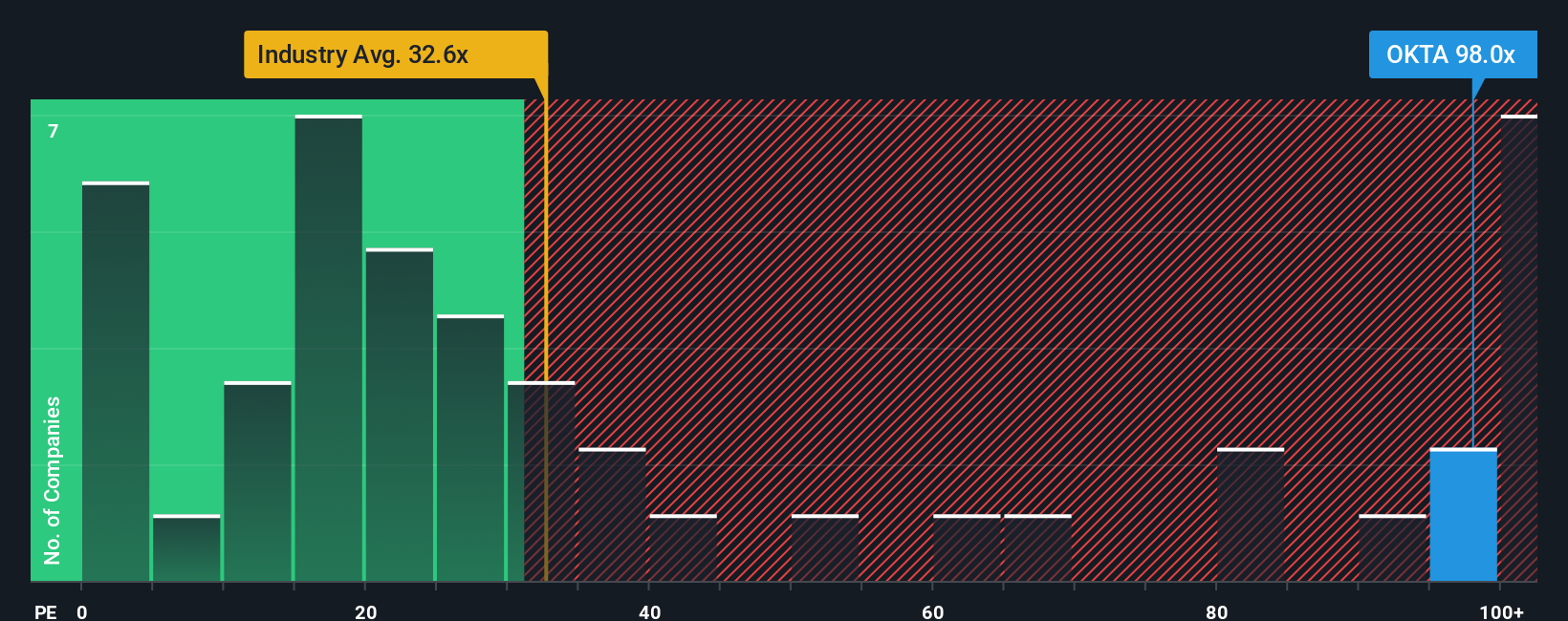

The Price-to-Earnings (PE) ratio is a widely used valuation tool, especially relevant for profitable companies like Okta. It helps investors gauge how much the market is willing to pay today for a dollar of a company’s current or future earnings. A higher PE can suggest the market expects stronger growth ahead, or it may signal increased risk or a premium attached to the business model.

Okta’s current PE ratio sits at 92x, well above both the IT industry average of 32.7x and the peer group average of 30.3x. Such a premium can often prompt questions about whether the stock is richly valued, but headline comparisons do not always capture the full picture.

To offer a more tailored valuation, Simply Wall St’s proprietary “Fair Ratio” takes into account not just earnings, but also growth prospects, profit margins, the company’s industry, market capitalization, and risk factors. For Okta, the calculated Fair PE Ratio is 40.5x, a figure that balances these company-specific considerations. This approach provides a more nuanced benchmark than relying solely on industry or peer averages, giving investors a clearer sense of valuation in context of Okta’s unique fundamentals.

Comparing Okta’s actual PE of 92x with its Fair Ratio of 40.5x implies the shares are currently overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Okta Narrative

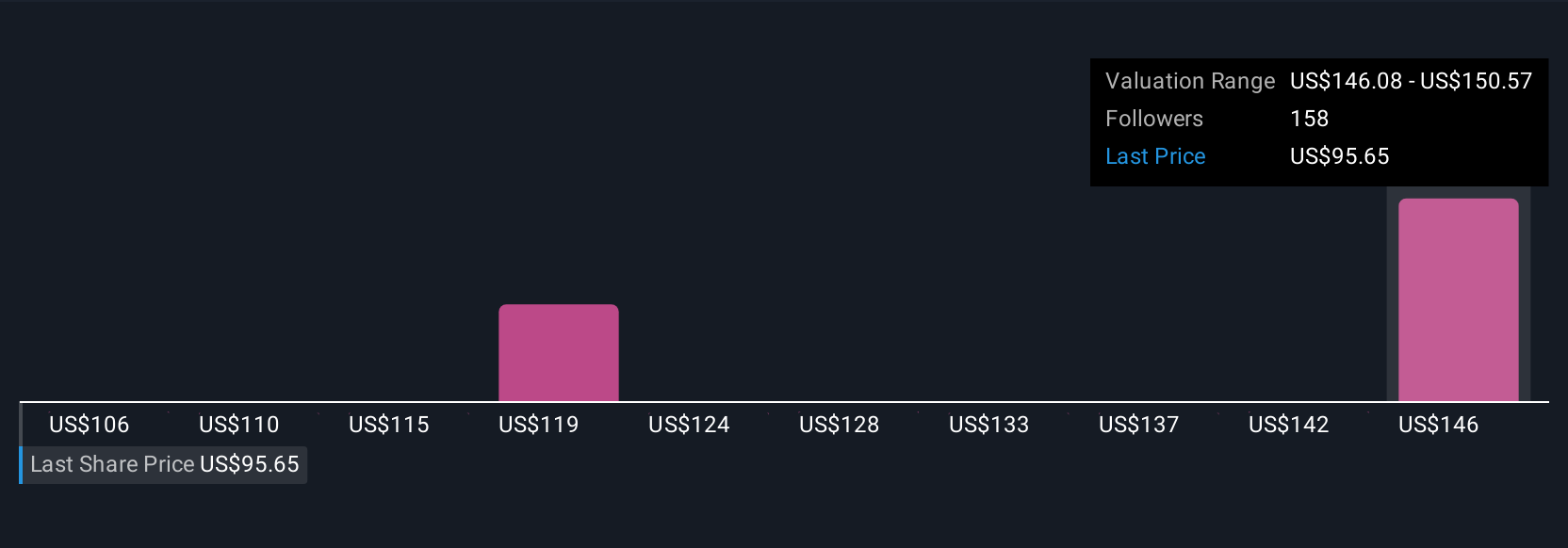

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives provide a powerful, story-driven way to make investment decisions, allowing you to connect what you know and believe about a company’s future, such as Okta’s growth potential, upcoming risks, or strategic wins, to a personal financial forecast and a resulting fair value.

On Simply Wall St’s Community page, Narratives make it easy for anyone to blend their own perspectives and assumptions (like expected revenue, earnings, or profit margins) with the numbers, creating a living valuation that updates dynamically as new news or earnings come in. This helps you decide when a company is undervalued or overpriced by directly comparing a Narrative’s Fair Value with the latest market price.

For example, two investors might have very different Okta Narratives. One sees a fair value around $75, weighing risks and competition, while another projects a fair value above $143, confident in robust growth and profitability. By exploring and sharing Narratives in the Community, you can gain new insights and see a range of real-world scenarios for Okta, making your investment decisions more informed and adaptable.

Do you think there's more to the story for Okta? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion