- United States

- /

- IT

- /

- NasdaqGS:OKTA

Assessing Okta’s 2025 Potential After Its Recent 20% Surge

Reviewed by Bailey Pemberton

Wondering what to do with Okta stock after its latest climb? You are not alone. Okta has been turning heads with its impressive run so far this year, delivering a 20.4% return year-to-date and an eye-catching 31.7% gain over the past twelve months. Even the past week and month have been positive for shareholders, up 4.1% and 6.1% respectively. Yet, if you zoom out, Okta’s long-term journey has been a rollercoaster, with shares down a dramatic 60% over the last five years. This mix of strong recent momentum and an uncertain long-term story might have you weighing both risk and reward as you consider your next move.

Shifting dynamics in the identity management market, along with changing investor sentiment around tech and cybersecurity, seem to be playing out in Okta’s stock price. Some investors are clearly seeing renewed potential, while others remain cautious, remembering volatility from earlier years. At just under $95 per share as of the latest close, Okta sits at a valuation crossroads.

To help cut through the emotions and headlines, let us get quantitative. Based on six commonly used valuation checks, Okta scores a 2, meaning it only looks undervalued in two out of six categories. But that is just the starting point. As you will see next, digging into the details behind these scores and exploring an even more insightful way to think about valuation can help clarify where the stock really stands today.

Okta scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Okta Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. This approach helps investors look beyond short-term noise and evaluate what those future cash streams are actually worth right now.

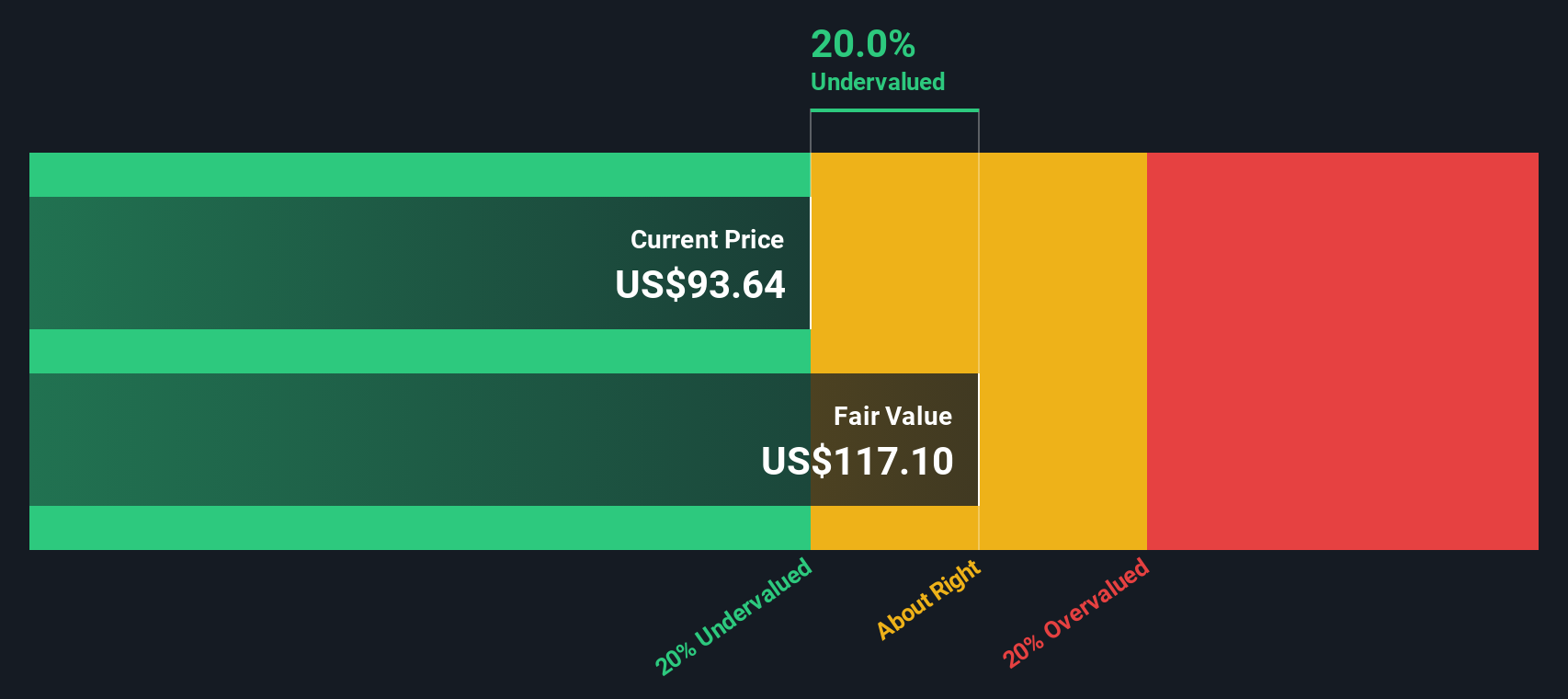

For Okta, the model used is a 2 Stage Free Cash Flow to Equity. The company reported Last Twelve Months Free Cash Flow (FCF) of $830 million, with analyst forecasts projecting steady growth. In five years, FCF is estimated to reach roughly $1,277 million. Beyond analyst forecasts, projections are extrapolated out to 2035. However, the most meaningful inputs remain the next few years as provided by actual analyst estimates.

Using these cash flow projections and discounting them at an appropriate rate, the DCF model calculates Okta's intrinsic fair value at $117.55 per share. With the stock currently trading just under $95 per share, this suggests that Okta is trading at a 19.3% discount to its estimated intrinsic value. In other words, the model indicates that Okta shares appear undervalued at today's levels based on future expected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Okta is undervalued by 19.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Okta Price vs Earnings

For companies that have reached profitability, the Price-to-Earnings (PE) ratio is a commonly used valuation tool. It enables investors to assess how much they are paying for each dollar of earnings, making it especially relevant for evaluating mature, profitable businesses like Okta.

However, a “normal” or “fair” PE ratio is not one-size-fits-all. High expected growth or lower perceived risk often justify a higher PE, while companies with slow growth or greater uncertainty typically trade at lower PEs.

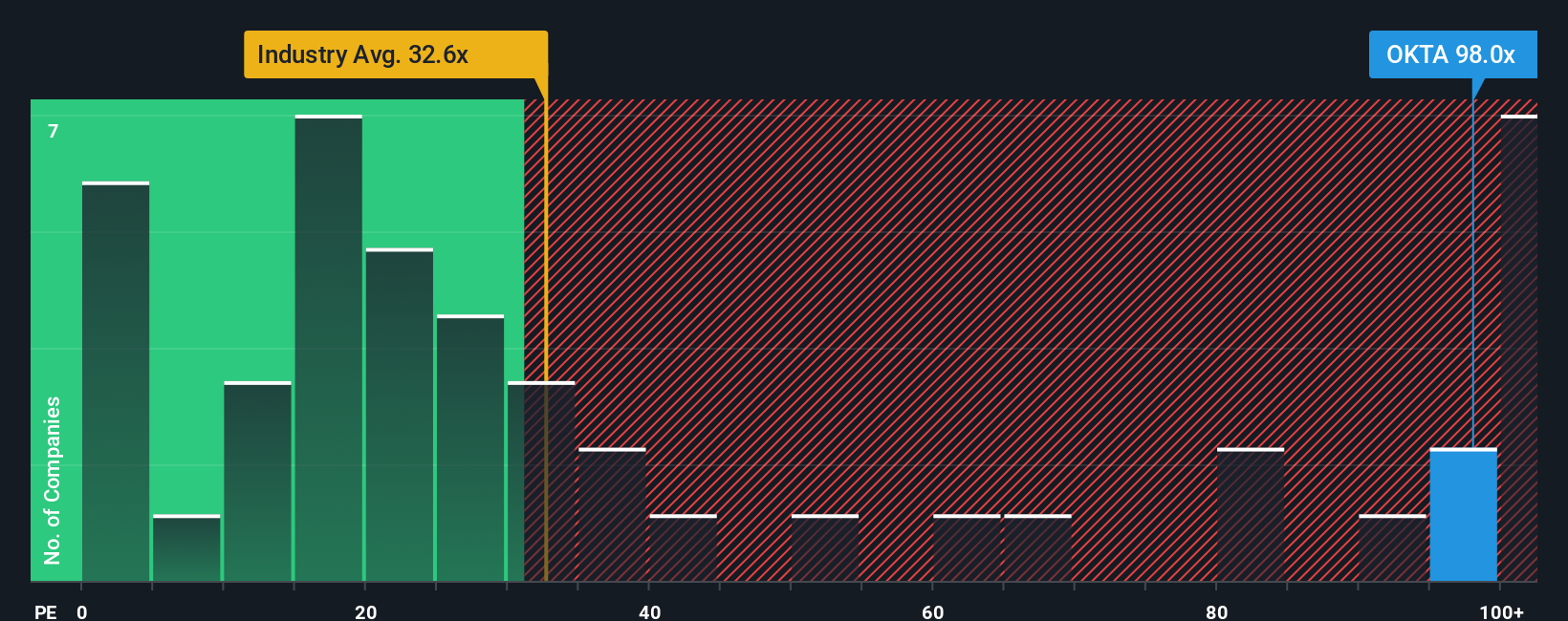

Right now, Okta trades at a lofty 99.6x PE. That is well above both its industry average of 32.7x and the peer average of 33.2x. At first glance, this premium might look alarming. However, context is crucial.

Simply Wall St's “Fair Ratio” method takes things a step further by computing the PE that Okta should trade at, given factors like its earnings growth outlook, profit margins, risk profile, industry, and size. In Okta’s case, the Fair Ratio is 40.6x. This tailored benchmark provides a much more meaningful point of comparison because it considers nuances that peer and industry averages overlook.

Comparing Okta’s actual PE of 99.6x to its Fair Ratio of 40.6x suggests the stock is currently being valued far above what its fundamentals justify. Investors should be aware that the current price assumes hyper-optimistic future growth and could imply overvaluation if those expectations are not met.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Okta Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic tool for making investment decisions. A Narrative is your story behind the numbers: it is an approach where you link your personal view of Okta’s business, such as expected revenue growth, future margins, or upcoming industry shifts, to a specific forecast and ultimately a fair value estimate.

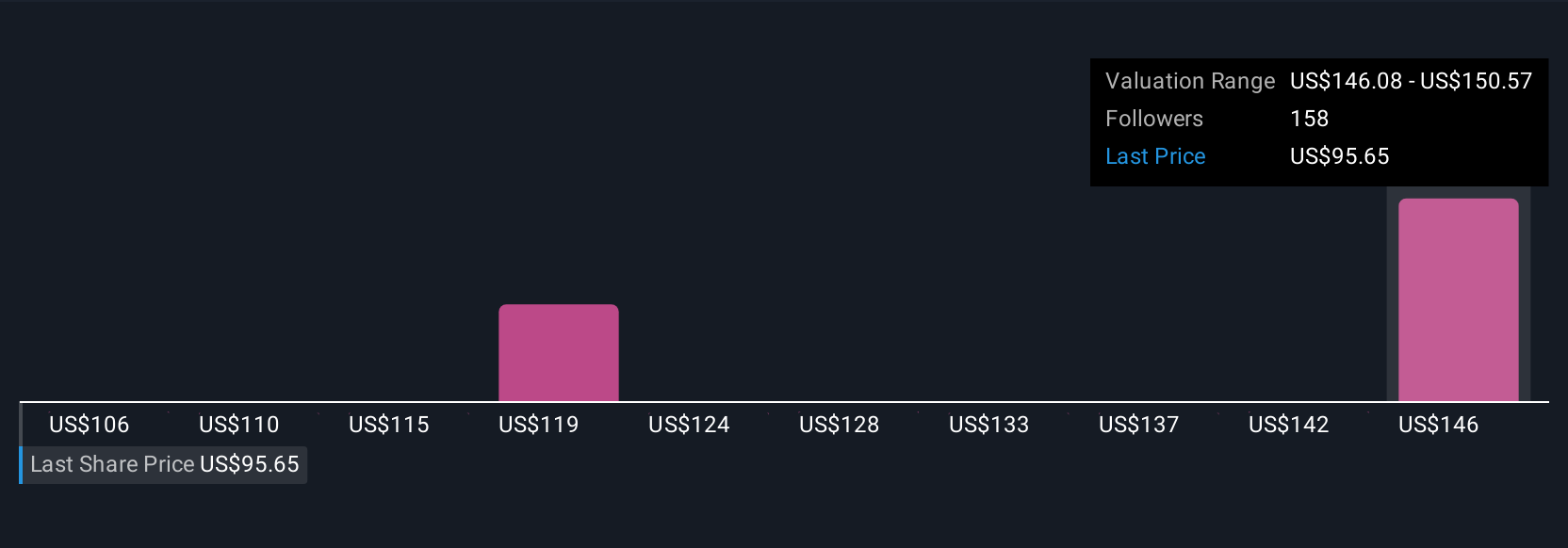

Narratives connect a company’s unique story to real financial outcomes, helping you see how assumptions translate into a price that makes sense for you. On Simply Wall St’s Community page, millions of investors use Narratives to easily adjust their beliefs about a company, compare against others’ perspectives, and decide whether Okta is a buy or sell by matching Fair Value to the latest Price.

What makes Narratives especially powerful is how they are automatically updated as new information arrives, such as earnings results or important news. This keeps your view smarter and always up to date. For example, one Okta Narrative expects a fair value of $147, reflecting confidence in strong profit margin expansion and a sustainable business model. Another Narrative is more cautious at $75, stressing revenue risks and industry competition. Narratives put you, not just the numbers, in control of your investment decisions.

Do you think there's more to the story for Okta? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives