- United States

- /

- Medical Equipment

- /

- NasdaqCM:LGMK

Investors Who Bought Nxt-ID (NASDAQ:NXTD) Shares Five Years Ago Are Now Down 98%

While it may not be enough for some shareholders, we think it is good to see the Nxt-ID, Inc. (NASDAQ:NXTD) share price up 22% in a single quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Five years have seen the share price descend precipitously, down a full 98%. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Nxt-ID

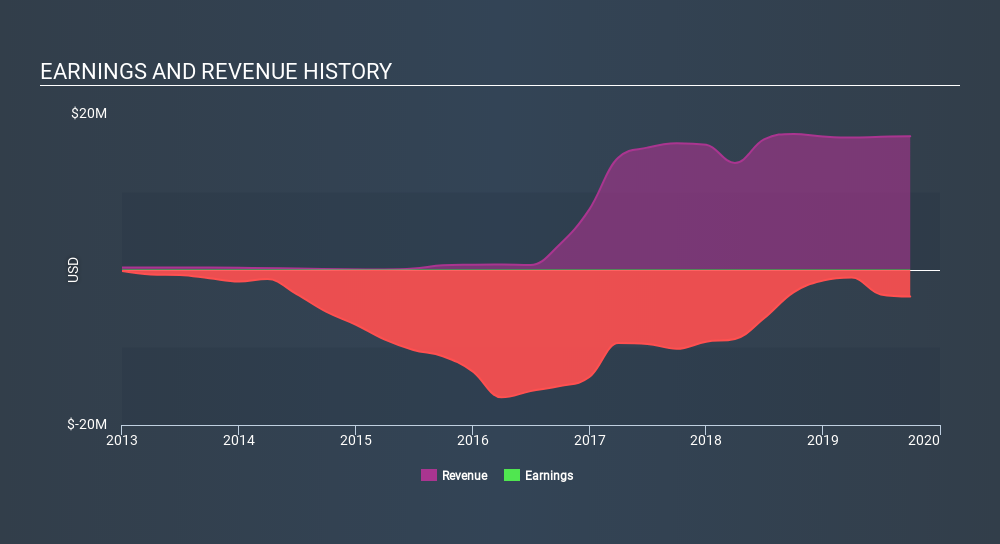

Nxt-ID isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

You can see how revenue has changed over time in the image below.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Nxt-ID shareholders are down 44% for the year, but the market itself is up 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 54% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You could get a better understanding of Nxt-ID's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:LGMK

LogicMark

Provides personal emergency response systems (PERS), health communications devices, and Internet of Things (IoT) technology that creates a connected care platform in the United States.

Medium-low with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives