- United States

- /

- Software

- /

- NasdaqCM:NTWK

NetSol Technologies (NASDAQ:NTWK) May Have Issues Allocating Its Capital

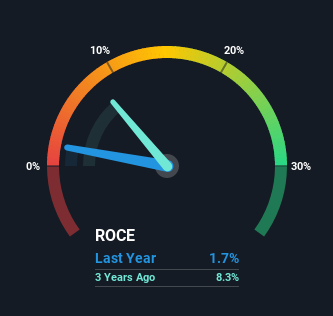

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. On that note, looking into NetSol Technologies (NASDAQ:NTWK), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for NetSol Technologies:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.017 = US$1.0m ÷ (US$81m - US$21m) (Based on the trailing twelve months to September 2021).

So, NetSol Technologies has an ROCE of 1.7%. Ultimately, that's a low return and it under-performs the Software industry average of 10%.

View our latest analysis for NetSol Technologies

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how NetSol Technologies has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

In terms of NetSol Technologies' historical ROCE trend, it isn't fantastic. The company used to generate 9.1% on its capital five years ago but it has since fallen noticeably. In addition to that, NetSol Technologies is now employing 24% less capital than it was five years ago. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

What We Can Learn From NetSol Technologies' ROCE

To see NetSol Technologies reducing the capital employed in the business in tandem with diminishing returns, is concerning. It should come as no surprise then that the stock has fallen 13% over the last five years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

If you want to continue researching NetSol Technologies, you might be interested to know about the 4 warning signs that our analysis has discovered.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if NetSol Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NTWK

NetSol Technologies

Engages in the design, development, marketing, and export of enterprise software solutions to the automobile financing and leasing, banking, and financial services industries in North America, Europe, and Asia Pacific.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Nedbank please contact me,l need guidance step by step, please

CEO comp looks high on the surface, but context matters. Cognyte is approaching profitability — losses narrowed 23% YoY and they’re now guiding positive adjusted EBITDA of $47M for FY26. Revenue is growing 12-14% annually with a debt-free balance sheet. The board is compensating for execution on a turnaround, not rewarding stagnation. If they hit their $500M revenue / 20%+ EBITDA margin target by FY28, today’s comp will look like a bargain in hindsight. Imagine if everyone that has invested in Tesla 10 years ago had the same mentality...