- United States

- /

- Software

- /

- NasdaqCM:NTWK

Is NetSol Technologies (NASDAQ:NTWK) Using Debt Sensibly?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that NetSol Technologies, Inc. (NASDAQ:NTWK) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for NetSol Technologies

What Is NetSol Technologies's Net Debt?

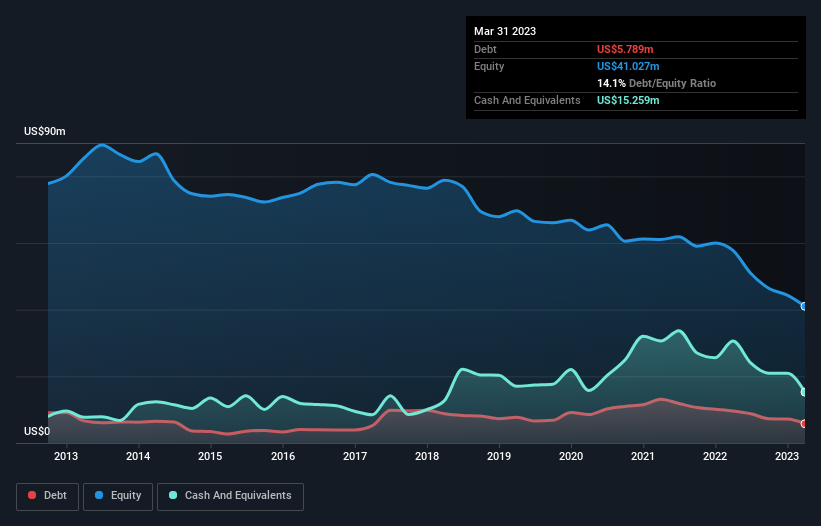

As you can see below, NetSol Technologies had US$5.79m of debt at March 2023, down from US$9.63m a year prior. But on the other hand it also has US$15.3m in cash, leading to a US$9.47m net cash position.

How Strong Is NetSol Technologies' Balance Sheet?

The latest balance sheet data shows that NetSol Technologies had liabilities of US$17.7m due within a year, and liabilities of US$866.7k falling due after that. Offsetting these obligations, it had cash of US$15.3m as well as receivables valued at US$23.2m due within 12 months. So it actually has US$19.9m more liquid assets than total liabilities.

This surplus strongly suggests that NetSol Technologies has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that NetSol Technologies has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since NetSol Technologies will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year NetSol Technologies had a loss before interest and tax, and actually shrunk its revenue by 12%, to US$52m. That's not what we would hope to see.

So How Risky Is NetSol Technologies?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months NetSol Technologies lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$2.4m and booked a US$2.3m accounting loss. Given it only has net cash of US$9.47m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that NetSol Technologies is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if NetSol Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NTWK

NetSol Technologies

Engages in the design, development, marketing, and export of enterprise software solutions to the automobile financing and leasing, banking, and financial services industries in North America, Europe, and Asia Pacific.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Circle Internet Group: From Crypto Proxy to Rate-Sensitive Financial Infrastructure

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks