- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NasdaqGS:NTNX) Unveils Cloud Native AOS And Partners With Pure Storage

Reviewed by Simply Wall St

Nutanix (NasdaqGS:NTNX) saw its stock rise by 24% over the past month, a movement that came amid several key developments. The launch of their Cloud Native AOS solution significantly enhances data management capabilities for Kubernetes environments and provides robust disaster recovery features. Additionally, a strategic partnership with Pure Storage promises to deliver scalable infrastructure for virtual workloads, potentially boosting Nutanix's competitive stance. While the broader market experienced mixed movements with technology giants like Alphabet facing declines due to competitive pressures, Nutanix's advancements in its product lineup and partnerships may have contributed positively to its stock performance.

Every company has risks, and we've spotted 1 warning sign for Nutanix you should know about.

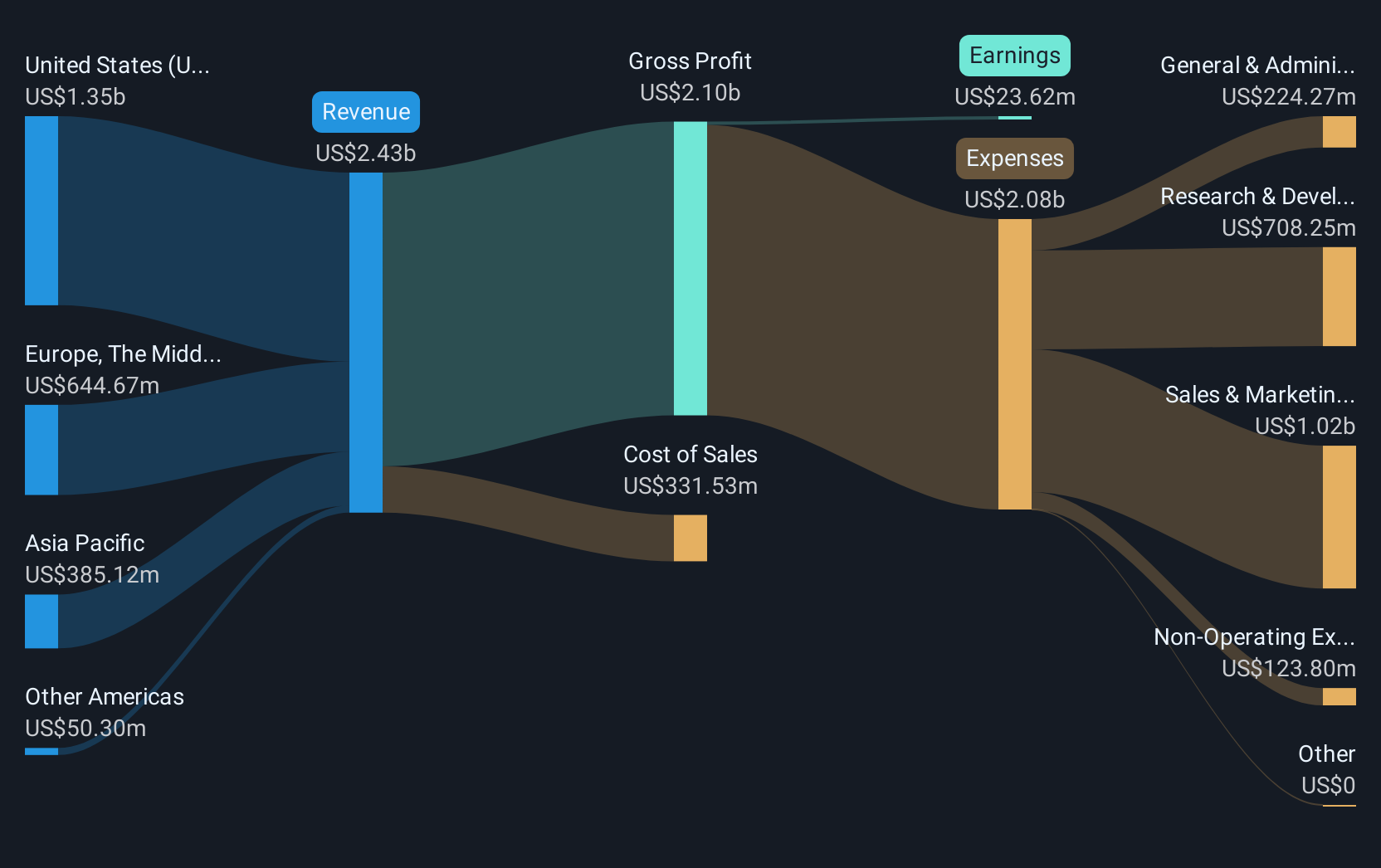

The recent developments involving Nutanix, particularly the launch of their Cloud Native AOS solution and the partnership with Pure Storage, hold the potential to significantly impact the company's future revenue and earnings forecasts. These advancements may enhance Nutanix's competitiveness and market penetration, especially in the infrastructure modernization and GenAI deployment spaces. By influencing customer acquisition and retention, these innovations are likely to support the projected annual revenue growth of 18.6%, alongside a shift from current profit margins of 2.4% to an expected 13% in the coming years.

Over a three-year period, Nutanix's total shareholder return, including dividends, soared by 242.89%, reflecting a remarkable performance relative to broader market trends. However, when comparing one-year returns, Nutanix slightly exceeded the overall US market return of 7.2% but underperformed the US Software industry, which saw a 14% growth. This highlights Nutanix's potential despite certain industry challenges, markedly supported by its recent technological initiatives and strategic alliances.

Currently trading at US$68.52, Nutanix's share price reflects a discount to analysts' consensus price target of US$87.64, indicating a potential upside of 21.8%. Analyst consensus suggests Nutanix could achieve significant growth with projected earnings of US$505.2 million by May 2028, provided that the company continues leveraging its strong position in expanding markets. Investors should weigh these potential growth drivers against inherent risks and macroeconomic uncertainties that could affect Nutanix's execution of its growth strategy.

Understand Nutanix's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nutanix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives