- United States

- /

- Software

- /

- NasdaqGS:NBIS

Nebius Group (NBIS) Is Up 11.6% After $17.4 Billion Microsoft AI Deal—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Microsoft recently announced an expanded partnership with OpenAI and awarded Nebius Group a five-year, US$17.4 billion agreement to supply GPU-driven AI infrastructure for Microsoft Azure from its New Jersey data center.

- This development uniquely positions Nebius Group as a key global supplier of AI compute resources, with significant exposure to surging demand from API-based AI products and workloads on Azure’s cloud platform.

- We'll explore how Nebius Group’s massive Microsoft agreement could reshape its investment narrative given rapidly expanding AI infrastructure requirements.

Find companies with promising cash flow potential yet trading below their fair value.

Nebius Group Investment Narrative Recap

To be a shareholder in Nebius Group, you need to believe the company can sustain its rapid expansion as a critical AI infrastructure supplier, especially following the five-year, US$17.4 billion Microsoft Azure agreement. While this partnership drives significant near-term visibility and is a clear catalyst, heightened competition for supplying AI compute to hyperscalers remains the biggest risk that could materially influence Nebius’s growth promise and margin outlook in the short term.

Among recent developments, the September 8 announcement of Nebius Group’s multi-year infrastructure deal with Microsoft stands out as the most relevant. This agreement delivers meaningful exposure to hyperscaler demand and cash flow stability, reinforcing Nebius’s position in the market and directly linking to its largest growth catalyst, rising global AI workloads and cloud adoption.

Yet, despite these tailwinds, the growing intensity of rivals in the AI infrastructure supply chain is a risk investors should watch carefully as...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's outlook projects $3.2 billion in revenue and $428.7 million in earnings by 2028. This forecast assumes a 133.9% annual revenue growth rate and a $238.5 million increase in earnings from the current $190.2 million.

Uncover how Nebius Group's forecasts yield a $156.40 fair value, a 20% upside to its current price.

Exploring Other Perspectives

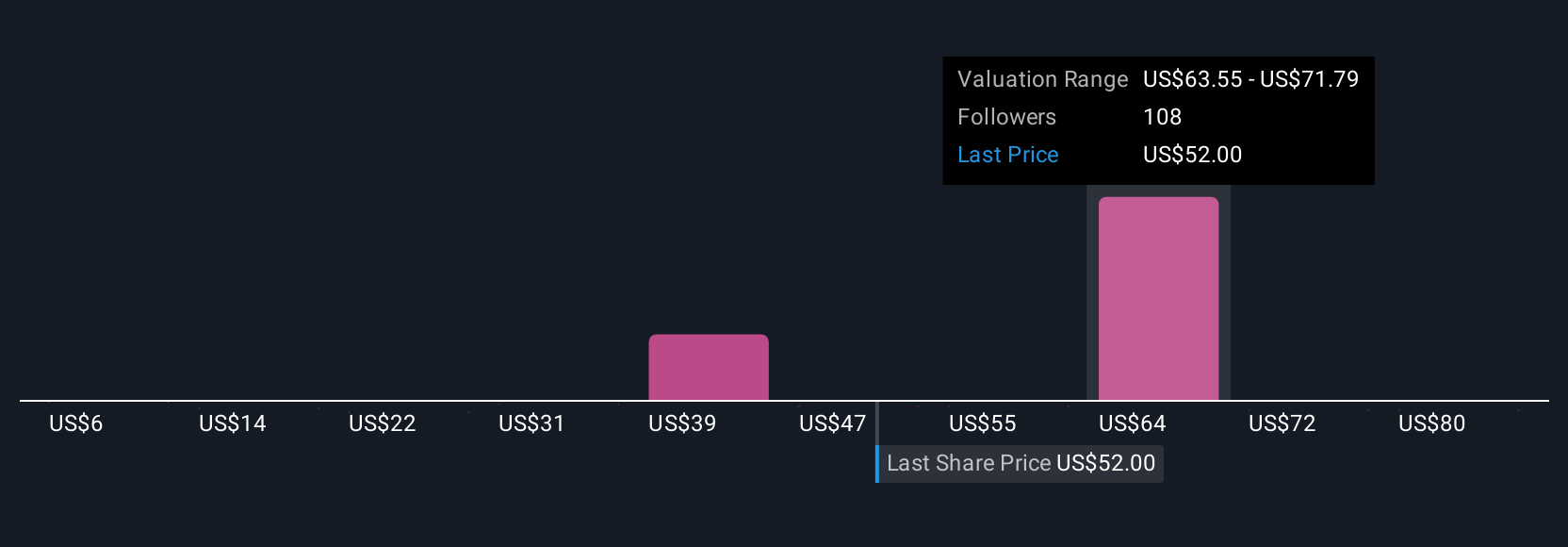

Simply Wall St Community members estimated the fair value of Nebius Group stock across a wide US$9.17 to US$176.90 range, based on 36 independent views. While opinions differ, the recently secured Microsoft agreement could shift expectations given potential competition-driven margin pressure; consider how different market participants assess this opportunity and risk.

Explore 36 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion