- United States

- /

- Software

- /

- NasdaqGS:NBIS

Assessing Nebius Group (NasdaqGS:NBIS) Valuation After Recent 14% Share Price Climb

Reviewed by Kshitija Bhandaru

See our latest analysis for Nebius Group.

Zooming out, Nebius Group’s share price momentum has been strong lately, with a 14% gain over the past month and a remarkable 271.8% share price return so far this year. Momentum is clearly building, and investors are taking note of the company’s growth potential as well as shifting risk perceptions around the stock’s future.

If rapid moves like this spark your curiosity, it is an ideal moment to expand your watchlist and discover fast growing stocks with high insider ownership

But with such exceptional gains and a price still nearly 38% below analyst targets, the big question is whether Nebius Group is undervalued at current levels or if the market is already factoring in its future growth. Could now be a real buying opportunity?

Most Popular Narrative: 27.5% Undervalued

According to the most widely followed narrative, Nebius Group’s fair value is pegged well above the last close price, suggesting further headroom if current growth momentum holds. This valuation is built on an optimistic set of forward-looking assumptions and bold expansion strategies.

The current valuation assumes Nebius Group can sustain hyper growth in AI compute infrastructure. However, market-wide demand for AI and machine learning clouds is attracting intense competition and accelerating adoption of open-source technologies. These factors could drive pricing pressure and erode margins over the next several years, directly impacting long-term profitability and gross margins.

Want to know what’s really fueling this impressive upside? The secret is in sky-high growth estimates and a profit trajectory rarely seen in the sector. A single assumption could swing the outcome. What is it? Read on to see which big number underpins the narrative’s bullish price target.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative may shift if Nebius delivers continued hypergrowth in AI demand or rapidly expands into new markets, which could fuel even stronger top-line gains.

Find out about the key risks to this Nebius Group narrative.

Another View: Market Ratios Show Expensive Territory

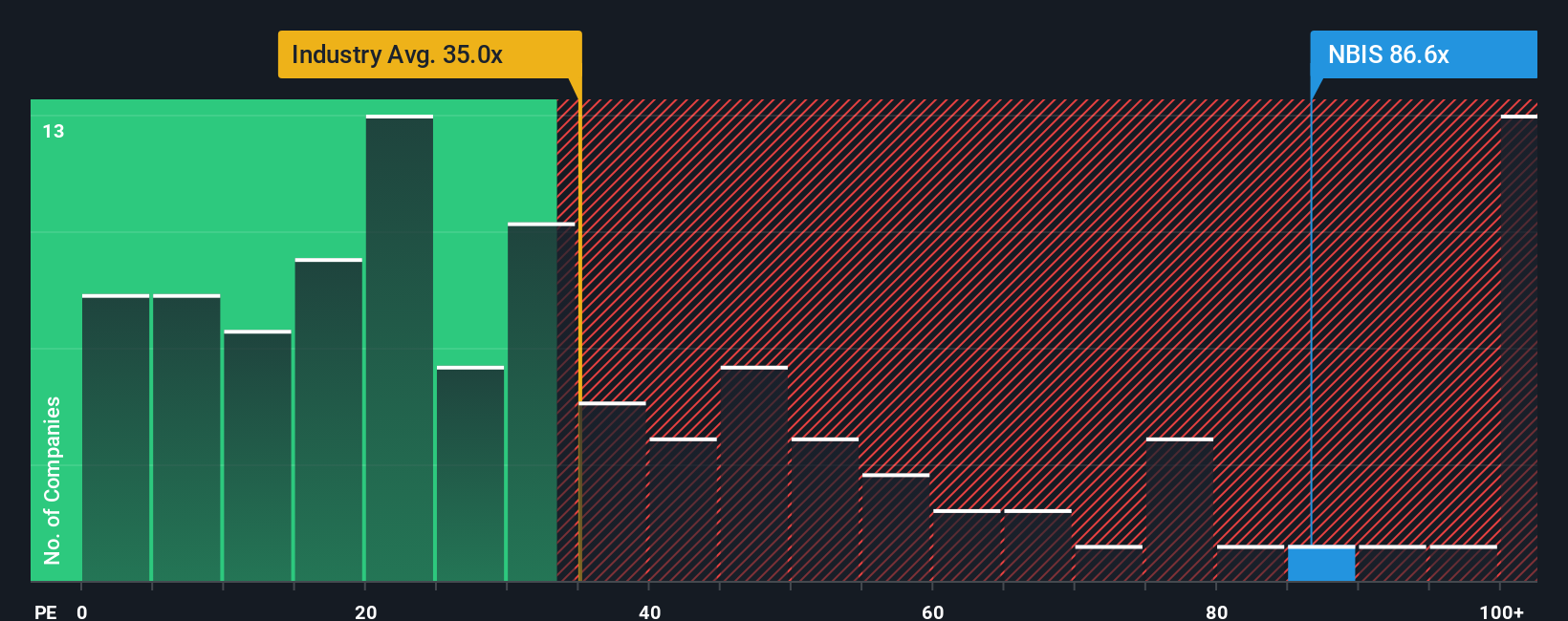

Looking from a different angle, Nebius Group’s price-to-earnings ratio sits at 149.8x, far above both the industry average of 34.9x and its peers at 27.3x. Notably, this multiple is well above the fair ratio of 53.8x, which indicates the stock is priced at a significant premium. This heightens the risk that investors may be overpaying if future growth expectations are not met. Could the market be ahead of itself, or is a new baseline being set?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nebius Group Narrative

If you think a different storyline makes more sense or want to dive into the numbers on your own terms, you can shape your own Nebius Group outlook in just a few minutes, so why not Do it your way?

A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by. Instantly see what else is out there with these handpicked screens that make spotting smart investments fast and simple:

- Start building real passive income streams by checking out these 18 dividend stocks with yields > 3%, which features reliable yields over 3% and stable balance sheets.

- Get ahead of the curve by assessing these 24 AI penny stocks, which uniquely harness artificial intelligence to disrupt traditional industries with significant future potential.

- Catalyze your portfolio’s upside by reviewing these 878 undervalued stocks based on cash flows, which the market has not fully priced in and may be poised for future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives