- United States

- /

- Software

- /

- NasdaqGS:MTLS

The Materialise (NASDAQ:MTLS) Share Price Is Up 963% And Shareholders Are Delighted

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Materialise NV (NASDAQ:MTLS) shares for the last five years, while they gained 963%. If that doesn't get you thinking about long term investing, we don't know what will. And in the last month, the share price has gained 18%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Materialise

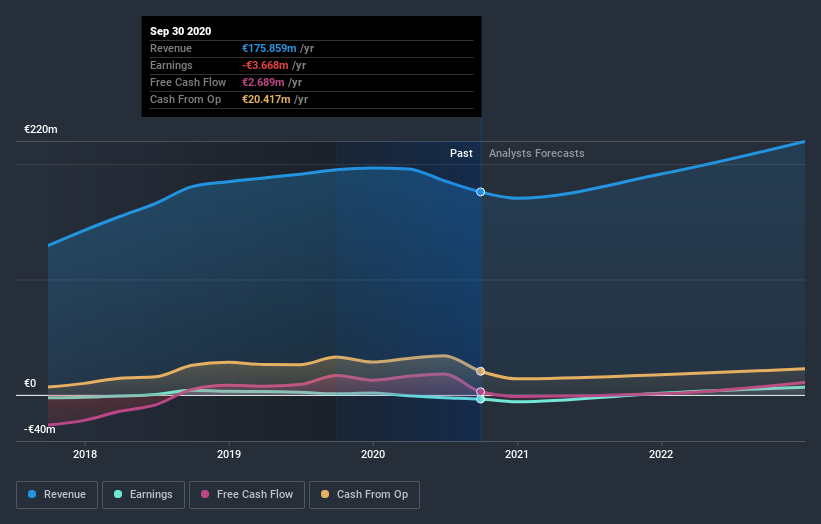

Given that Materialise didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Materialise can boast revenue growth at a rate of 15% per year. That's a fairly respectable growth rate. However, the share price gain of 60% during the period is considerably stronger. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Materialise's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Materialise shareholders have received a total shareholder return of 236% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 60% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Materialise better, we need to consider many other factors. For example, we've discovered 2 warning signs for Materialise that you should be aware of before investing here.

But note: Materialise may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Materialise, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:MTLS

Materialise

Provides additive manufacturing and medical software tools, and 3D printing services in the Americas, Europe and Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives