- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Slumps 17% As Q4 Earnings Reveal US$671M Loss

Reviewed by Simply Wall St

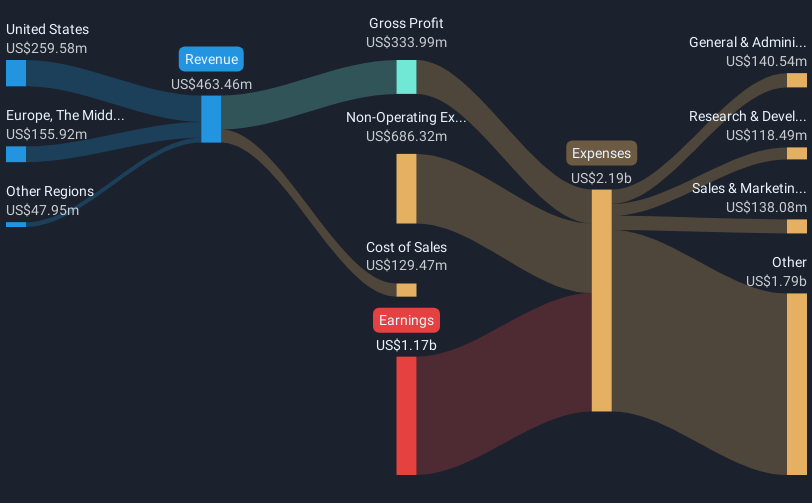

MicroStrategy (NasdaqGS:MSTR) has recently reported a net loss of USD 671 million for the fourth quarter of 2024, a stark contrast to the previous year's net income of USD 89 million. This financial downturn appears alongside significant developments such as a substantial amendment to the company's bylaws, increasing authorized shares significantly, and the introduction of MicroStrategy ONE, a platform leveraging AI technologies. Meanwhile, the broader market saw a 3.6% decline over the past week, exacerbated by investor concerns about new tariffs on North American and Chinese imports. The tech-heavy Nasdaq and the broader stock market environment have been mixed, with notable declines seen in tech stocks such as Nvidia and Tesla, adding to the uncertainty. These factors, combined with the disappointing earnings report, may have contributed to the company's stock price decline of 17.38% during the past week.

Take a closer look at MicroStrategy's potential here.

MicroStrategy's shares have soared a very large 1833.39% over the past five years, reflecting its substantial transformation and aggressive strategies. Critical developments include its incorporation into the NASDAQ-100 Index in December 2024, highlighting its growing prominence. Furthermore, the company launched MicroStrategy ONE in January 2025, positioning itself at the forefront of AI-driven data analysis, an area with rapidly growing market interest.

Additionally, the company's proactive capital-raising strategy, exemplified by a planned US$1.75 billion 0% convertible senior notes offering in November 2024, underscores its commitment to new ventures, particularly its strategic focus on Bitcoin acquisition. Major changes in January 2025, such as a significant increase in authorized shares, could also impact shareholder value by facilitating future corporate activities. Despite the recent quarterly earnings loss, these longer-term initiatives have bolstered the stock's extensive growth trajectory compared to broader market trends and the US Software industry over the last five years.

- Get the full picture of MicroStrategy's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing MicroStrategy and how they might influence its performance—click here to read more.

- Are you invested in MicroStrategy already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives