- United States

- /

- Software

- /

- NasdaqGS:MSTR

How Investors Are Reacting To MicroStrategy (MSTR) Profit Rebound and New Preferred Stock Dividends

Reviewed by Simply Wall St

- MicroStrategy recently reported second quarter earnings, issued robust 2025 profit guidance projecting US$24 billion net income, and announced major preferred stock offerings with a new monthly dividend for holders.

- Remarkably, the company's quarterly results reflect a dramatic turnaround from a net loss last year to very large net income, underscoring significant changes to its financial profile and capital-raising strategy.

- We'll examine how MicroStrategy's strong full-year profit outlook and preferred stock dividends shape the company's investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is MicroStrategy's Investment Narrative?

Owning MicroStrategy stock means buying into a bold transformation story, where rapid shifts in capital structure, significant profit forecasts and high-profile dividend announcements are now central. The recent Q2 results and robust 2025 guidance, showing net income projected at US$24 billion, mark a stunning swing from last year’s losses, potentially strengthening management’s claims of a financial turnaround. This sharp change could reshape near-term catalysts, focusing attention on how successful the preferred stock offerings and their monthly dividends will be in enhancing shareholder value. However, the wave of equity and preferred issuances may bring added dilution and financial complexity just as legal challenges add uncertainty. While the market’s price reaction suggests optimism, the sudden profit trajectory and ongoing lawsuits introduce new variables that could shift risk and reward going forward.

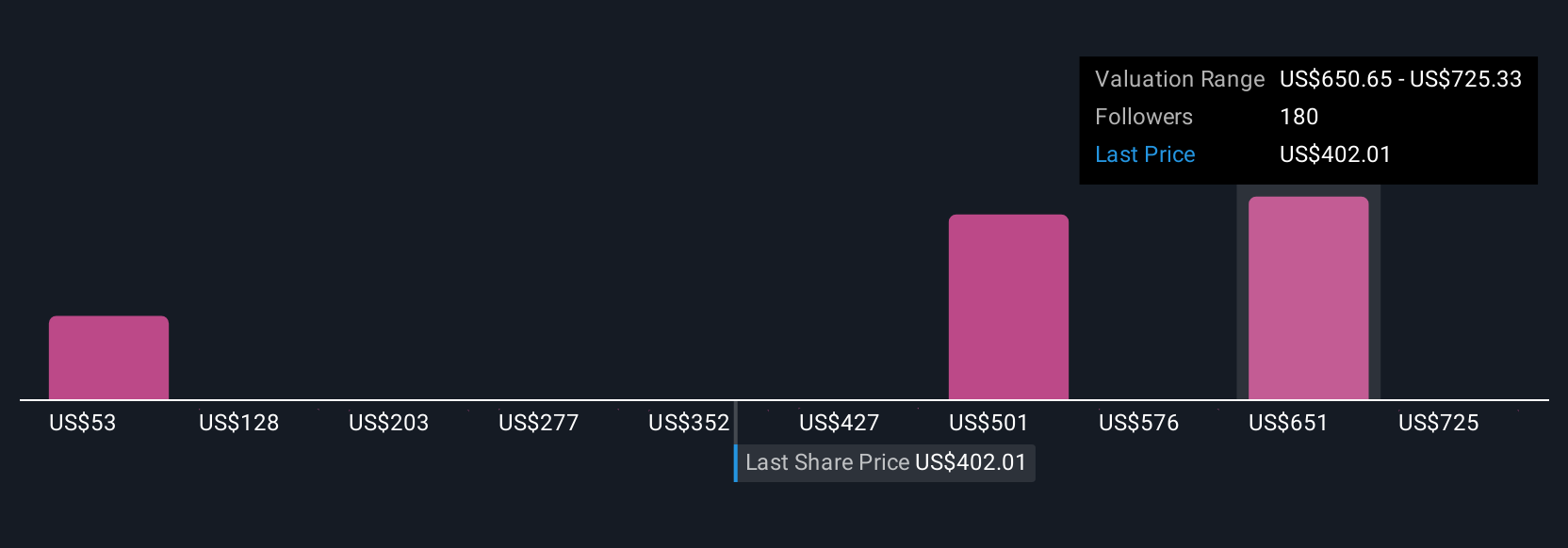

On the flip side, fresh legal claims tied to recent moves could influence future investor sentiment. The analysis detailed in our MicroStrategy valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 20 other fair value estimates on MicroStrategy - why the stock might be worth less than half the current price!

Build Your Own MicroStrategy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MicroStrategy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MicroStrategy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MicroStrategy's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives