- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NASDAQ:MSFT) jumps 7.5% this week, though earnings growth is still tracking behind five-year shareholder returns

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For instance, the price of Microsoft Corporation ( NASDAQ:MSFT ) stock is up an impressive 223% over the last five years. On top of that, the share price is up 27% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report .

Since it's been a strong week for Microsoft shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Microsoft

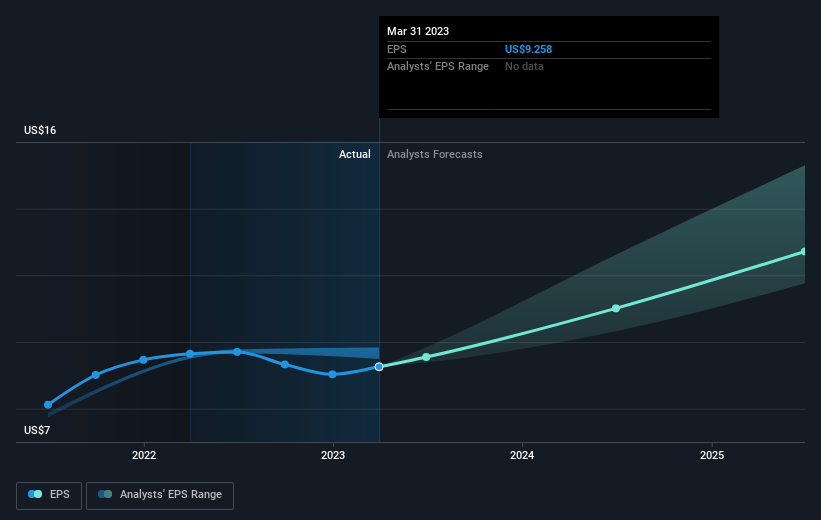

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Microsoft managed to grow its earnings per share at 35% a year. The EPS growth is more impressive than the yearly share price gain of 26% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Microsoft's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Microsoft's TSR for the last 5 years was 242%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Microsoft shareholders have received a total shareholder return of 12% over the last year. That's including the dividend. Having said that, the five-year TSR of 28% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Microsoft better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Microsoft .

We will like Microsoft better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature.

We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Unique One, Retail Sector, but Short Time Investmentnya Almost 2,5 kali Persediaan

OPAP S.A.: Merger Momentum and Greek Gaming Resilience

A Global Powerhouse in the Making

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion