- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NASDAQ:MSFT) Has an Impressive ROE for its Size

After the first half of the year, Microsoft's (NASDAQ: MSFT) stock is up over 30%. It is quite a feat for a company now worth over US$2tn.

Today we will outline the latest developments and look at companys' return on equity (ROE) to see how it fares against the industry average.

Latest Earnings Report

The company delivered yet another solid report. Interestingly, the last time the company missed its earnings forecast was over 5 years ago, in April 2016.

Results for the quarter ended June 30, 2021.

- Non-GAAP EPS: US$2.17 (beat by US$0.25)

- Operating income: US$19.1b (+42% y/y)

- Net income: US$16.5b (+47% y/y)

After the report, analysts started pushing the target prices higher , quoting strengthening gaming and cloud services units. This thesis is supported by Microsoft announcing the acquisition of Peer5 , a web-based electronic content delivery network. Their technology will enhance live video streaming for Microsoft Teams.

While the company expects a full return to offices by October 4, it will require vaccinations for U.S workers, vendors, and office visitors.

Check out our latest analysis for Microsoft

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Microsoft is:

43% = US$61b ÷ US$142b (Based on the trailing twelve months to June 2021).

The "return" is the amount earned after tax over the last twelve months. Basically, for every $1 worth of equity, the company was able to earn $0.43 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability.Based on how much of its profits the company chooses to reinvest or "retain," we can evaluate a company's future ability to generate profits.Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily bear these characteristics.

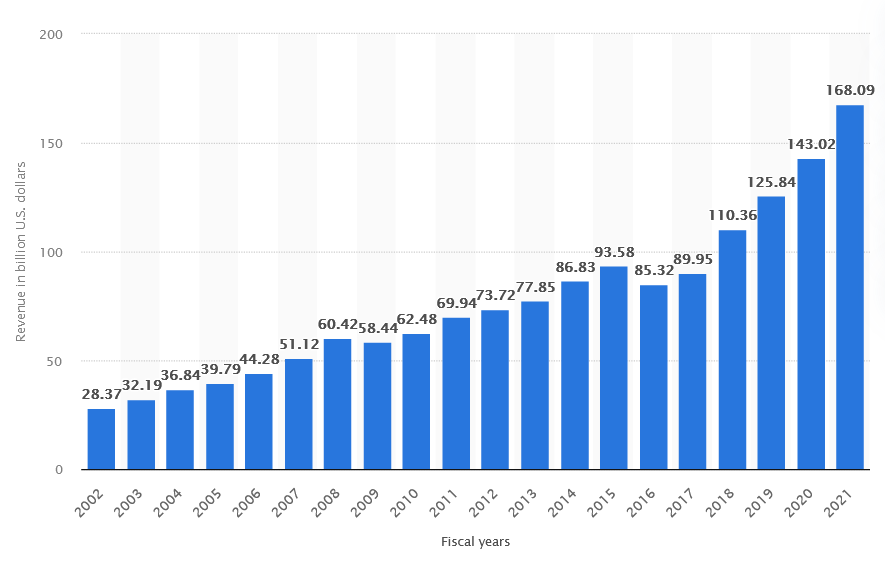

Meanwhile, the company retains substantial revenue growth, efficiently doubling within the last 5 years.

A Side By Side Comparison of Microsoft's Earnings Growth And 43% ROE

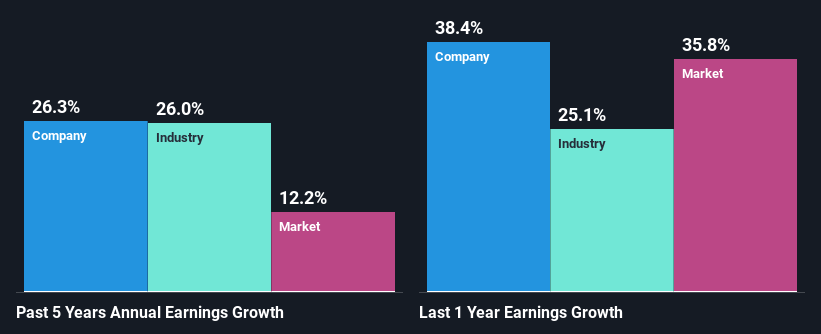

To begin with, Microsoft has a pretty high ROE which is interesting.Secondly, even when compared to the industry average of 13%, the company's ROE is quite impressive.As a result, Microsoft's exceptional 26% net income growth was seen over the past five years, which doesn't come as a surprise.

As a next step, we compared Microsoft's net income growth with the industry and found that the company has a similar growth figure compared with the industry average growth rate of 26% in the same period.

Earnings growth is an important factor in stock valuation.The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in.Doing so will help them show if the stock's future looks promising or ominous. Is MSFT reasonably valued? This infographic on the company's intrinsic value has everything you need to know.

Is Microsoft Efficiently Re-investing Its Profits?

The three-year median payout ratio for Microsoft is 35%, which is moderately low. The company is retaining the remaining 65%.So it seems that Microsoft is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Besides, Microsoft has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 26% over the next three years.However, the company's ROE is not likely to change by much despite the lower expected payout ratio.

Conclusion

In total, we are pretty happy with Microsoft's performance.In particular, it's great to see that the company is investing heavily into its business, and along with a high rate of return that has resulted in a sizeable growth in its earnings.That being so, a study of the latest analyst forecasts shows that the company is expected to see a slowdown in its future earnings growth.

To learn more about the company's future earnings growth forecasts, take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Zero One +Tive report on Anime & $CTW

ICOP S.p.A. – Investment Narrative and Multibagger Monitoring Framework

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026