- United States

- /

- Software

- /

- NasdaqGS:MSFT

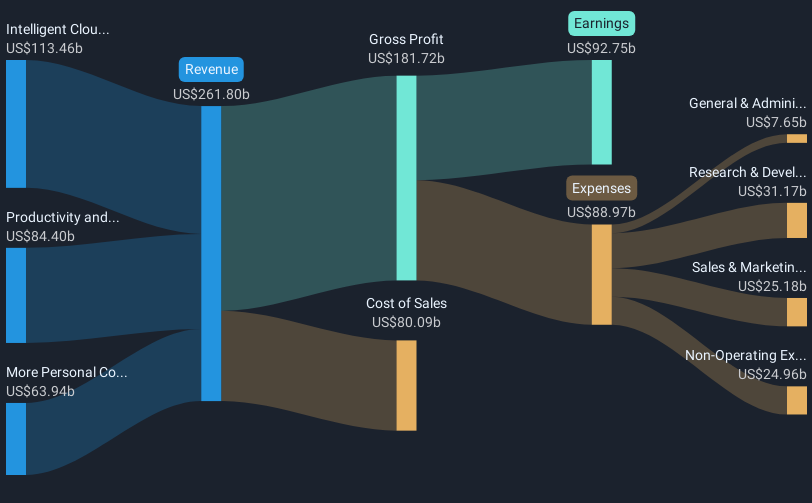

Microsoft (NasdaqGS:MSFT) Reports US$70 Billion Revenue With US$26 Billion Net Income

Reviewed by Simply Wall St

Microsoft (NasdaqGS:MSFT) recently reported robust third-quarter earnings, showing substantial growth in revenue and net income. This news, alongside strategic alliances such as the partnership with Health Catalyst and IBM Consulting, likely added momentum to Microsoft's 3.42% price rise over the last month. The company's focus on AI-driven solutions along with strong market trends, where major tech stocks have been leading gains, created a favorable backdrop for Microsoft's share performance. Microsoft's impressive growth in cloud computing and continued AI infrastructure investments have reinforced investor confidence, aligning with broader market optimism that has seen the Nasdaq up 2.7% in the last week.

Buy, Hold or Sell Microsoft? View our complete analysis and fair value estimate and you decide.

The recent positive developments, including Microsoft's strategic partnerships and robust third-quarter earnings, could reinforce the company's narrative of sustained growth through AI advancements and cloud expansion. These factors may drive long-term revenue growth and margin expansion, potentially aligning with the current analyst forecasts of an annual revenue increase of 13.6% over the next three years. The integration of Copilot in Microsoft 365 could further accelerate enterprise adoption, impacting revenue positively and contributing to higher average revenue per user.

Over a five-year period, Microsoft's total shareholder return was 124.91%, reflecting a substantial gain. In contrast, the company's one-year return underperformed the US Software industry, which saw a 10.8% return, demonstrating Microsoft's stronger performance over a longer horizon despite shorter-term challenges. This historical context highlights the company's ability to deliver significant value to shareholders over time, even amid market variations.

In terms of future earnings, while analysts project an increase of earnings to US$138.7 billion by April 2028, risks such as execution challenges in AI and capacity constraints could pose potential downside to these projections. Despite the recent share price increase of 3.42% over the last month, the stock remains at a discount of approximately 24.3% to the consensus price target of US$493.34, suggesting potential upside if future developments align with analyst expectations. Investors are encouraged to consider their assumptions in light of these forecasts when evaluating Microsoft's long-term outlook.

Review our growth performance report to gain insights into Microsoft's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices and solutions worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives