- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT): Evaluating the Stock’s Valuation After Recent Gains

See our latest analysis for Microsoft.

Microsoft's share price has gained solid ground so far this year, despite some recent volatility, with a 13.24% year-to-date rise and a one-year total shareholder return of 14.02% reflecting steady momentum. With both near-term pullbacks and long-term outperformance, such as the impressive 100.75% total return over three years, investors continue to view Microsoft as a resilient, growth-oriented leader, even as sentiment shifts day to day.

If today's performance has you scanning for the next big opportunity in tech, consider exploring the landscape with our See the full list for free.

Yet with Microsoft's impressive track record and robust fundamentals, investors are left to wonder whether the current stock price still offers upside or if the market has already factored in all of the company’s future potential.

Most Popular Narrative: 5.2% Undervalued

With Microsoft shares last closing at $474, the leading narrative from PicaCoder signals a fair value estimate of $500. This indicates potential upside from current levels. The dramatic rise in valuation is powered by aggressive assumptions around core business growth and the company’s ability to overcome sector headwinds.

The world has been captivated by the artificial intelligence boom, and no company has ridden the wave of investor enthusiasm quite like Microsoft. Supported by its strategic partnership with OpenAI and the integration of AI across its product ecosystem, the company's valuation has soared to unprecedented heights.

Curious what numbers really back up this bullish outlook? The fair value rests on ambitious revenue lifts, bold margin expansion, and a crucial discount rate assumption. Ready to see the full narrative breakdown and the forecasts driving this eye-catching price target?

Result: Fair Value of $500 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing PC sales and rising datacenter costs pose real risks. These factors could challenge Microsoft's bullish valuation over the coming quarters.

Find out about the key risks to this Microsoft narrative.

Another View: Breaking Down Value by Earnings Ratio

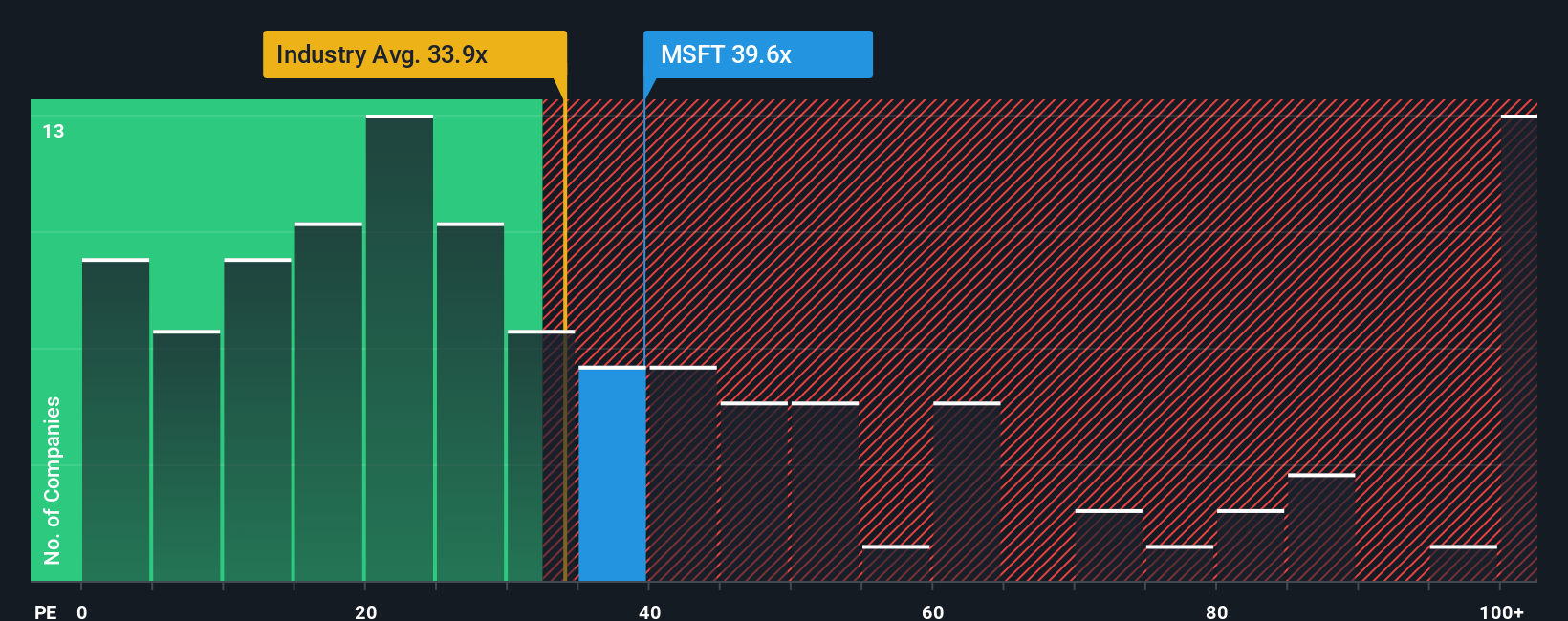

Looking at Microsoft's valuation through its price-to-earnings ratio, the stock trades at 33.6 times earnings. This is higher than the US Software industry average of 28.8 but roughly in line with its peer average of 34.9. Notably, it is well below the fair ratio of 57.1, which some believe is where the market could eventually head. This gap could signal opportunity, but it may also present risk if the market does not move as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microsoft Narrative

If you think the story could unfold differently or want to dive deeper into Microsoft's numbers yourself, creating your personal narrative only takes a few minutes. Do it your way

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunity rarely knocks twice. Don’t miss your shot to get ahead. Tap into these handpicked lists and unlock fresh strategies for your portfolio today.

- Supercharge your returns with these 26 AI penny stocks benefiting from artificial intelligence breakthroughs and industry-changing innovations.

- Capture income and beat low savings rates by targeting these 14 dividend stocks with yields > 3% packed with reliable, high-yield payouts.

- Seize a head start in digital finance by checking out these 81 cryptocurrency and blockchain stocks focused on blockchain pioneers and crypto market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Inotiv NAMs Test Center

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion