- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT): Assessing Valuation After Recent Share Price Gains and Sustained Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Microsoft.

Microsoft’s share price has surged 22% so far this year, fueling optimism that momentum is building after several steady quarters. The company’s three-year total shareholder return of 129% reflects not just near-term growth, but also a sustained run fueled by ongoing product launches and cloud expansion.

For investors watching the pace of tech sector gains, now is a great time to discover more opportunities. See the full list for free with our Tech & AI Screener: See the full list for free.

But with these impressive gains and robust financials, the real question is whether Microsoft remains undervalued or if the current share price already reflects future growth expectations. This could leave little room for upside for new investors.

Most Popular Narrative: 41.9% Overvalued

At $510.96, Microsoft's current share price stands well above the fair value calculated in the most popular narrative, highlighting a notable premium attached by the market. This gap draws attention to the ambitious outlook and key assumptions driving the narrative's valuation.

Microsoft is exceptionally well-positioned to lead the enterprise software and cloud landscape in the age of artificial intelligence. With Azure (cloud infrastructure), Microsoft 365 (productivity), GitHub & Copilot (developer tools), Xbox & Activision (gaming), and Dynamics & LinkedIn, Microsoft offers a uniquely integrated and diversified product ecosystem. This creates strong network effects, high customer retention, and significant cash flow, reinforcing its wide economic moat.

Curious about the number-crunching powering this eye-catching fair value? This narrative reveals a striking blueprint that combines growth, margins, and future profit expectations rarely seen in tech. Discover which assumptions transform Microsoft’s product ecosystem into a bold valuation. The real driver may surprise you.

Result: Fair Value of $360.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressures or delays in AI monetization could quickly shift sentiment and challenge the case for Microsoft’s continued high valuation.

Find out about the key risks to this Microsoft narrative.

Another View: Is Microsoft Actually a Good Deal?

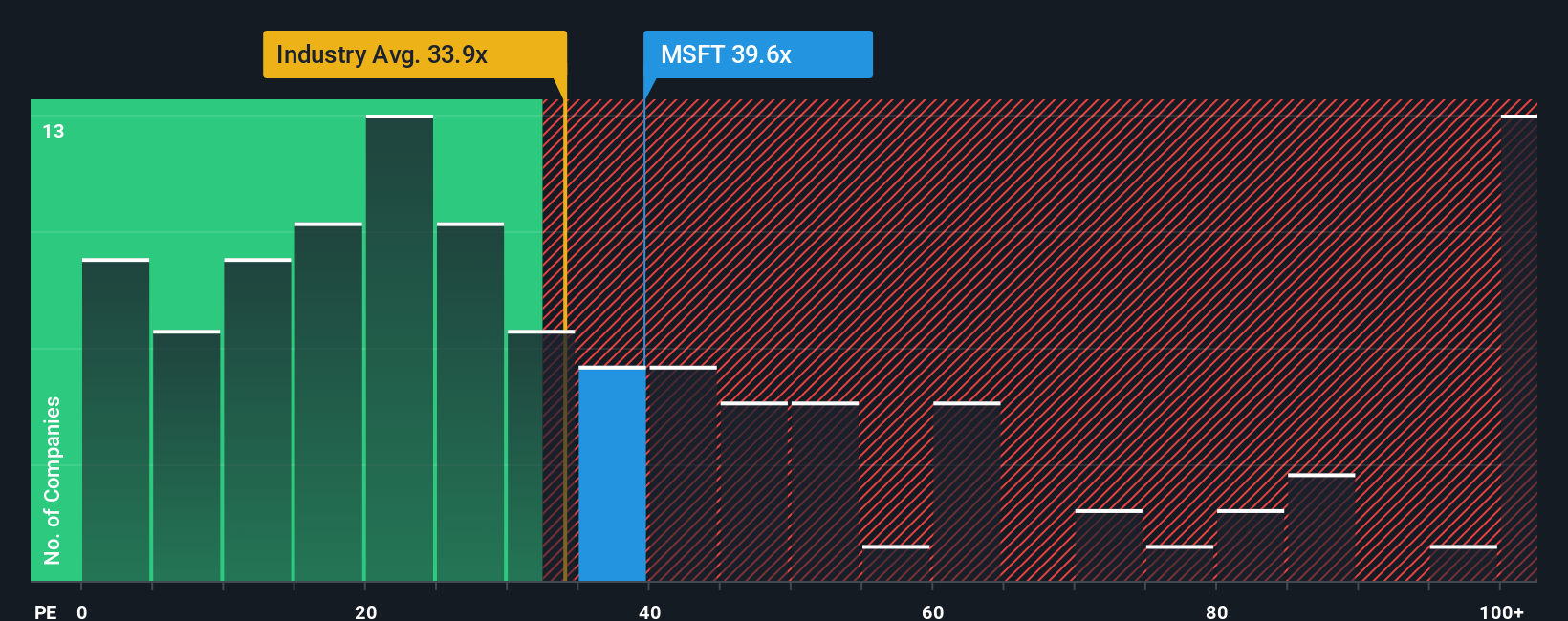

Stepping away from bold growth forecasts, we can look at how Microsoft is valued through the price-to-earnings ratio. At 37.3x, Microsoft trades slightly cheaper than its peer group average (38.3x), but more expensive than the broader software industry (34.8x). Compared to the fair ratio of 56.2x, the current valuation leaves little margin for error. Is the premium justified or setting up for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microsoft Narrative

If you want to take a different approach or dig into the numbers on your own, creating a personalized narrative is quick and insightful. Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let market momentum pass you by. Expand your strategy and spot powerful opportunities by leveraging smart screeners built to highlight different growth stories.

- Uncover high-yield plays with stable income by checking out these 19 dividend stocks with yields > 3%, which consistently deliver attractive payouts well above market averages.

- Tap into tomorrow’s breakthroughs and target emerging leaders by reviewing these 24 AI penny stocks, which are at the forefront of artificial intelligence and machine learning innovation.

- Position yourself ahead of the curve with these 898 undervalued stocks based on cash flows, poised for a market re-rate based on strong fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion