- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft Earnings Preview: It’s all About the Guidance

Key takeaways from this analysis:

- Consensus estimates for Microsoft’s 2nd quarter point to a 6.5% year-on-year decline in EPS and 3% revenue growth.

- Guidance will be crucial to the growth trajectory over the next few years and may affect the sustainability of the valuation.

- Longer term, investors will be focused on more qualitative factors and strategy.

Microsoft ( Nasdaq: MSFT ) will be reporting 2nd quarter financial results on Tuesday after the market closes. The company has seen a marked slowdown in revenue and earnings growth which culminated in quarterly earnings declining year-on-year for the quarter that ended September 2022.

The consensus estimate for EPS for the quarter ending December is $2.32. This would reflect a decline of 6.5% from the $2.48 reported a year earlier and a small sequential decline from the first quarter. That compares to growth rates that hit 48% in September 2021 and have fallen steadily since.

Wall Street is looking for $53.2 bln in revenue, a 3% year-on-year increase, and a record quarterly sales number.

EPS estimates for the quarter peaked at $2.77 in May last year, while revenue forecasts peaked at $58 bln around the same time.

See our latest analysis for Microsoft Corporation

Valuation and Growth Trajectory

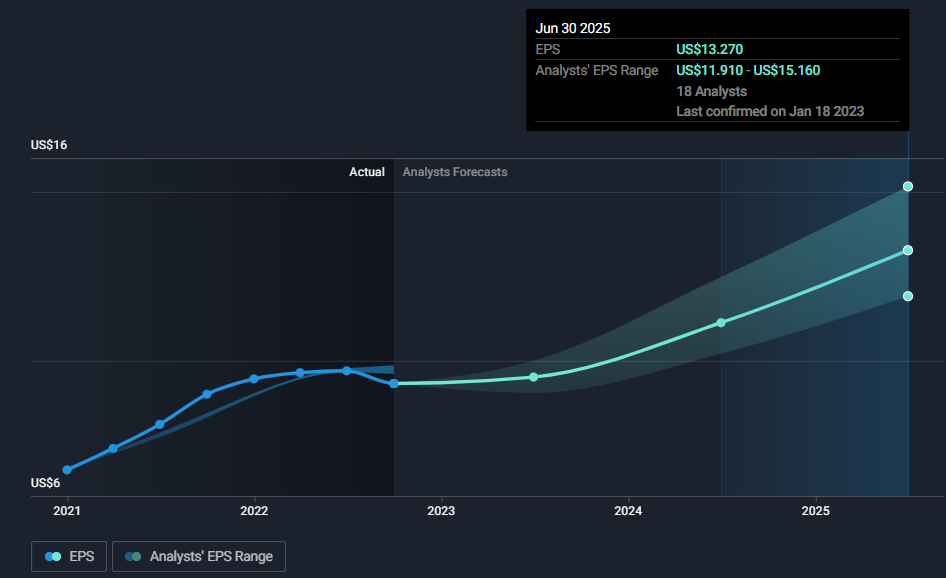

While the stock price will probably react to an earnings beat or miss in the short term, more important will be the guidance and what it means for the growth trajectory going forward. The chart below reflects EPS estimates to June 2025 from Wall Street analysts. Annualized EPS growth estimates range from 8% to 17%, with an average of about 11.5%.

The upper end of that range would probably justify the current valuation - but at the lower end, it would be hard to maintain a 25.7x price multiple. Incidentally, the current stock price is very close to the Simply Wall Street fair value estimate based on current forecasts ($241).

In the current environment, it's hard to imagine margins improving very much - so expected revenue growth will be key.

Staff cuts

Microsoft recently announced plans to lay off 10,000 employees . This represents about 5% of the workforce, so the impact on spending will be quite limited. It’s also worth noting that Microsoft hired 40,000 people in the year to June 2022 .

ChatGPT

Much has been made of Microsoft’s investment in OpenAI and the upcoming integration of ChatGPT with Bing. This is an exciting development but will take time to translate into revenue.

It may well allow Bing to attract new users - the challenge then will be to offer users a ChatGPT-like experience that can still be monetized.

Nevertheless, any discussion of AI will be an interesting part of the earnings call and will add to the long-term growth narrative.

The Bottom Line

Microsoft and Apple ( Nasdaq: AAPL ) were the two tech stocks that initially held up relatively well in 2022, and they are still viewed as relatively defensive within the sector. This means these stocks are widely owned which may be a near-term risk if the outlook continues to deteriorate.

Beyond 2025 there is little visibility on earnings growth. However, the company has plenty of compelling attributes including a diversified growth strategy, several competitive advantages, and excellent leadership. So any short term weakness could create an even better opportunity for long term investors.

Check out our full analysis of Microsoft to learn more about the company, and in particular how the current valuations stack up against earnings forecasts and peers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.

Nedbank please contact me,l need guidance step by step, please