- United States

- /

- IT

- /

- NasdaqGS:APLD

High Growth Tech Stocks In The US Market July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.2% and is up 13% over the last 12 months, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these positive market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| Ardelyx | 21.02% | 61.29% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Applied Digital (APLD)

Simply Wall St Growth Rating: ★★★★★☆

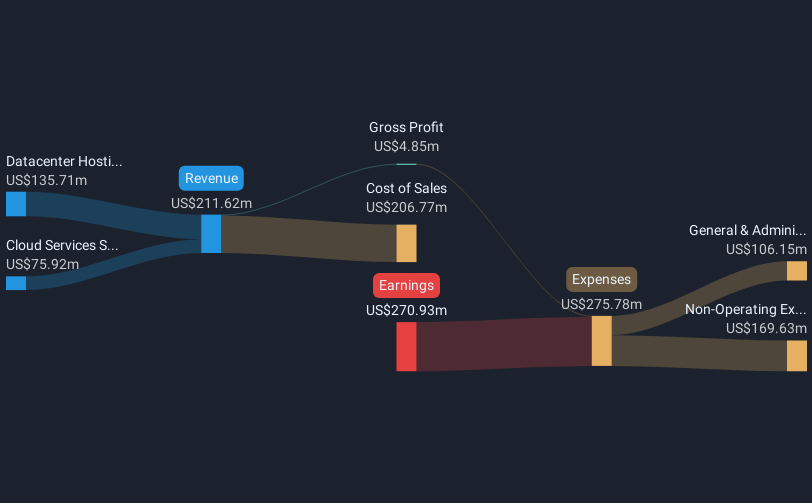

Overview: Applied Digital Corporation designs, develops, and operates digital infrastructure solutions and cloud services for high-performance computing and artificial intelligence industries in North America, with a market cap of $2.37 billion.

Operations: Applied Digital generates revenue primarily from its Datacenter Hosting Segment, contributing $133.08 million, and its Cloud Services Segment, which brings in $88.11 million. The company focuses on providing digital infrastructure solutions for high-performance computing and artificial intelligence industries across North America.

Applied Digital's recent partnership with BASX to design a cutting-edge cooling system for its AI factory, Polaris Forge 1, underscores its commitment to innovative and sustainable solutions in high-performance computing (HPC). This collaboration is pivotal as it addresses the immense power demands of AI infrastructure, which are up to 30 times higher than traditional data centers. With an annualized revenue growth of 37.4% and a projected shift into profitability within three years, Applied Digital is strategically positioning itself in the burgeoning AI market. Moreover, their recent $138 million shelf registration suggests a robust financial strategy to support ongoing expansions and technological advancements.

- Click here and access our complete health analysis report to understand the dynamics of Applied Digital.

Explore historical data to track Applied Digital's performance over time in our Past section.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

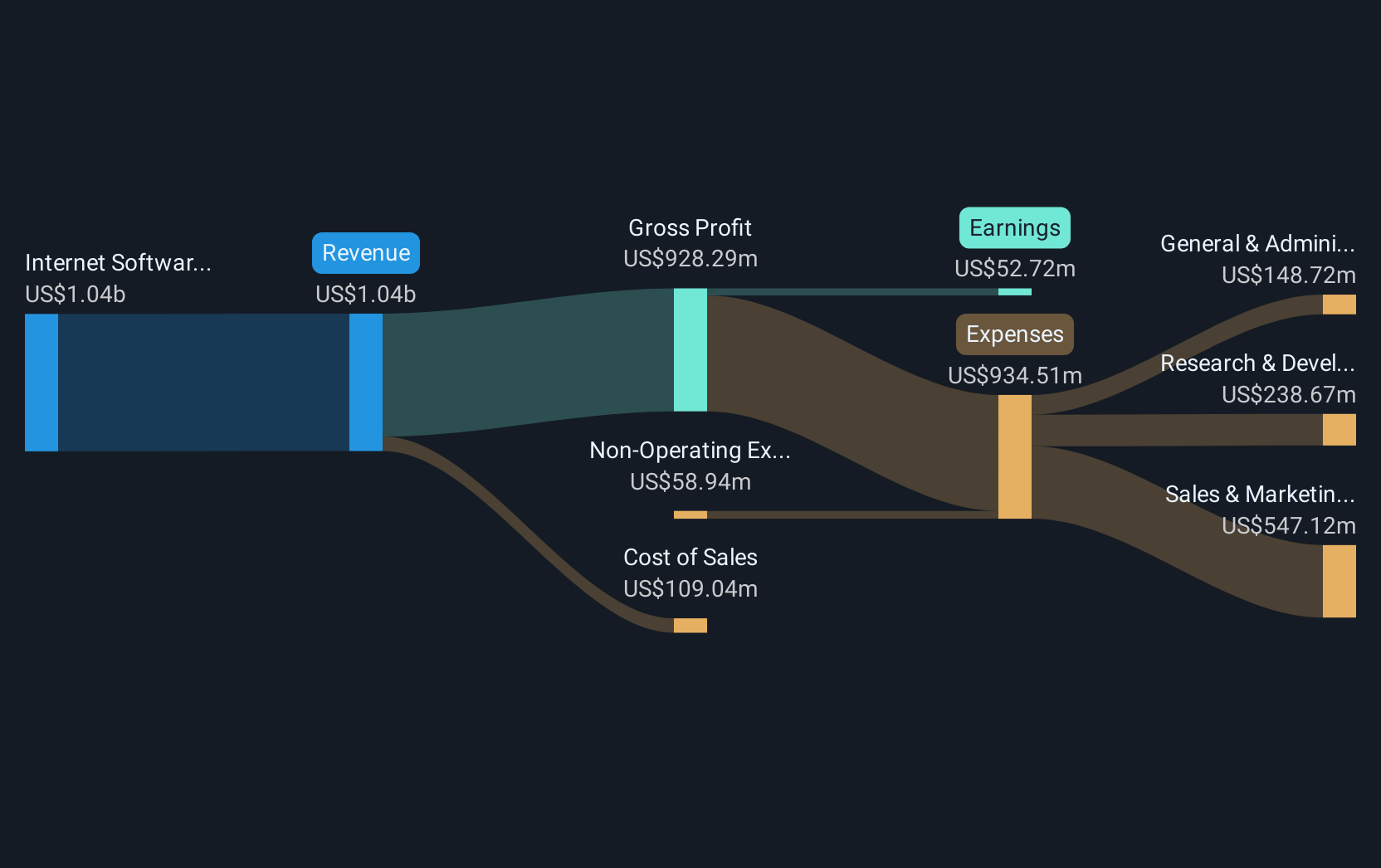

Overview: monday.com Ltd., alongside its subsidiaries, creates software applications for various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market capitalization of approximately $15.62 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, which amounts to $1.04 billion.

With a notable 27.6% annual earnings growth, monday.com outpaces the broader U.S. market's 14.6%, demonstrating robust financial health and innovation in software solutions. This growth is complemented by an 18.7% increase in revenue, highlighting effective market penetration and customer acquisition strategies. Additionally, the company has strategically increased its R&D spending to $120 million this year, accounting for approximately 10% of its total revenue, underscoring a commitment to advancing its technological capabilities and maintaining competitive advantage in a rapidly evolving industry.

- Take a closer look at monday.com's potential here in our health report.

Gain insights into monday.com's past trends and performance with our Past report.

Super Micro Computer (SMCI)

Simply Wall St Growth Rating: ★★★★★★

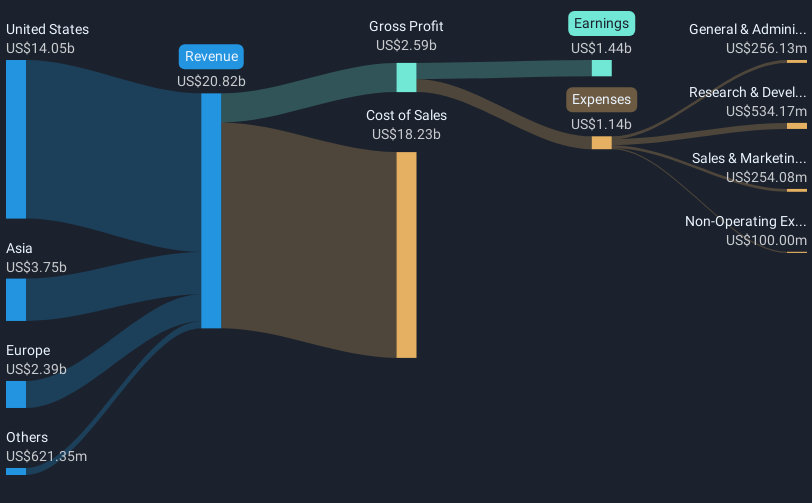

Overview: Super Micro Computer, Inc. is a company that specializes in developing and selling high performance server and storage solutions using modular and open architecture across the United States, Europe, Asia, and other international markets, with a market cap of $28.17 billion.

Operations: The company generates revenue primarily from developing and providing high-performance server solutions, amounting to $21.57 billion. It operates across multiple regions, including the United States, Europe, and Asia.

Super Micro Computer, Inc. (SMCI) stands out in the high-growth tech sector with a projected annual earnings increase of 39.1% and revenue growth at 25% per year, significantly outpacing the broader U.S. market averages of 14.6% for earnings and 8.7% for revenue growth. Recent developments include SMCI's immersion cooling technology certification which enhances server efficiency—a critical advancement as data centers evolve to meet escalating demands from AI and HPC applications. This innovation not only underscores SMCI’s commitment to sustainability by reducing energy use in cooling systems but also positions it advantageously as industries increasingly rely on high-performance computing solutions.

Turning Ideas Into Actions

- Delve into our full catalog of 226 US High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions and cloud services high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives