- United States

- /

- Software

- /

- NasdaqGS:MNDY

Does the Recent Partnership Signal a Better Price for monday.com in 2025?

Reviewed by Bailey Pemberton

- Curious whether monday.com is a hidden bargain or overpriced hype? You are not alone, as investors are increasingly asking whether today's stock price actually reflects its potential.

- After wild swings in recent years, monday.com is down 1.7% over the past week, up 2.1% in the last month, but still sits 16.6% lower year-to-date and 39.0% below where it was a year ago. This reminds us that perceptions around tech stocks can shift fast.

- Investors have been digesting a string of headlines. Earlier this month, a major partnership announcement with prominent enterprise clients signaled monday.com's ongoing push into new markets. Sector-wide volatility continues to influence short-term sentiment, and these factors have heightened the debate over the company's current and future value.

- If you have been tracking its fundamentals, monday.com currently sits at a value score of 3 out of 6, based on how many valuation checks it passes. Next, we will investigate what those valuation approaches reveal, and perhaps more importantly, introduce a smarter way to evaluate if the stock is truly priced right.

Find out why monday.com's -39.0% return over the last year is lagging behind its peers.

Approach 1: monday.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company's true worth by projecting its future cash flows and discounting them back to their present value. This approach aims to capture both the current financial position and realistic expectations of future growth.

For monday.com, the latest data shows a Free Cash Flow (FCF) of $321.8 million. Over the coming years, analysts forecast that FCF will continue to climb, reaching an estimated $795.0 million by the end of 2029. Only the next five years benefit from direct analyst estimates, while cash flows further out are modeled using long-term growth assumptions. All projections are provided in US dollars.

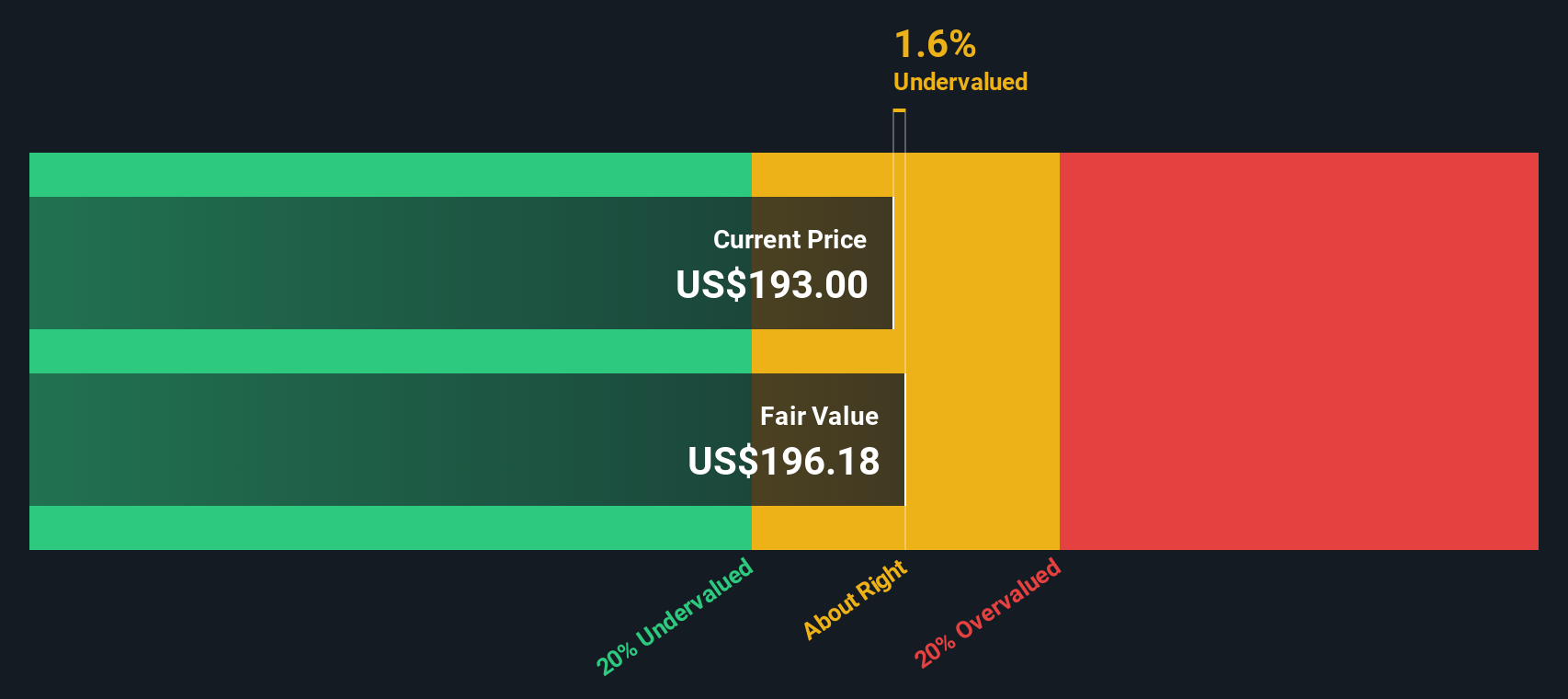

Applying this two-stage DCF approach, the estimated fair value for monday.com stock comes to $227.72 per share. This indicates the stock is currently trading at a 15.4% discount to its intrinsic value, suggesting it is undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests monday.com is undervalued by 15.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: monday.com Price vs Sales

For fast-growing software businesses where profits are often reinvested for growth, the Price-to-Sales (PS) ratio is a widely favored valuation metric. This approach is especially useful when companies are not yet reporting stable earnings, as it lets investors focus on the ability to generate revenue, regardless of short-term profitability swings.

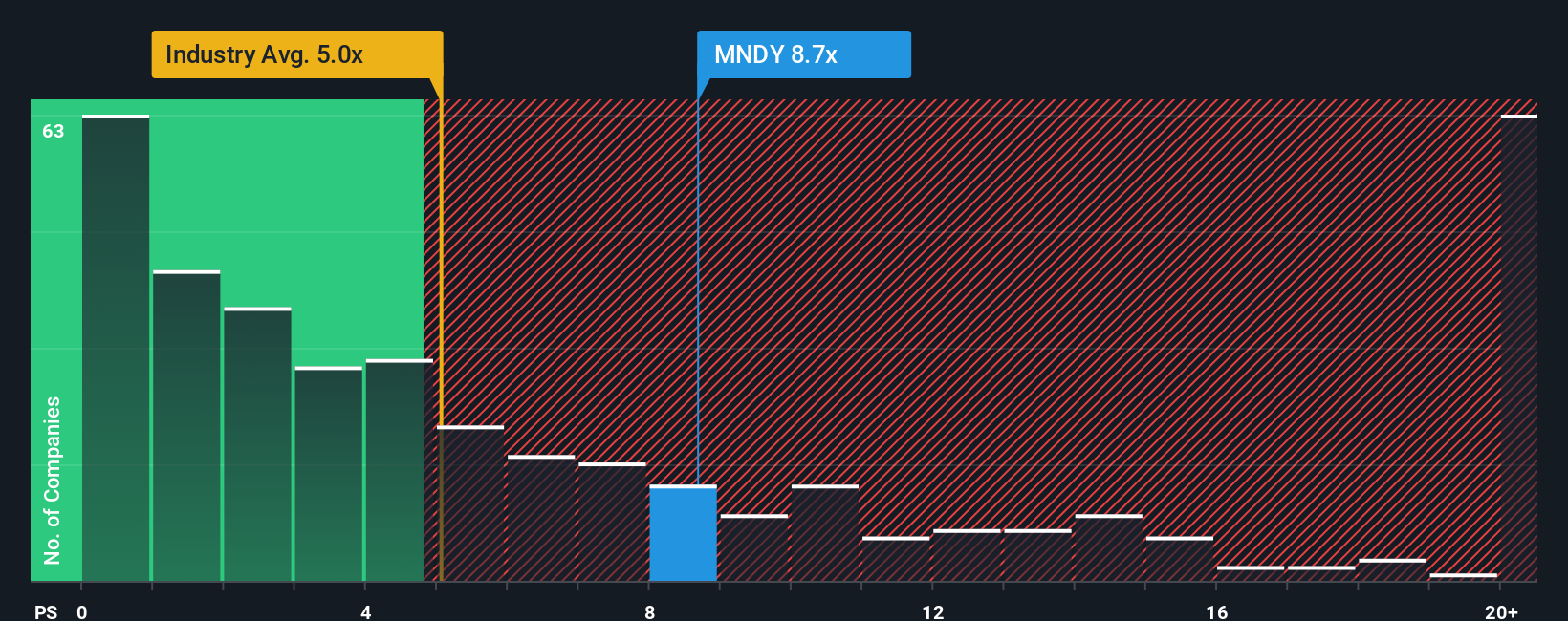

A company’s PS ratio helps investors judge whether the market is too optimistic or pessimistic about future sales and growth. Typically, high-growth companies can justify a higher PS ratio if they are expected to become profitable and expand quickly, but the risks around technology business models mean that too high a premium may signal excessive optimism. For monday.com, the current PS ratio stands at 9.0x. This is higher than both the industry average of 5.1x and the peer group average of 7.9x. This suggests the stock trades at a premium to many direct competitors and the broader software sector.

To provide a more nuanced benchmark, Simply Wall St has developed a “Fair Ratio.” In this instance, the Fair Ratio is 12.1x and blends factors like monday.com’s growth outlook, profit margin profile, market cap, and industry-specific risks. Unlike a straightforward industry or peer comparison, the Fair Ratio adapts to a company’s unique fundamentals, capturing whether its growth potential or risk profile justifies its current valuation.

Comparing monday.com’s actual PS ratio of 9.0x to its Fair Ratio of 12.1x shows that the stock is trading below what would be expected given its underlying strengths and prospects. This may point to an opportunity for value-oriented investors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your monday.com Narrative

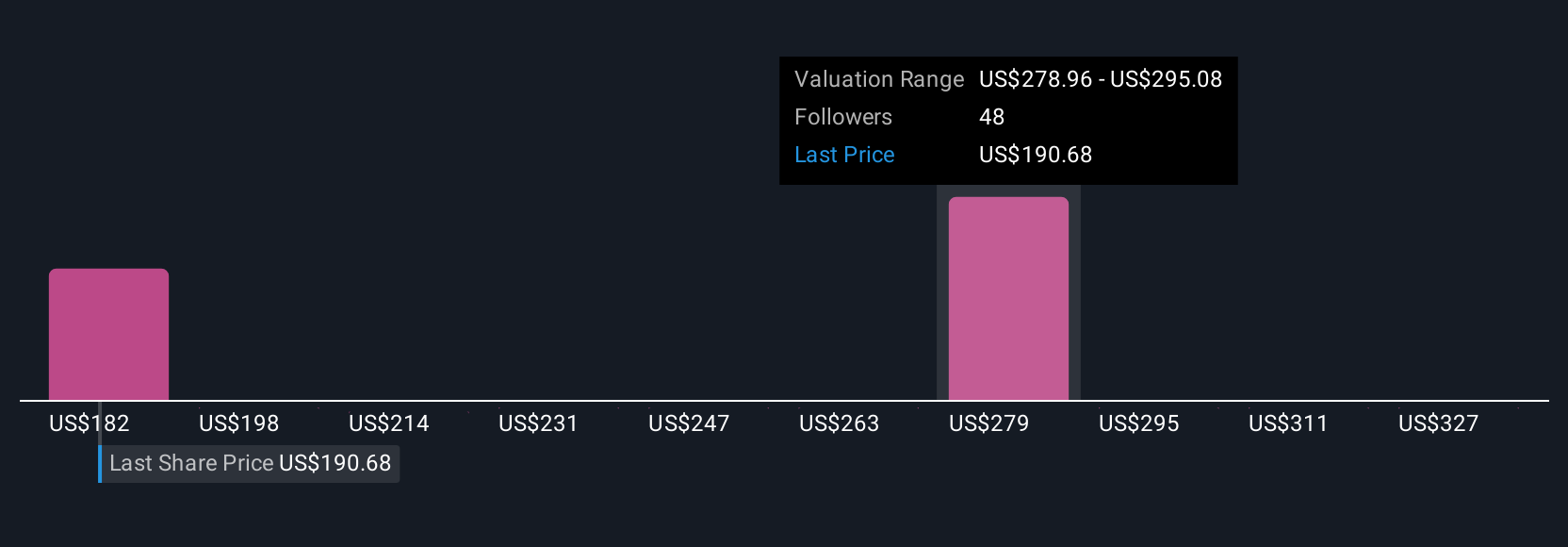

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your interpretation of a company's story, linking your view of its potential growth, earnings, and margins to a specific financial forecast and a personalized estimate of fair value.

Narratives are a powerful, easy-to-use tool available on Simply Wall St’s Community page, used by millions of investors to shape their investment decisions. Unlike static valuation models, Narratives let you combine your assumptions and convictions about a company with real numbers to see whether you believe the current price is fair, cheap, or overpriced.

With Narratives, you can instantly see if your outlook suggests now is a good time to buy or sell by directly comparing your fair value to where monday.com trades today. As new information comes in, such as fresh news headlines or quarterly results, Narratives update automatically, helping you stay on top of fast-moving market conditions without extra effort.

For example, one monday.com Narrative might forecast robust enterprise adoption and sustained 20%+ annual growth, valuing the stock at $450 per share. Another, more cautious Narrative may foresee competitive challenges limiting expansion, resulting in a fair value closer to $205. This puts you in control to choose the perspective that fits your view and risk appetite.

Do you think there's more to the story for monday.com? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives