- United States

- /

- Software

- /

- NasdaqCM:MIGI

Mawson Infrastructure Group, Inc.'s (NASDAQ:MIGI) Share Price Boosted 36% But Its Business Prospects Need A Lift Too

Mawson Infrastructure Group, Inc. (NASDAQ:MIGI) shareholders have had their patience rewarded with a 36% share price jump in the last month. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 89% share price drop in the last twelve months.

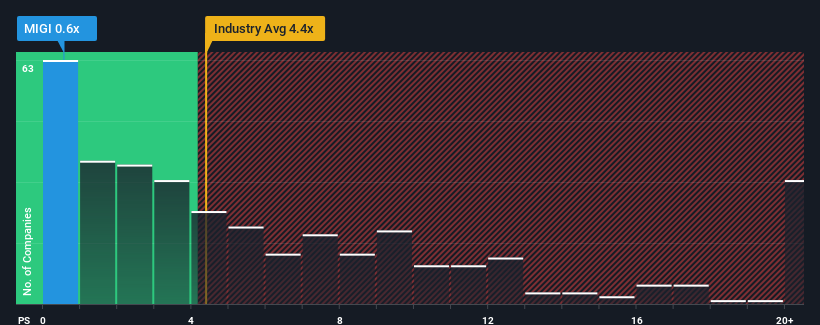

In spite of the firm bounce in price, Mawson Infrastructure Group may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.4x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Mawson Infrastructure Group

What Does Mawson Infrastructure Group's Recent Performance Look Like?

Recent times have been advantageous for Mawson Infrastructure Group as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Mawson Infrastructure Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Mawson Infrastructure Group's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Mawson Infrastructure Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 92% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.3% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Mawson Infrastructure Group's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Mawson Infrastructure Group's P/S?

Shares in Mawson Infrastructure Group have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Mawson Infrastructure Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Mawson Infrastructure Group (including 1 which doesn't sit too well with us).

If these risks are making you reconsider your opinion on Mawson Infrastructure Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MIGI

Mawson Infrastructure Group

Develops and operates digital infrastructure for digital currency on the bitcoin blockchain network in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.