- United States

- /

- Software

- /

- NasdaqGS:MGIC

Magic Software Enterprises (NasdaqGS:MGIC): Assessing Valuation Following Strong Earnings Beat and New Dividend Announcement

Reviewed by Kshitija Bhandaru

Magic Software Enterprises (NasdaqGS:MGIC) is attracting attention after reporting quarterly earnings that topped expectations, along with news of a semi-annual dividend for investors holding shares on October 6th.

See our latest analysis for Magic Software Enterprises.

This upbeat earnings release and freshly announced dividend appear to have sparked renewed investor confidence. Magic Software Enterprises’ steady upward share price return over the past year is complemented by a one-year total shareholder return approaching 1%. The stock’s longer-term performance remains resilient, which points to durable underlying momentum.

If you’re curious about where the next big ideas in tech might be hiding, take this opportunity to discover See the full list for free..

Given these strong results and the company’s continued growth, the key question now is whether Magic Software Enterprises’ stock is trading at a bargain or if the market has already accounted for all of its future potential.

Most Popular Narrative: 15% Overvalued

With Magic Software Enterprises’ price at $20.68 and the widely followed consensus narrative anchoring a fair value at $18.00, the market is currently placing a premium above what analysts deem justified. The difference raises questions around the sustainability and drivers of today’s price.

Management highlighted a rapid ramp in AI-focused services and partnerships, with a reported 70% success rate for GenAI projects (compared to a 12% industry average), fueling bullish expectations of continued service expansion and market share gains. This assumes Magic will maintain this competitive advantage even as competition and client expectations intensify.

Curious why this valuation has investors so divided? The narrative is betting big on surging technology adoption and upgraded profit margins. Want to discover the bold assumptions that shape this price tag? Click to reveal the financial details and major growth bets fueling this valuation.

Result: Fair Value of $18.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in tech adoption or weaker than expected integration from the Matrix merger could challenge these bullish valuation assumptions.

Find out about the key risks to this Magic Software Enterprises narrative.

Another View: What Do the Numbers Say?

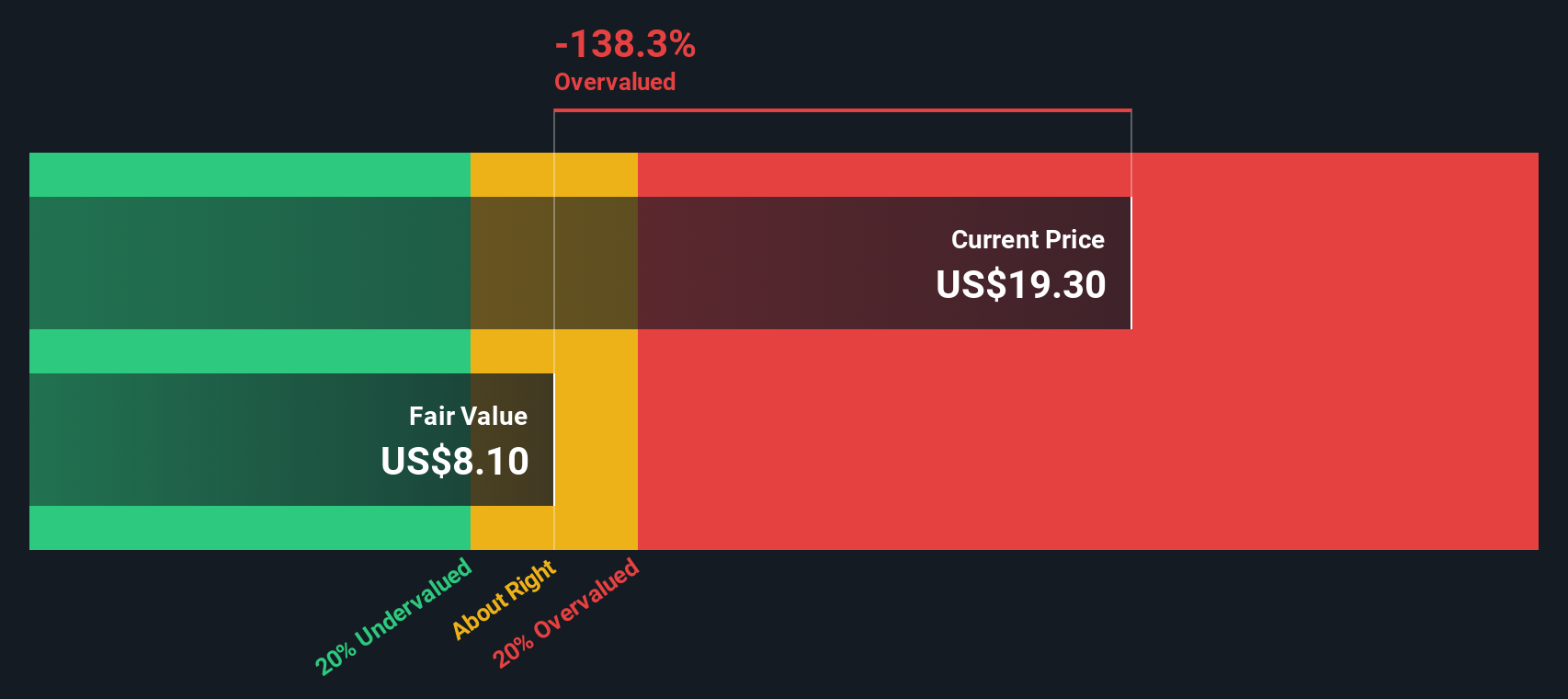

Looking beyond analyst targets, our SWS DCF model presents a very different picture for Magic Software Enterprises. According to this discounted cash flow approach, the shares appear significantly overvalued and are currently trading at more than double the model's estimated fair value. Could market optimism be running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Magic Software Enterprises Narrative

Not convinced by the consensus or eager to do your own due diligence? You can create your own perspective in just a few minutes, so why not Do it your way.

A great starting point for your Magic Software Enterprises research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for the obvious. Expand your search with powerful tools that reveal companies making headlines and reshaping industries. These opportunities won’t wait around, and neither should you.

- Target growth potential by checking out these 25 AI penny stocks transforming everything from automation to data security, and riding the next big wave in tech innovation.

- Maximize income possibilities with these 19 dividend stocks with yields > 3% offering stronger yields and the stability many long-term investors look for in their portfolios.

- Take your chance to catch undervalued gems by investigating these 887 undervalued stocks based on cash flows, where smart capital is already positioning for future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives