- United States

- /

- Software

- /

- NasdaqGS:MGIC

Can You Imagine How Magic Software Enterprises's (NASDAQ:MGIC) Shareholders Feel About The 35% Share Price Increase?

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Magic Software Enterprises Ltd. (NASDAQ:MGIC) share price is up 35% in the last five years, that's less than the market return. Unfortunately the share price is down 0.3% in the last year.

View our latest analysis for Magic Software Enterprises

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Magic Software Enterprises actually saw its EPS drop 3.2% per year. By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

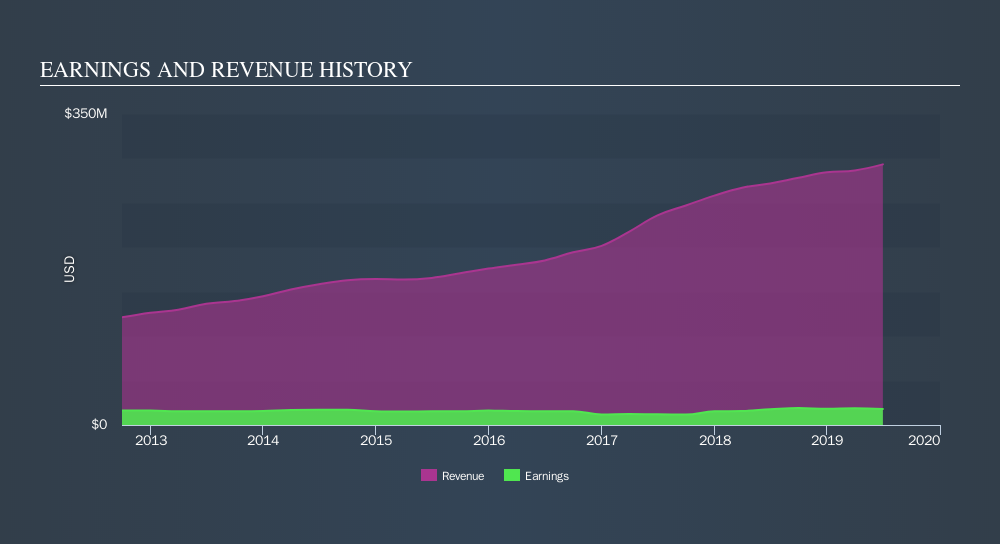

On the other hand, Magic Software Enterprises's revenue is growing nicely, at a compound rate of 14% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Magic Software Enterprises stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Magic Software Enterprises, it has a TSR of 56% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Magic Software Enterprises shareholders have received a total shareholder return of 3.2% over the last year. Of course, that includes the dividend. However, that falls short of the 9.3% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before forming an opinion on Magic Software Enterprises you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

We will like Magic Software Enterprises better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives