- United States

- /

- Software

- /

- NasdaqCM:MARA

Marathon Digital Holdings (MARA): Evaluating Valuation After a 20% Year-to-Date Gain

Reviewed by Simply Wall St

MARA Holdings (MARA) shares have moved sideways this week, as investors continue to weigh the latest numbers and market trends. The stock has posted a year-to-date gain of 20%, and with healthy revenue growth, its valuation remains a talking point.

See our latest analysis for MARA Holdings.

MARA Holdings has seen its share price return climb more than 20% so far this year, boosted by a resurgence in growth-focused stocks and renewed attention on its fundamentals. While momentum has cooled in recent days following a strong run, its long-term story remains shaped by a 651% total shareholder return over five years. This signals both the potential and the volatility that come with this name.

If you're seeking other compelling stories in the market, now’s an ideal time to widen your scope and uncover fast growing stocks with high insider ownership

The numbers may look tempting at first glance. However, with shares having already delivered substantial returns, the real question is whether MARA Holdings is still undervalued or if the market has already factored in its future growth potential.

Most Popular Narrative: 12.8% Undervalued

At $20.73 per share, MARA Holdings trades below the narrative's fair value estimate of $23.78, pointing to unrecognized upside and renewed optimism among analysts.

Bullish analysts have raised MARA Holdings' price target due to the company's expanding bitcoin treasury, emphasizing its ability to accumulate digital assets faster than peers. Capital market advantages are seen as a significant driver, enabling MARA Holdings to raise funds efficiently and sustain growth in digital asset holdings.

What's powering this high conviction? The most followed narrative hinges on a fundamental shift in profits, a margin turnaround, and a bold new outlook for future performance. Can their aggressive assumptions actually play out? Find out what’s fueling analyst enthusiasm and what they aren’t telling you upfront.

Result: Fair Value of $23.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, MARA Holdings' high dependence on bitcoin mining and the unpredictable regulatory landscape could create sudden volatility and challenge its projected growth story.

Find out about the key risks to this MARA Holdings narrative.

Another View: Valuation by Earnings Multiple

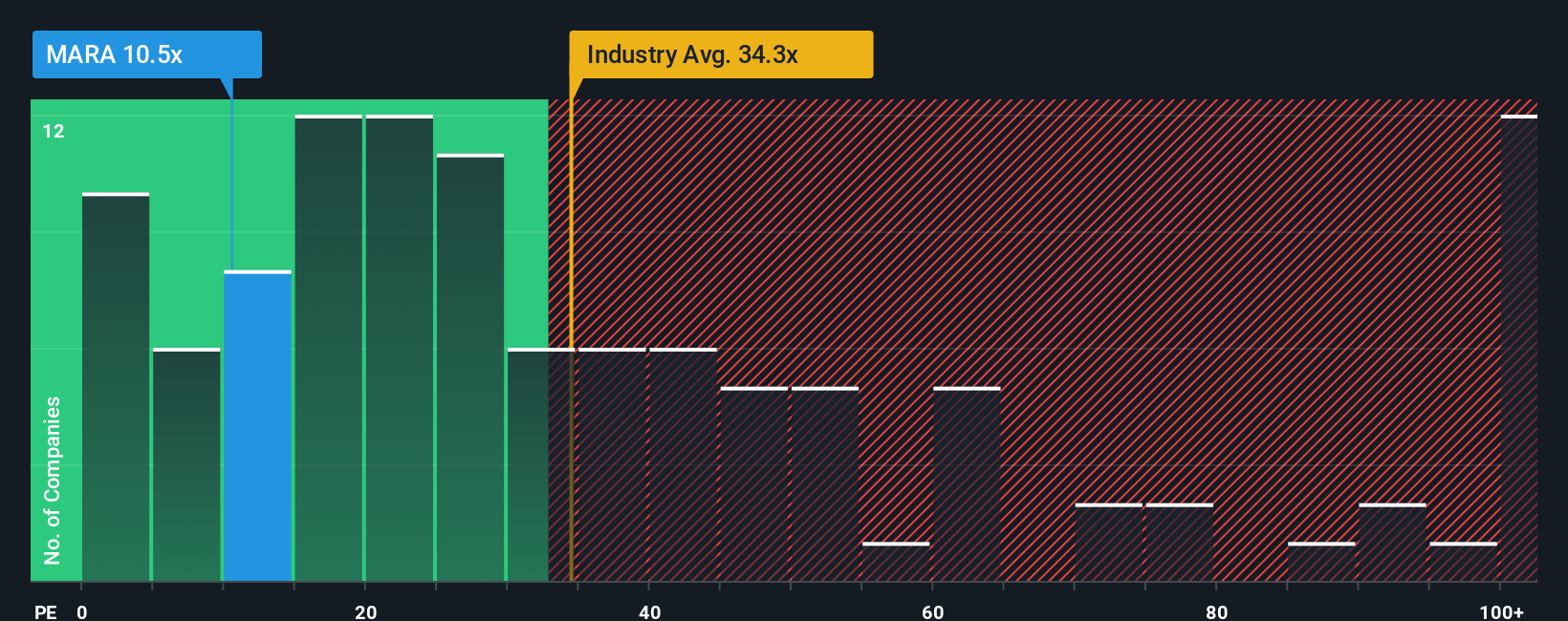

Looking through the lens of the price-to-earnings ratio, MARA Holdings trades at 11.3 times earnings, which is much cheaper than the US Software sector average of 35.3x and offers better value than direct peers at 67.3x. However, this is still a long way from the fair ratio of 2.6x. This raises questions about how much potential there truly is for upside, or if risks are being discounted instead. Does the market's optimism go too far, or not far enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MARA Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunity rarely knocks twice. Get ahead of the crowd by tapping into unique markets and companies most people overlook. Your next great investment could be just a click away.

- Capitalize on rapid growth trends by checking out these 24 AI penny stocks, which deliver real-world solutions in artificial intelligence.

- Spot emerging value opportunities in the market with these 872 undervalued stocks based on cash flows, a tool tailored to highlight strong potential based on cash flows.

- Boost your portfolio's income potential as you track down these 17 dividend stocks with yields > 3% offering impressive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives