- United States

- /

- Software

- /

- NasdaqGS:MANH

Manhattan Associates (MANH): Assessing Valuation as Reshoring Drives New Interest in Logistics Solutions

Reviewed by Kshitija Bhandaru

Manhattan Associates (MANH) is drawing fresh attention as supply chain shifts are driving more manufacturers to bring operations back to the U.S. This reshoring wave is fueling interest in the company’s logistics software solutions among investors.

See our latest analysis for Manhattan Associates.

Momentum for Manhattan Associates has been fairly steady lately. After some ebb and flow, the past year’s total shareholder return is essentially flat at -0.27%, while its share price sits at $201.36. Despite recent supply chain themes rekindling interest, performance has cooled from the longer-term uptrend. However, the reshoring narrative is keeping the company on investors’ radars.

If you want to discover other technology leaders riding similar trends, check out the latest movers in our Tech & AI Growth Screener See the full list for free.

With shares near recent highs and optimism around reshoring momentum, the key question is whether Manhattan Associates is still trading below its true value, or if the market has already priced in future growth potential.

Most Popular Narrative: 11.6% Undervalued

Manhattan Associates' most followed valuation narrative points to a fair value substantially above the last close, suggesting upside potential despite steady recent performance.

Enhanced investments in AI, automation, and unified product development (such as Agentic AI and the Manhattan Active Agent Foundry) position Manhattan to capture increasing customer demand for real-time analytics and next-generation supply chain automation. This may drive new bookings, average contract value, and expansion into underpenetrated markets, which could support sustainable double-digit top-line growth.

Curious how aggressive tech adoption and ambitious growth forecasts translate to this optimistic price? The narrative is built on bold expansion plans, improving margins, and a profit outlook rivaling tech sector standouts. Want to know which assumptions propel this premium valuation? Dive deeper to uncover the underlying projections.

Result: Fair Value of $227.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow customer transitions to cloud and ongoing services revenue volatility could limit Manhattan Associates’ growth and pose challenges for bullish forecasts.

Find out about the key risks to this Manhattan Associates narrative.

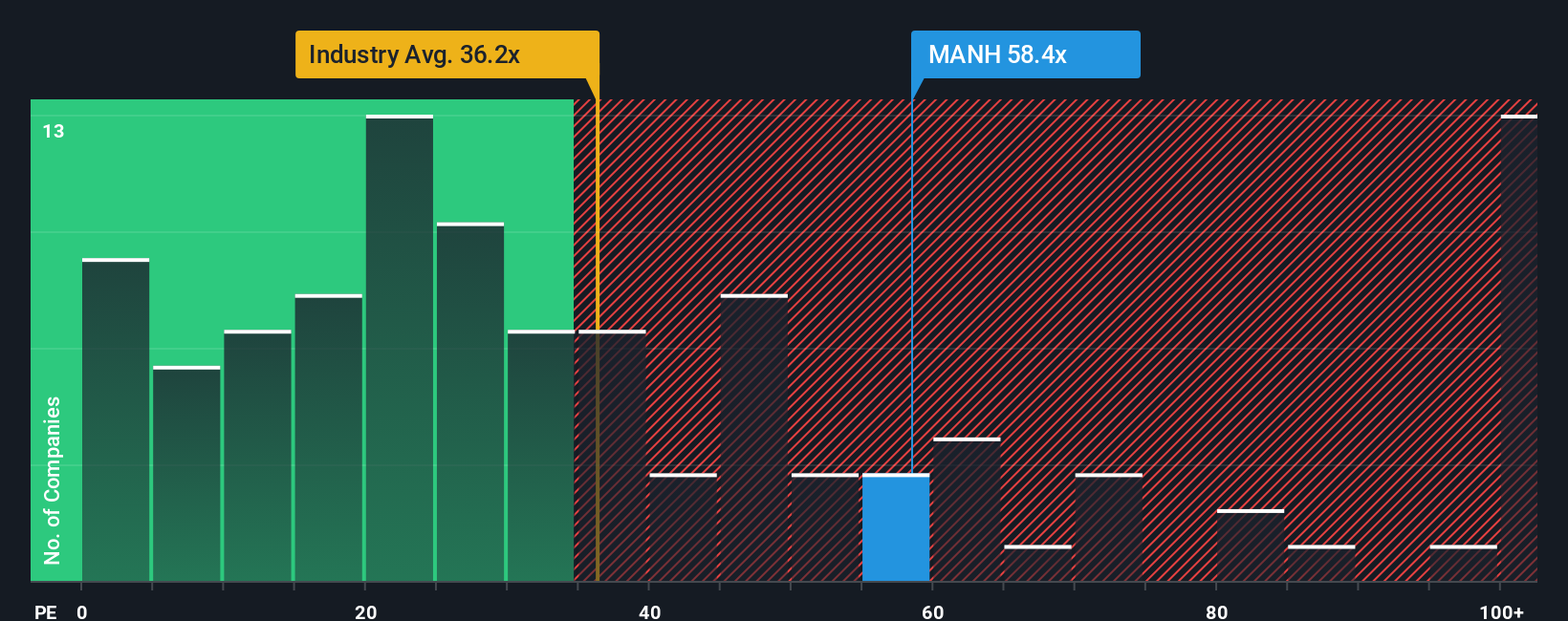

Another View: Multiples Raise Valuation Questions

Looking beyond optimistic forecasts, Manhattan Associates’ price-to-earnings ratio of 55.1x stands noticeably above both the Software industry average of 35.5x and peer average of 41.5x. This compares to the fair ratio of 32.3x that the market could return to, making the current price appear stretched by comparison. Are investors paying a premium that may not last, or is there still headroom for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Manhattan Associates Narrative

If you like to reach your own conclusions or question the prevailing view, you can easily put together your own analysis in just a few minutes. Do it your way

A great starting point for your Manhattan Associates research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to give your portfolio an edge? Get ahead of the crowd by targeting market opportunities others might overlook, all with the help of the Simply Wall Street Screener.

- Unlock long-term potential by selecting companies with robust cash flows among these 916 undervalued stocks based on cash flows that show value is still available.

- Find steady income streams by focusing on these 19 dividend stocks with yields > 3% offering yields above 3%, ideal for investors seeking regular returns.

- Step into the future by backing innovators at the frontier of medicine through these 31 healthcare AI stocks featuring transformational healthcare technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives