- United States

- /

- Software

- /

- NasdaqGS:MANH

A Closer Look at Manhattan Associates (MANH) Valuation After Strong Q2 Cloud Revenue Growth

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 4.5% Undervalued

According to the most widely followed narrative, Manhattan Associates is currently trading at a modest discount to its estimated fair value, largely driven by long-term growth in cloud and AI-powered revenues.

The accelerating adoption of cloud-based and AI-powered supply chain solutions continues to unlock recurring, higher-margin revenue streams for Manhattan Associates. This is evidenced by sustained +20% cloud revenue growth, strong cross-sell rates, and an expanding pipeline of large and longer-term contracts. These trends are seen as likely to have a positive impact on revenue growth, margin expansion, and long-term earnings visibility.

Curious how Manhattan’s valuation compares with its high profit multiples and ambitious growth assumptions? This narrative is based on strong earnings projections and margin improvements, but what crucial targets underpin the case for upside? Dive in to uncover the key numbers shaping the fair value debate.

Result: Fair Value of $227.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slow cloud migration and volatile services revenue could limit the company’s earnings momentum and challenge the bullish outlook highlighted by analysts.

Find out about the key risks to this Manhattan Associates narrative.Another View: Market-Based Comparison

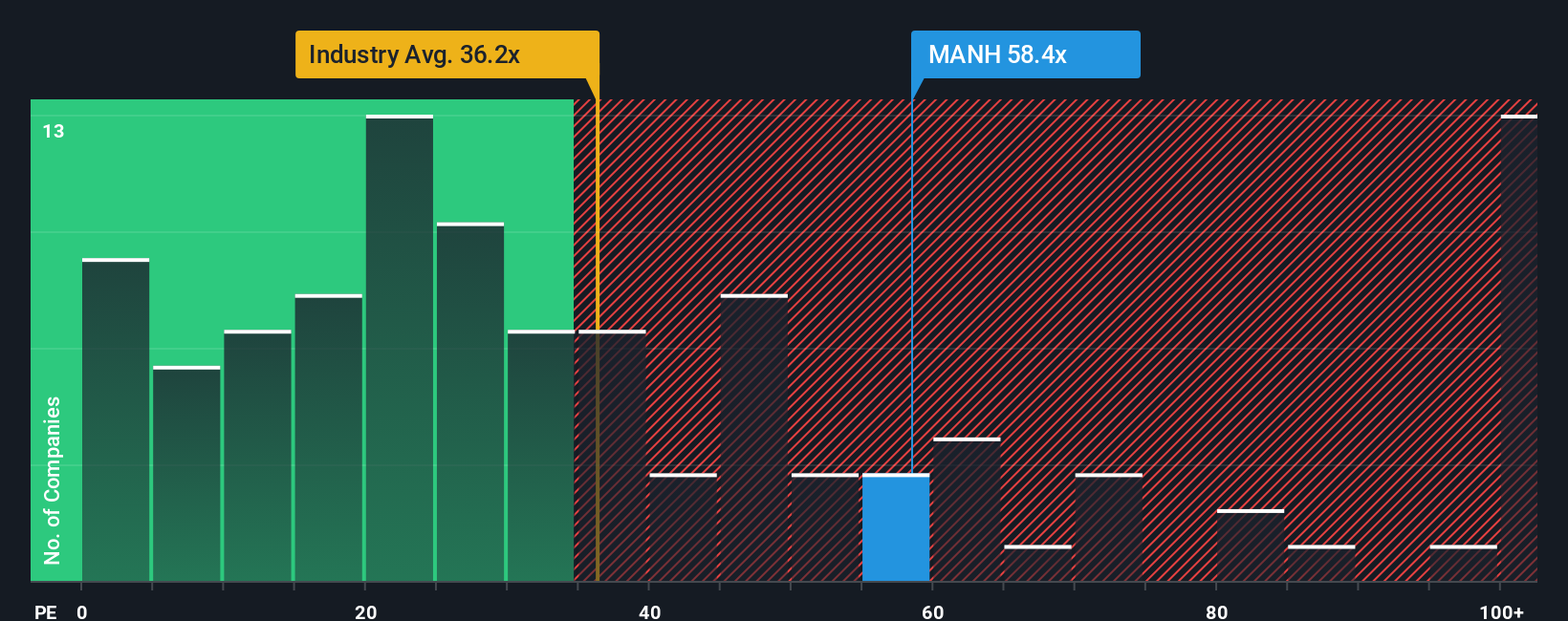

Looking at Manhattan Associates through the lens of its price-to-earnings ratio versus the industry average tells a different story. This approach indicates the stock may be on the expensive side relative to its sector. Could market optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Manhattan Associates to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Manhattan Associates Narrative

If you want to challenge the prevailing viewpoints or prefer to dig into the data on your own terms, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Manhattan Associates research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Unlock today's market winners before everyone else does. With so many trends reshaping the game, you'll want your next investment decision to be informed by real data, not just hunches. If you are ready to hunt for value and opportunity beyond the obvious choices, these powerful research shortcuts will have you covered:

- Jump on income opportunities by sifting through promising companies with yields higher than 3% using our dividend stocks with yields > 3% for reliable dividend performers.

- Stay ahead of rapid advances in medical technology by checking out trailblazers in artificial intelligence within the healthcare space via our trusted healthcare AI stocks.

- Uncover overlooked gems that could surge ahead by scanning under-the-radar stocks trading below their intrinsic value through our proven undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MANH

Manhattan Associates

Develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives