- United States

- /

- Software

- /

- NasdaqCM:KARO

Karooooo (NasdaqCM:KARO): Evaluating Valuation After S&P Global BMI Index Addition Boosts Institutional Attention

Reviewed by Kshitija Bhandaru

Karooooo (NasdaqCM:KARO) has just been added to the S&P Global BMI Index, a move that often draws new attention from institutional investors and can result in increased trading activity.

See our latest analysis for Karooooo.

Karooooo’s recent inclusion in the S&P Global BMI Index comes at a moment when its short-term share price returns have been modest but steady. Its 1-year total shareholder return of 0.47% and 3-year return above 2% hint at underlying stability and room for renewed interest. The index listing could act as a catalyst for fresh momentum as more institutional eyes turn to the stock.

If you’re watching institutional moves and want to see what else is attracting attention, now’s a prime opportunity to broaden your search and discover fast growing stocks with high insider ownership

But with shares still trading just 6% below analyst price targets despite healthy revenue and profit growth, investors are left to wonder if this is an undervalued growth play or if future gains are already priced in.

Most Popular Narrative: 6% Undervalued

The latest narrative pegs Karooooo’s fair value at $60.44, just above its last close of $56.69. This raises a debate about whether current momentum is justified by the growth story or analyst optimism.

Robust ongoing expansion and headcount investment in Southeast Asia and Europe position Karooooo to capture significant upside from the accelerating global transition to digital fleet management and IoT-enabled logistics. This expands the addressable market and drives future subscription revenue growth.

Curious what ambitious growth rates and margin assumptions underpin this valuation? The suspense is in the narrative’s projections for new markets and recurring revenue. Get the inside track on the next big leap before everyone else.

Result: Fair Value of $60.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on South Africa and high expansion costs could quickly shift the outlook if local conditions or execution fall short.

Find out about the key risks to this Karooooo narrative.

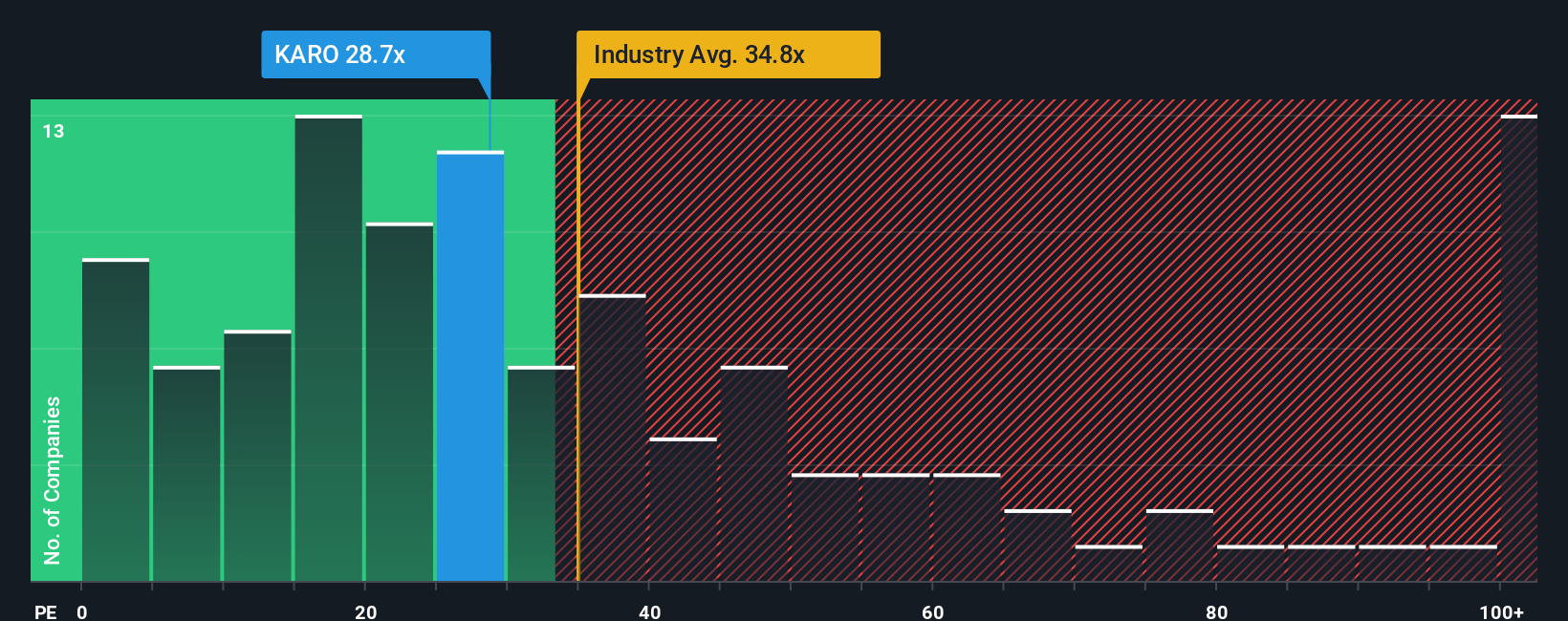

Another View: Reality Check from Market Multiples

While analyst forecasts spark optimism, looking at how Karooooo stacks up using the market’s standard gauge tells a more cautious story. Its price-to-earnings ratio sits at 31.3x, not just below the software industry average of 35.7x, but also significantly lower than its direct peers at 97.1x. Meanwhile, the fair ratio is estimated at 27.9x, suggesting investors might be overpaying unless future growth holds up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Karooooo Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Karooooo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead by tapping into fresh opportunities, so don’t leave potential gains on the table. Check out these standout themes now:

- Secure steady income with companies offering ample yields and dependable payouts in these 19 dividend stocks with yields > 3%.

- Tap into the booming healthcare revolution by searching for innovation-driven leaders featured in these 32 healthcare AI stocks.

- Unearth outstanding value plays based on solid cash flow metrics among these 896 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karooooo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:KARO

Karooooo

Provides a mobility software-as-a-service (SaaS) platform for connected vehicles in South Africa, the rest of Africa, Europe, the Asia-Pacific, the Middle East, and the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives