- United States

- /

- Software

- /

- NasdaqCM:KARO

A Fresh Look at Karooooo (NasdaqCM:KARO) Valuation After Upbeat Earnings and Confident 2026 Guidance

Reviewed by Simply Wall St

Karooooo (NasdaqCM:KARO) caught investors’ attention after reporting higher sales and net income for the latest quarter and half-year. The company also reaffirmed upbeat earnings guidance for 2026. This combination points to ongoing business momentum.

See our latest analysis for Karooooo.

Karooooo’s shares surged 5.3% after its upbeat results and strong guidance, trimming some of the sharp declines from earlier this month. This momentum is clearer in the big picture, with a 20.7% total shareholder return over the past year and a remarkable 113% three-year total shareholder return. This highlights long-term value creation despite some recent volatility.

If business momentum stories like Karooooo’s inspire you to broaden your search, take the next step and discover fast growing stocks with high insider ownership

With its recent rally and upbeat guidance, the key question now is whether Karooooo is still trading below its true value or if the market has already priced in its future growth, leaving little room for upside.

Most Popular Narrative: 23.5% Undervalued

Karooooo’s most widely followed valuation narrative points to sizable upside, as the consensus fair value sits well above the last closing price. The narrative price target suggests that today's market has not fully reflected key growth drivers and profitability improvements.

Robust ongoing expansion and headcount investment in Southeast Asia and Europe positions Karooooo to capture significant upside from the accelerating global transition to digital fleet management and IoT-enabled logistics. This expands the addressable market and drives future subscription revenue growth.

Curious what powers this bullish outlook? The key driver is not simply top-line growth or recurring revenues. Uncover which financial forecasts and operational shifts have set the stage for Karooooo’s ambitious price target. Dive in to find out what’s fueling analyst conviction.

Result: Fair Value of $60.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on South Africa and slower-than-expected ARPU growth could quickly dampen the bullish outlook if challenges persist in these core areas.

Find out about the key risks to this Karooooo narrative.

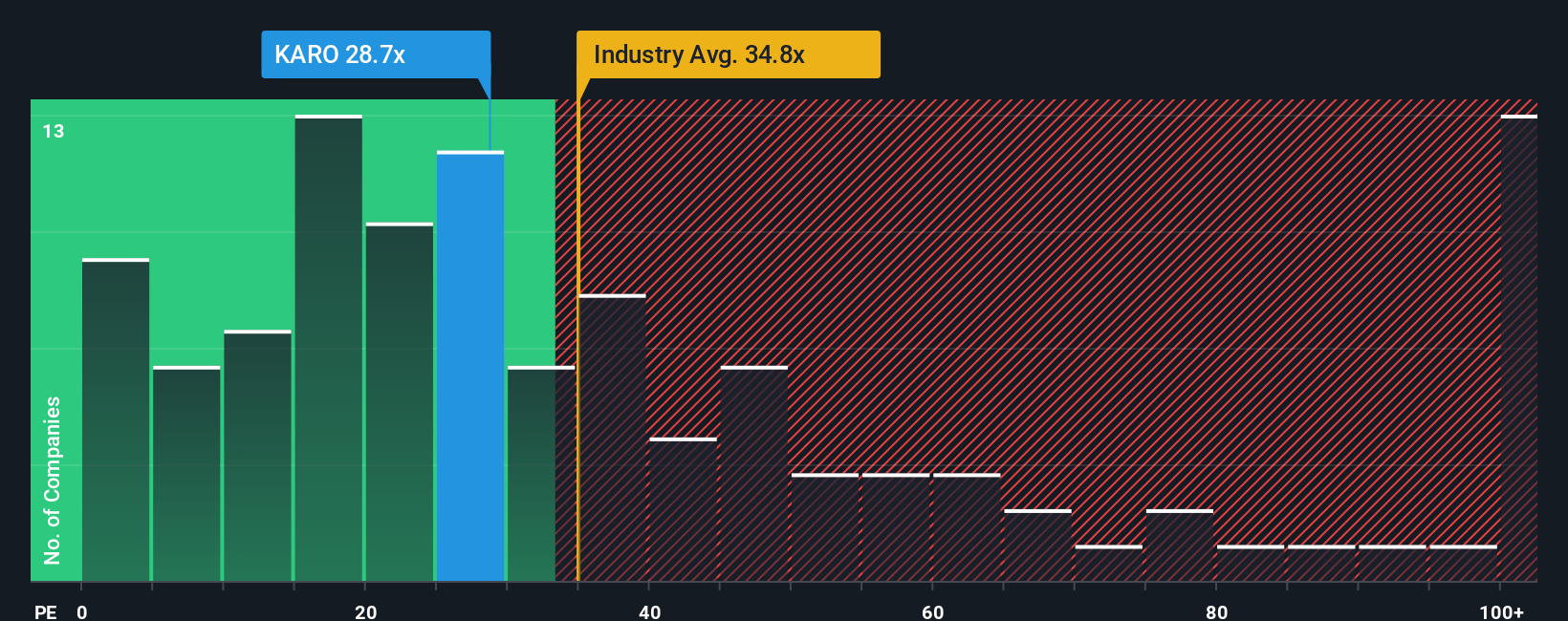

Another View: Multiples Comparison Shows Relative Value

Stepping outside of analyst forecasts, Karooooo’s valuation also looks favorable when compared to industry benchmarks. Trading at a price-to-earnings ratio of 25x, it sits below both its US software peers at 35.3x as well as the fair ratio of 26.3x. This suggests some margin of safety for investors. Could that gap close if market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Karooooo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Karooooo Narrative

If you see the story differently or want to dig deeper on your own, you can quickly create your own narrative in just a few minutes, or Do it your way.

A great starting point for your Karooooo research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t leave your strategy to chance when there are so many ways to get ahead. Tap into expert-curated ideas that could help you find your next big winner.

- Uncover fresh value by targeting companies currently trading below intrinsic worth with these 879 undervalued stocks based on cash flows. This can help you make the most of market mispricing.

- Capitalize on the fast-moving world of digital assets by checking out these 79 cryptocurrency and blockchain stocks for top innovators in blockchain and cryptocurrency technology.

- Boost your passive income goals and see which reliable payers rise above the rest with these 17 dividend stocks with yields > 3%, featuring stocks yielding over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karooooo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:KARO

Karooooo

Provides a mobility software-as-a-service (SaaS) platform for connected vehicles in South Africa, the rest of Africa, Europe, the Asia-Pacific, the Middle East, and the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives