- United States

- /

- Software

- /

- NasdaqCM:JG

Would Shareholders Who Purchased Aurora Mobile's (NASDAQ:JG) Stock Three Years Be Happy With The Share price Today?

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Aurora Mobile Limited (NASDAQ:JG), who have seen the share price tank a massive 73% over a three year period. That'd be enough to cause even the strongest minds some disquiet. Shareholders have had an even rougher run lately, with the share price down 32% in the last 90 days.

See our latest analysis for Aurora Mobile

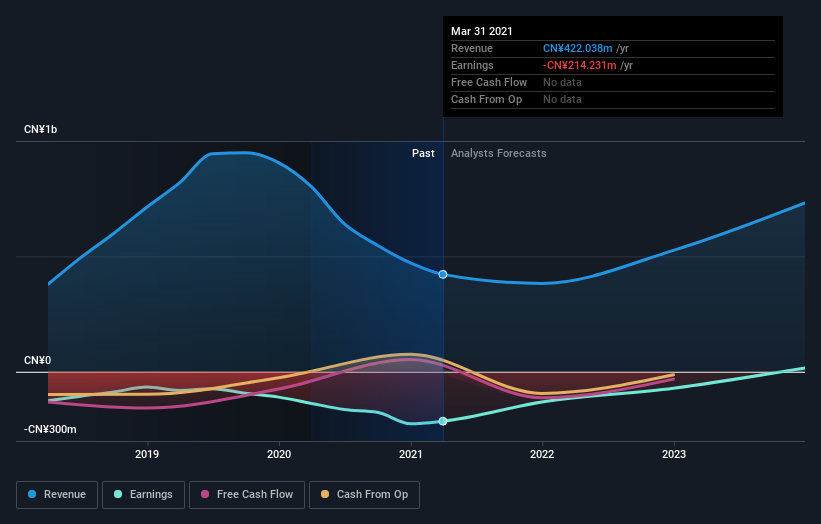

Aurora Mobile wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Aurora Mobile saw its revenue shrink by 1.2% per year. That's not what investors generally want to see. The share price fall of 20% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Aurora Mobile's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Aurora Mobile shareholders have gained 38% over twelve months. This isn't far from the market return of 41%. Given the three-year TSR of 20% per year, shareholders probably aren't too concerned by the recent gain! It could well be that the business is getting back on track. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Aurora Mobile has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Aurora Mobile, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:JG

Aurora Mobile

Through its subsidiaries, provides a range of developer services and vertical applications in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives