- United States

- /

- Software

- /

- NasdaqGS:JAMF

What Jamf Holding (JAMF)'s Microsoft Security Store Inclusion Means For Shareholders

Reviewed by Sasha Jovanovic

- Jamf recently announced its inclusion in the Microsoft Security Store Partner Ecosystem, highlighting its close collaboration and experience with Microsoft Security technologies to bring integrated management and security to Apple and Microsoft environments.

- This partnership strengthens Jamf's ability to provide unified security and identity solutions for organizations operating across mixed device fleets, helping IT and Security teams achieve greater oversight and workflow efficiency.

- We'll assess how Jamf's selection for the Microsoft Security Store could further reinforce its position in the enterprise security market.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

Jamf Holding Investment Narrative Recap

For investors to remain confident in Jamf, they need to believe the company can continue expanding its reach as organizations adopt more Apple devices, while successfully differentiating itself amid intensifying competition from both Apple’s native tools and broader enterprise security platforms. The recent inclusion in the Microsoft Security Store Partner Ecosystem could enhance Jamf’s short-term appeal and address a key catalyst, proving its solutions are indispensable for mixed device fleets, but it does not fully counter the longer-term risk of platform consolidation and product commoditization.

Among recent developments, Jamf’s July partnership with Smallstep stands out, as it focuses on strengthening device identity enforcement for Apple hardware. This move aligns closely with the security and integration catalyst now highlighted by the Microsoft announcement, reinforcing Jamf’s position as a provider of cross-platform, identity-centric management at a time when enterprises demand seamless and secure device oversight.

However, in contrast to these steps forward, investors should also recognize the specific risks Jamf faces if Apple expands its own management capabilities…

Read the full narrative on Jamf Holding (it's free!)

Jamf Holding's narrative projects $881.7 million revenue and $115.4 million earnings by 2028. This requires 9.8% yearly revenue growth and a $164.4 million earnings increase from the current earnings of $-49.0 million.

Uncover how Jamf Holding's forecasts yield a $14.20 fair value, a 33% upside to its current price.

Exploring Other Perspectives

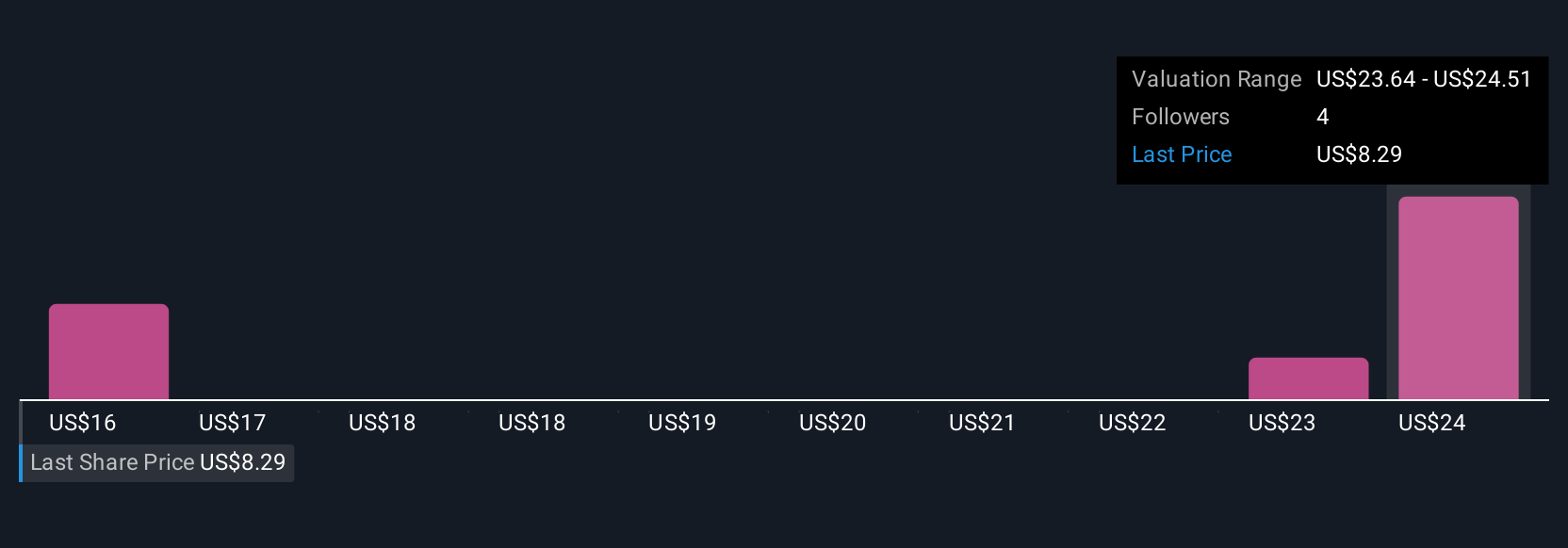

The Simply Wall St Community’s five fair value estimates for Jamf range from US$14.20 to US$23.75 per share. While several community members see high upside, the risk of Apple’s native tools increasing in capability could heavily influence Jamf’s future revenue and margins, reminding you to weigh multiple viewpoints before making decisions.

Explore 5 other fair value estimates on Jamf Holding - why the stock might be worth just $14.20!

Build Your Own Jamf Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jamf Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jamf Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jamf Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JAMF

Jamf Holding

Provides management and security solutions for Apple platforms in the Americas, Europe, the Middle East, India, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives