- United States

- /

- Software

- /

- NasdaqGS:JAMF

How Investors May Respond To Jamf (JAMF) Launching AI-Powered Mobile Forensic Tool for Security Teams

Reviewed by Sasha Jovanovic

- At its 16th annual Jamf Nation User Conference in Denver earlier this month, Jamf announced the beta release of AI Analysis for Executive Threat Protection, an artificial intelligence-powered tool that accelerates and simplifies mobile forensic analysis for device security teams.

- This upgrade enables rapid incident response and translates complex forensic data into actionable steps, equipping organizations with more efficient tools to protect high-risk users without requiring specialized expertise.

- We’ll explore how the addition of AI-driven forensic capabilities may influence Jamf's investment narrative, particularly regarding automation and enterprise security integration.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Jamf Holding Investment Narrative Recap

For investors to be shareholders in Jamf, the core belief centers on increasing demand for integrated Apple device management and security as more organizations adopt Apple hardware in complex enterprise settings. The launch of AI Analysis for Executive Threat Protection strengthens Jamf’s pitch around automated security, but is not expected to materially change the most significant short-term catalyst: accelerating cross-sell and security ARR growth. The leading risk remains potential customer migration to Apple’s own expanding management tools, threatening Jamf’s differentiation.

Among Jamf’s recent announcements, the introduction of its new Platform API ecosystem stands out as especially relevant. This development promises greater automation and flexibility for organizations managing Apple devices at scale, tying directly into Jamf's strategy to drive more seamless security and device management integrations, the very catalysts that could impact ARR growth and counter competitive pressures.

Yet, in contrast, investors should remain aware of new risks emerging if Apple’s native offerings begin to erode Jamf’s value proposition, especially if...

Read the full narrative on Jamf Holding (it's free!)

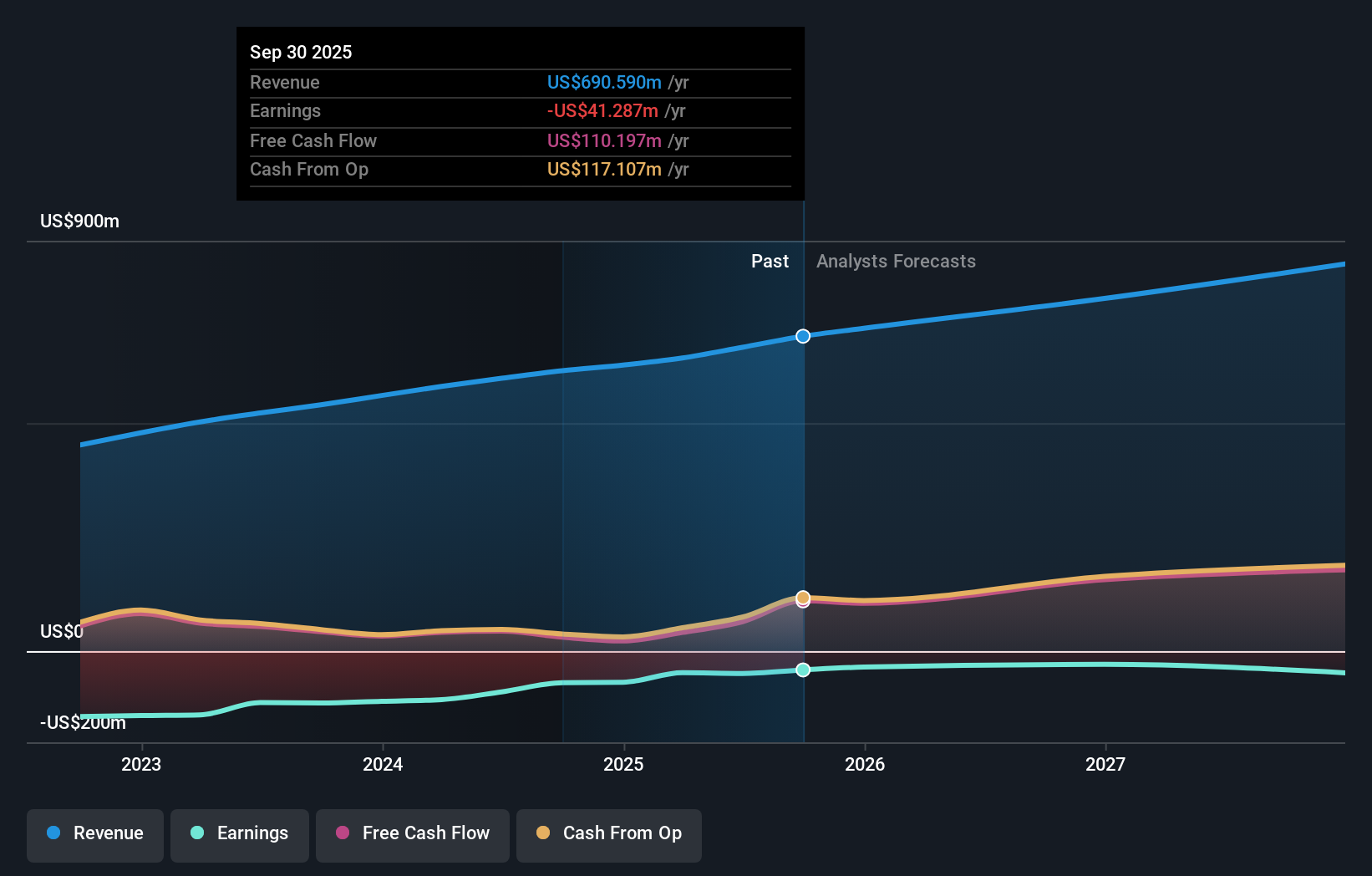

Jamf Holding's outlook anticipates $881.7 million in revenue and $115.4 million in earnings by 2028. This is based on a 9.8% annual revenue growth rate and a $164.4 million increase in earnings from the current level of -$49.0 million.

Uncover how Jamf Holding's forecasts yield a $14.20 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community see Jamf's fair value between US$14.20 and US$23.75 per share. Amid these varied viewpoints, cross-platform expansion and automation remain crucial changes that could shape future revenue and profitability, so it’s worth seeing how others interpret these shifts.

Explore 4 other fair value estimates on Jamf Holding - why the stock might be worth over 2x more than the current price!

Build Your Own Jamf Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jamf Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jamf Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jamf Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JAMF

Jamf Holding

Provides management and security solutions for Apple platforms in the Americas, Europe, the Middle East, India, Africa, and the Asia Pacific.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion